Will SEC file appeal by deadline as Grayscale Bitcoin Trust discount hits yearly low?

Will SEC file appeal by deadline as Grayscale Bitcoin Trust discount hits yearly low? Will SEC file appeal by deadline as Grayscale Bitcoin Trust discount hits yearly low?

Market observers speculate that the U.S. Securities and Exchange Commission (SEC) will not contest the Court's directive.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

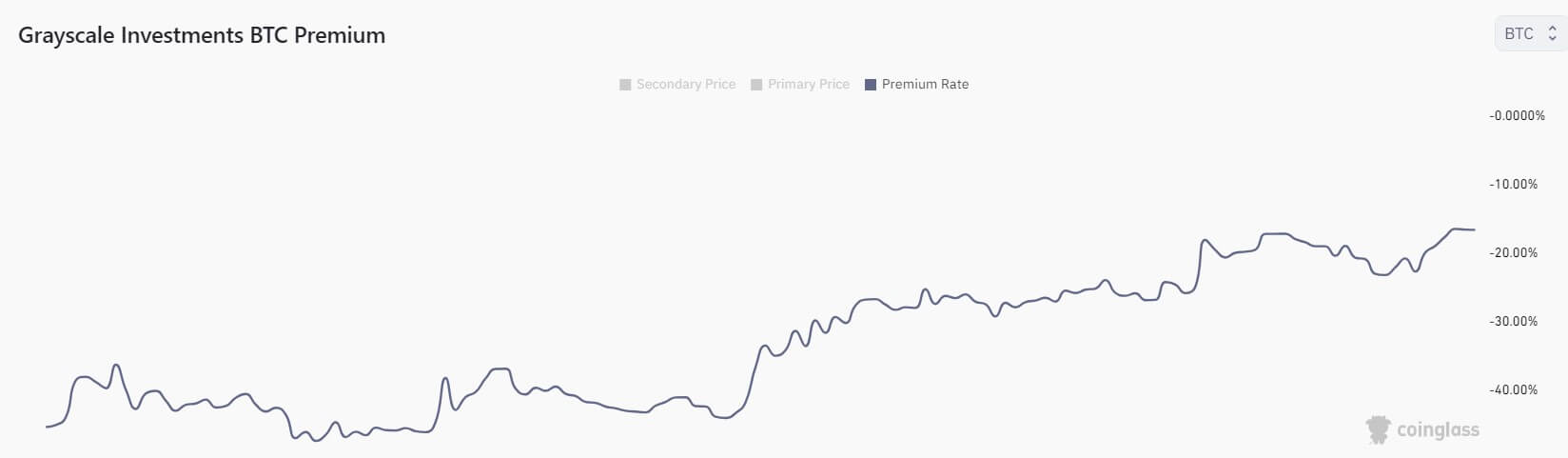

The discount on Grayscale Bitcoin Trust (GBTC) has reached its lowest point this year, currently standing at 16.58% as of Oct. 12, per data from Coinglass.

This narrowing discount is closely linked to the impending deadline for the U.S. Securities and Exchange Commission (SEC) to file an appeal against its previous loss to the asset management firm. In August, a U.S. court ordered the financial regulator to review Grayscale’s application to convert its BTC trust into a spot exchange-traded fund (ETF).

GBTC, the largest BTC investment vehicle, has experienced a notable upswing in its prospects following BlackRock’s application for a spot-based Bitcoin ETF to the SEC in June. The discount narrowed to under 20% for the first time in two years after the Court’s landmark ruling in favor of Grayscale.

Will the SEC appeal Grayscale’s victory?

With the deadline for an SEC’s appeal approaching, market observers speculate that the regulatory body will not contest the Court’s directive.

Nate Geraci, the President of ETFStore, said he does not expect the SEC to appeal the court ruling. According to Geraci, the failure of the SEC to appeal the ruling will put spot-Bitcoin ETFs in full throttle.

This view is similar to that of Bloomberg’s Senior ETF analyst, Eric Balchunas, who thinks an “appeal is a longshot.” However, he warned, “There’s always a chance of something else happening.”

Meanwhile, Geraci and Balchunas believe the regulator will approve a spot BTC ETF by next year.

Similarly, Matt Klein, a portfolio strategist at Nascent, opined that while the SEC may not appeal Grayscale’s victory, the regulator might delay its approval for the firm’s ETF application for months.

According to Klein, the regulator’s delay tactics might be part of its broader plan to allow other spot-bitcoin ETF providers like Blackrock, Ark, etc, to launch together.