80% of Bitcoin is now in a state of profit; here’s why this matters

80% of Bitcoin is now in a state of profit; here’s why this matters 80% of Bitcoin is now in a state of profit; here’s why this matters

Photo by Volodymyr Hryshchenko on Unsplash

Despite Bitcoin being down roughly 50 percent from its all-time highs, the vast majority of the benchmark cryptocurrency’s investors are profitable, with its immense climb from its March lows of $3,800 bolstering their profitability.

This data offers some interesting insights into the state of the market surrounding the digital asset, and can also offer insight into whether or not BTC is truly on the cusp of entering a bull market.

Based on historical precedent, it does appear that the current profitability of BTC’s investors bodes well for its near-term trend. On-chain analysis does, however, suggest that there are a few key levels buyers need to surmount before it sees any massive upside movement.

Bitcoin investors overwhelmingly profitable – here’s what this means for BTC

Bitcoin has seen some rocky price action throughout the past several months, forming a massive trading range between $3,800 and $10,500.

Despite the mid-March meltdown, the cryptocurrency’s price action has largely favored buyers, and even now it is trading just a hair below its yearly highs.

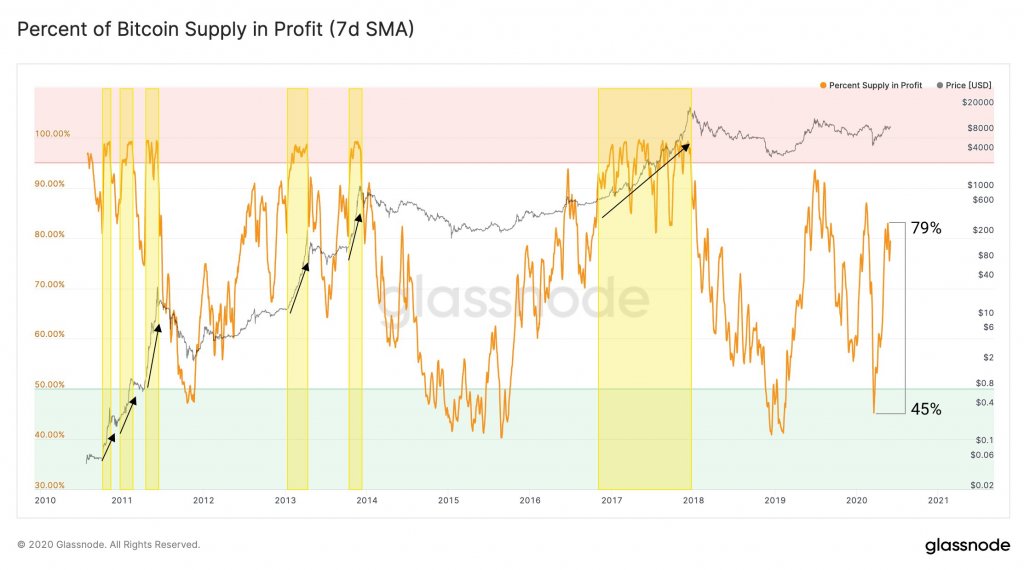

Newly released data shows that BTC’s ability to maintain its position around the upper end of its yearly range has allowed nearly 80 percent of the crypto’s investors to be in the money.

Analytics platform Glassnode spoke about this in a recent tweet, explaining that this figure reaching 90 percent it is a historical mark of the digital asset being within a clear bull market.

“Currently 79% of all Bitcoin supply is in a state of profit. It has been steeply increasing since its 45% low in March after Black Thursday. Historically, levels of 90% and higher have clearly marked pronounced BTC bull markets.”

While looking towards the above chart, it does appear that the 80 percent figure tends to be tapped during the early stages of previous parabolic bull runs. As such, this could mean BTC is bound to see some major near-term upside.

BTC’s “out of the money” data points to heavy resistance in $10,000 region

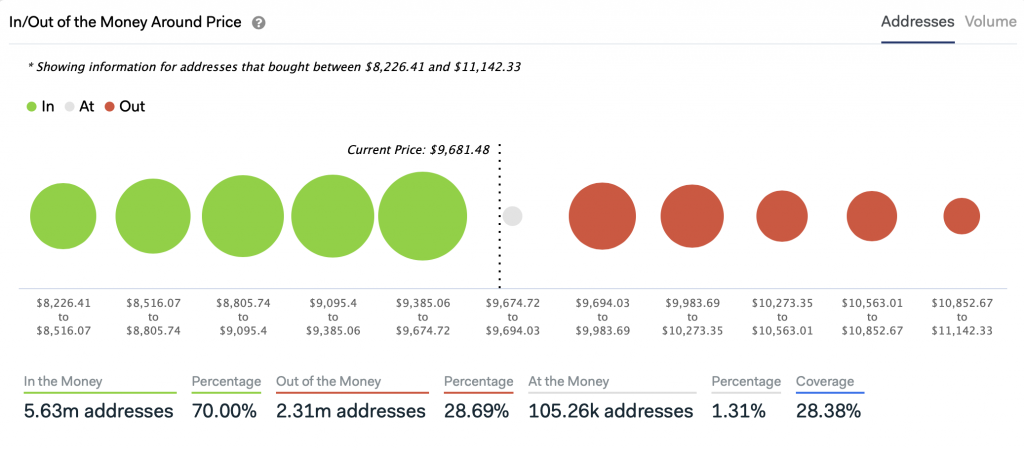

The percentage of Bitcoin investors who are profitable would grow immensely if BTC is able to surmount the lower-$10,000 region.

An analysis of Bitcoin’s “In/Out of the Money” indicator from data visualization platform IntoTheBlock reveals this trend, showing that a significant number of investors entered positions between $9,700 and $10,300.

As seen above, this number begins tapering off from there.

If Bitcoin is able to firmly break through this region in the days ahead, this could start pulling the investor profitability percentage up towards 90 percent as its bullishness mounts.

Bitcoin Market Data

At the time of press 9:30 pm UTC on Jun. 2, 2020, Bitcoin is ranked #1 by market cap and the price is down 1.01% over the past 24 hours. Bitcoin has a market capitalization of $175.04 billion with a 24-hour trading volume of $45.19 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:30 pm UTC on Jun. 2, 2020, the total crypto market is valued at at $268.99 billion with a 24-hour volume of $145.22 billion. Bitcoin dominance is currently at 65.06%. Learn more about the crypto market ›