Kyber Network (KNC) joins the DeFi party with Katalyst launch

Kyber Network (KNC) joins the DeFi party with Katalyst launch Kyber Network (KNC) joins the DeFi party with Katalyst launch

Photo by Bradley Jasper Ybanez on Unsplash

Katalyst, the protocol upgrade for Kyber Network that allows KNC token holders to earn yield and participate in economic decisions on the Kyber Network, goes live on July 7.

Upgrades include rolling out of KyberDAO and staking, which offer benefits for liquidity providers, KNC holders, and DEX traders.

Kyber is an on-chain liquidity protocol that allows decentralized token swaps to be integrated into any application, enabling value exchange to be performed seamlessly between all parties in the ecosystem.

Timed with the DeFi frenzy

As per a release today, the development is said to bolster Kyber’s DeFi capabilities, one that has facilitated over $1 billion in user transactions since inception.

Katalyst and @KyberDAO will go live tomorrow on 7th July, 7am GMT! ? #DeFi

?Please read this article to prepare for the launch: https://t.co/P4kYTCe8Sx

?Watch this Intro to Kyber: https://t.co/J0FYAWSF2M

?Join our community: https://t.co/GATUjxaPzt pic.twitter.com/vpeEc8b658— Kyber Network (@KyberNetwork) July 6, 2020

Over 80 different tokens, and 100 integrated projects such as the popular HTC Exodus smartphone and DeFi tools like Set Protocol and Melon, use both protocol and KNC to govern the network or provide incentives to users.

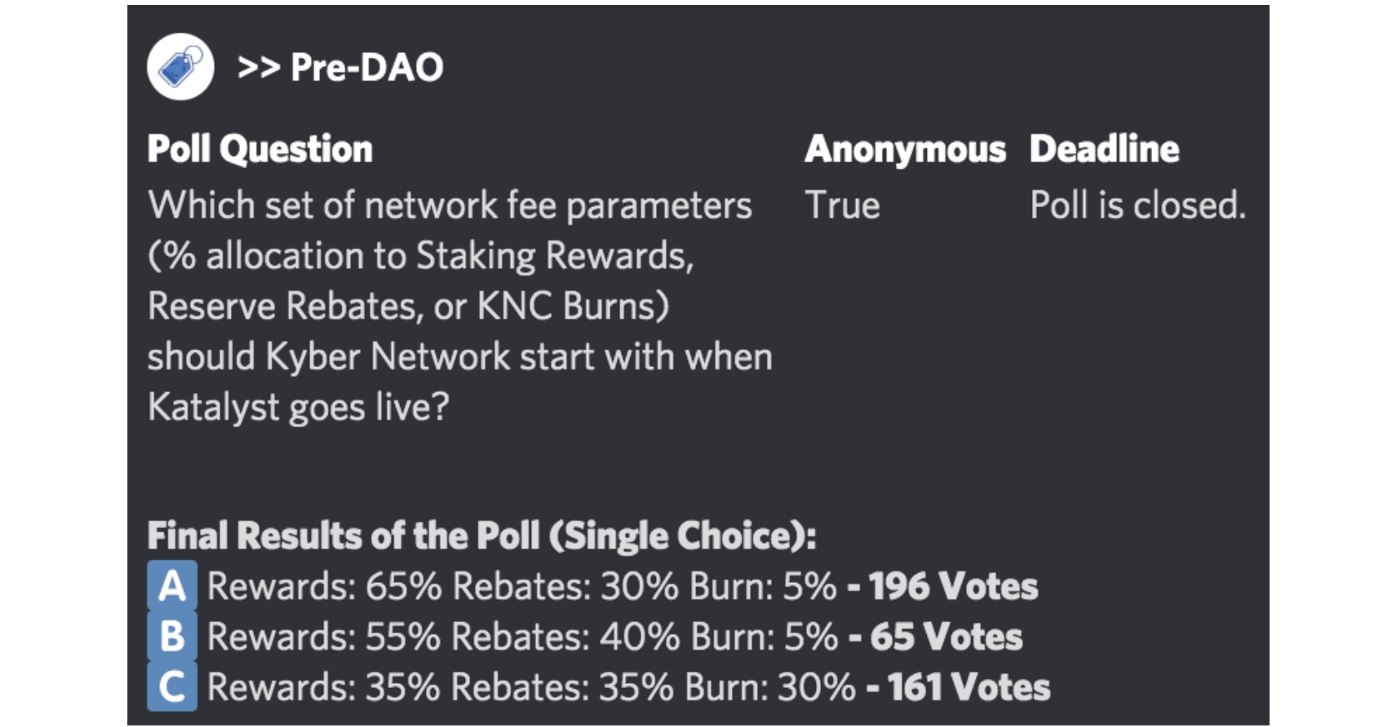

Alongside staking, the KyberDAO will facilitate the decentralized governance of the protocol. A Pre-DAO Poll conducted earlier with 422 participants showed the community reached a consensus on the initial set of network fee parameters that will kick-start on-chain governance on the KyberDAO.

