Grayscale adds Chainlink to its portfolio to meet institutional demand

Grayscale adds Chainlink to its portfolio to meet institutional demand Grayscale adds Chainlink to its portfolio to meet institutional demand

Institutional demand for Chainlink seems to be picking up, which could boost LINK's price.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto fund Grayscale announced that it would add LINK to its large-cap crypto fund in a release yesterday. The move comes a few weeks after the company launched a new Chainlink trust fund, offering institutional investors exposure to the token’s price movement.

The world’s largest digital currency asset manager said it sold “the existing Fund Components in proportion to their respective weightings” and used “the cash proceeds to purchase Chainlink (LINK) in accordance with the Fund’s construction criteria.”

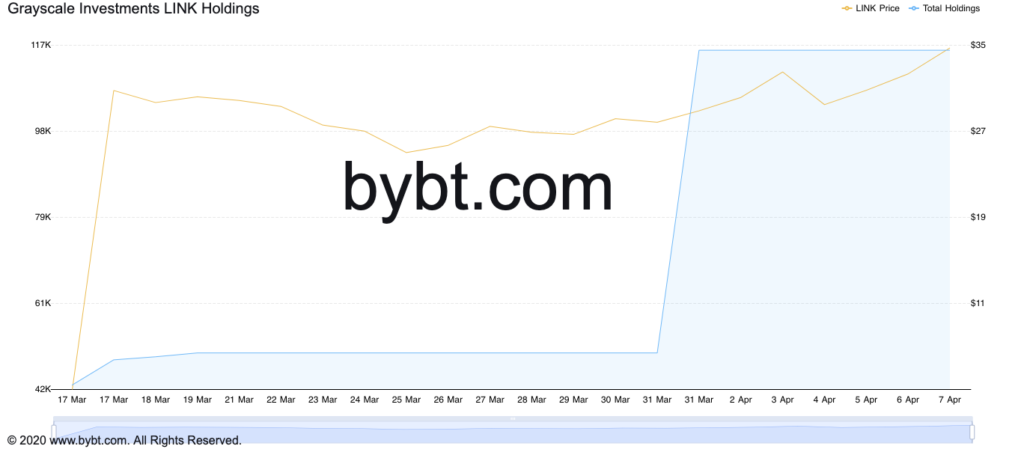

Data from crypto analytics took Bybt shows Grayscale has raked roughly 66,000 LINK over the past week, worth more than $2 million. The firm now holds nearly 115,600 LINK, representing 0.90% of all the digital assets in its large-cap crypto fund.

Chainlink’s market value has shot up by 20% since the beginning of the month as institutional demand picks up, slicing through the most significant resistance barriers ahead of it.

Little to No Resistance Ahead of Chainlink

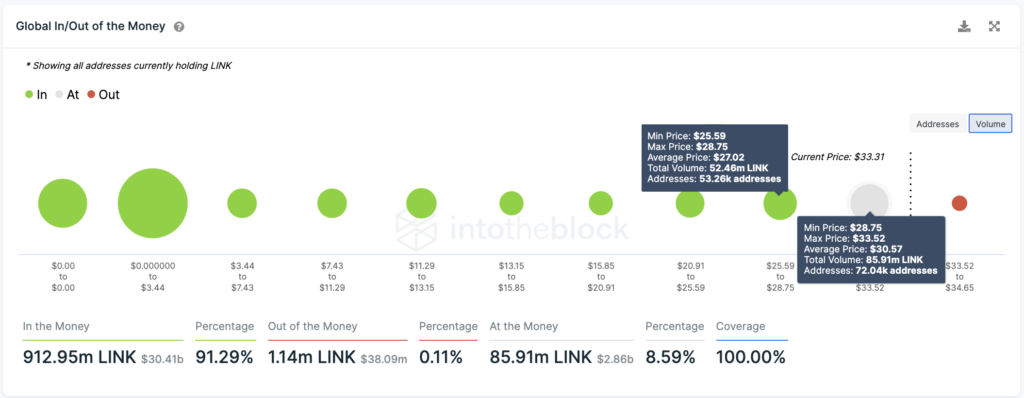

Based on on-chain analytics tool IntoTheBlock’s Global In/Out of the Money (GIOM) model, Chainlink seems to have built a price floor between $25.50 and $28.75. Here, over 52,200 addresses had previously purchased approximately 52.50 million LINK.

This massive demand wall would likely provide stiff support, absorbing any downward pressure behind Chainlink.

The GIOM cohorts also reveal that out of all LINK addresses on the network, roughly 91.30% are “In the Money” while 0.11% are “Out of the Money.”

These figures indicate that the investor base behind the decentralized oracles token is confident about further upward price action in the future. Only a sudden spike in profit-taking could see LINK fall as there is no major supply wall ahead of it.

Chainlink Market Data

At the time of press 3:14 pm UTC on Oct. 19, 2021, Chainlink is ranked #10 by market cap and the price is down 1.21% over the past 24 hours. Chainlink has a market capitalization of $13.36 billion with a 24-hour trading volume of $3.08 billion. Learn more about Chainlink ›

Crypto Market Summary

At the time of press 3:14 pm UTC on Oct. 19, 2021, the total crypto market is valued at at $1.9 trillion with a 24-hour volume of $214.38 billion. Bitcoin dominance is currently at 55.96%. Learn more about the crypto market ›