Research: Buoyant price action has Bitcoin options traders eyeing $30,000

Research: Buoyant price action has Bitcoin options traders eyeing $30,000 Research: Buoyant price action has Bitcoin options traders eyeing $30,000

Bitcoin Options Traders ignore wider macro concerns in the short term, turning further bullish amid the uncertainty.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

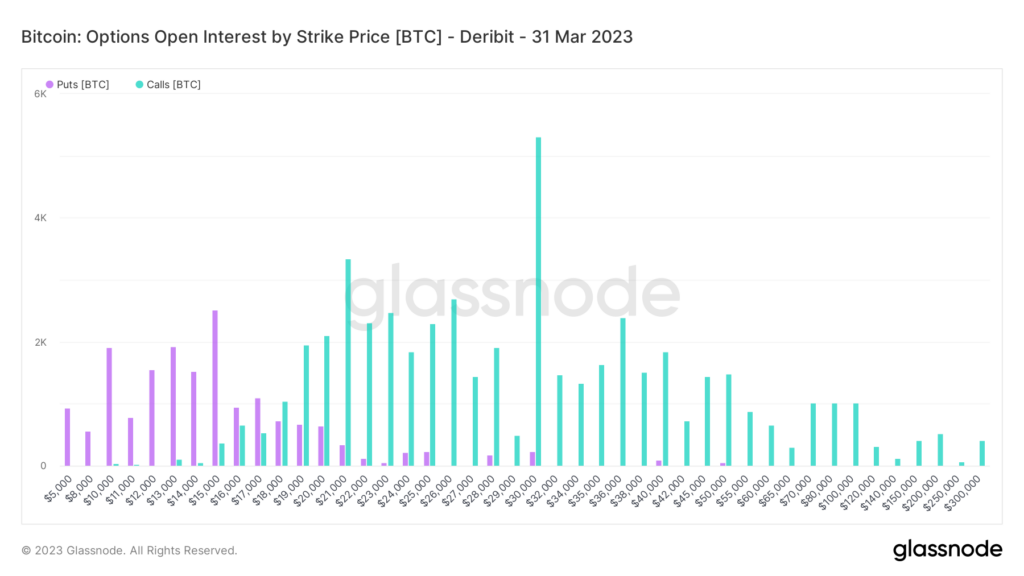

Bitcoin options traders have overwhelmingly re-revised their expectations to $30,000 by the end of March, according to Glassnode data analyzed by CryptoSlate.

Recent price action took a decidedly bullish tone during the second week of the new year.

Since Jan. 8, BTC recorded seven consecutive green daily closes, which took it 25% higher and recaptured $20,000 for the first time since the FTX collapse roughly nine weeks ago.

With that, sentiment among options traders has become more bullish.

Bitcoin sentiment flips further bullish among options traders

Previous research highlighted bullishness among Bitcoin and Ethereum options traders, as denoted by the prevalence of Open Interest calls, over puts, in both instances.

Calls and puts refer to the buying and selling, respectively, of options. These derivative products give holders the right, but not the obligation, to buy or sell the underlying asset at some future point for a predetermined price.

The spread of calls and puts at varying predetermined (or strike) prices indicate general market sentiment.

At that time, for Bitcoin, the range between $15,000 and $20,000 was favored due to the relatively even spread of calls and puts within this spread.

However, due to recent buoyant price action, Bitcoin options traders have flipped even more bullish.

Strike price calls at $30,000

The chart below provides updated Bitcoin Open Interest data following recent price moves. Again, calls far exceed puts, with the $16,000 to $18,000 range favored this time.

Nonetheless, revised Open Interest data showed the most activity for calls at $30,000 and by a significant margin, followed by calls for $21,000 by the quarter’s end. The most significant puts interest was at the $15,000 strike price.

While macro uncertainty remains, the dominance of calls in Bitcoin Options Open Interest suggests a degree of detachment from broader uncertainties, at least in the short term.

Farside Investors

Farside Investors

CoinGlass

CoinGlass