With Option A receiving garnering a majority, 65 percent of all fees will go to Staking Rewards, 30 percent to Reserve Rebates for Fed Price Reserves (FPRs), and 5 percent for purchasing KNC tokens and burning them

Kyber noted these were initial parameters and subject to change as newer proposals are introduced.

Governance via KNC

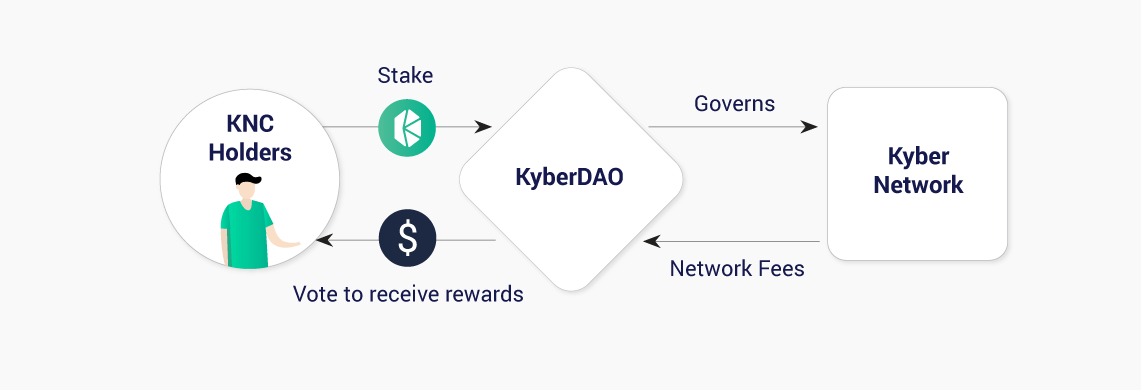

After Katalyst’s launch tomorrow, KNC holders can govern the protocol by voting on important proposals and parameters, while earning rewards (in ETH) for their efforts. Any KNC holder can contribute to Kyber’s development by participating in the KyberDAO, the blog noted.

KyberDAO is a mobile-optimized dApp accessible via Web3 browsers and crypto wallets, such as Trust, imToken, Enjin, Alpha Wallet, Status, HB Wallet, or web browsers Opera and Brave.

To increase inclusivity, staking requirements are kept minimal. Users only need KNC to vote and a little ETH to pay for gas costs, and all votes are done on-chain on Ethereum.

There is no minimum or maximum KNC for staking on Katalyst. Hard lockup periods and penalties are eliminated, and no compulsion for running nodes is required either.

dApps, pools, and providers to benefit

Kyber states the ability to set one’s own custom spread and fees per trade is a major benefit for dApps onboarding the platform. This removes the previous fee-sharing program of 30 percent of the 0.25% fee.

Bridge reserves that connect liquidity from external on-chain sources like Uniswap, Oasis, or Bancor, are not charged any network fee, while fees for all other providers are capped at 0.2 percent.

Reserves/Liquidity providers look forward to a simplified fee system, with no need for holding KNC. The blog adds:

“Network fees are automatically collected in every trade, removing a major friction and pain point for reserves that want to integrate with Kyber.”

Providers can earn rebates based on how much trade volume they facilitate for the network.

Lastly, KyberDAO pools can run a staking pool and vote on behalf of KNC holders, while charging a fee for their efforts. Different options for users are laid out here.

Kyber Network Crystal v2 Market Data

At the time of press 1:16 am UTC on Jul. 7, 2020, Kyber Network Crystal v2 is ranked #35 by market cap and the price is up 4.69% over the past 24 hours. Kyber Network Crystal v2 has a market capitalization of $305.4 million with a 24-hour trading volume of $125.45 million. Learn more about Kyber Network Crystal v2 ›

Crypto Market Summary

At the time of press 1:16 am UTC on Jul. 7, 2020, the total crypto market is valued at at $270.06 billion with a 24-hour volume of $71.89 billion. Bitcoin dominance is currently at 63.61%. Learn more about the crypto market ›