Top VC: Ethereum is miles ahead of “ETH killers” in this key category

Top VC: Ethereum is miles ahead of “ETH killers” in this key category Top VC: Ethereum is miles ahead of “ETH killers” in this key category

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

If you have been around in crypto for the past few years, you likely know of the concept of Ethereum-killers.

Over its five years of existence, Ethereum has become the largest and most prominent smart contract blockchain, with ETH rallying thousands of percent within a few years’ time while the network has seen mass adoption from firms like Ernst and Young and Microsoft. Not to mention, dozens of coins in the top 100 cryptocurrencies are based on the blockchain, like Chainlink and Maker.

It should come as no surprise then that other than Bitcoin, the project is arguably the envy of the cryptocurrency space.

Hence, many have tried to replicate Ethereum’s success, attempting to “kill” the blockchain and replace it in the process.

There are many projects with the moniker that are launching this year and many more that are currently live and are iterating, though a top venture capitalist in the space thinks that the “emperor has no clothes.”

That’s to say, “Ethereum killers” may not be so killer at the end of the day, at least for the time being.

Ethereum killers? Not so fast, top VC says

While there are projects like Polkadot attempting to make a run at Ethereum’s market share, Placeholder Capital partner Chris Burniske recently noted that these competitors are not even close at taking the market share.

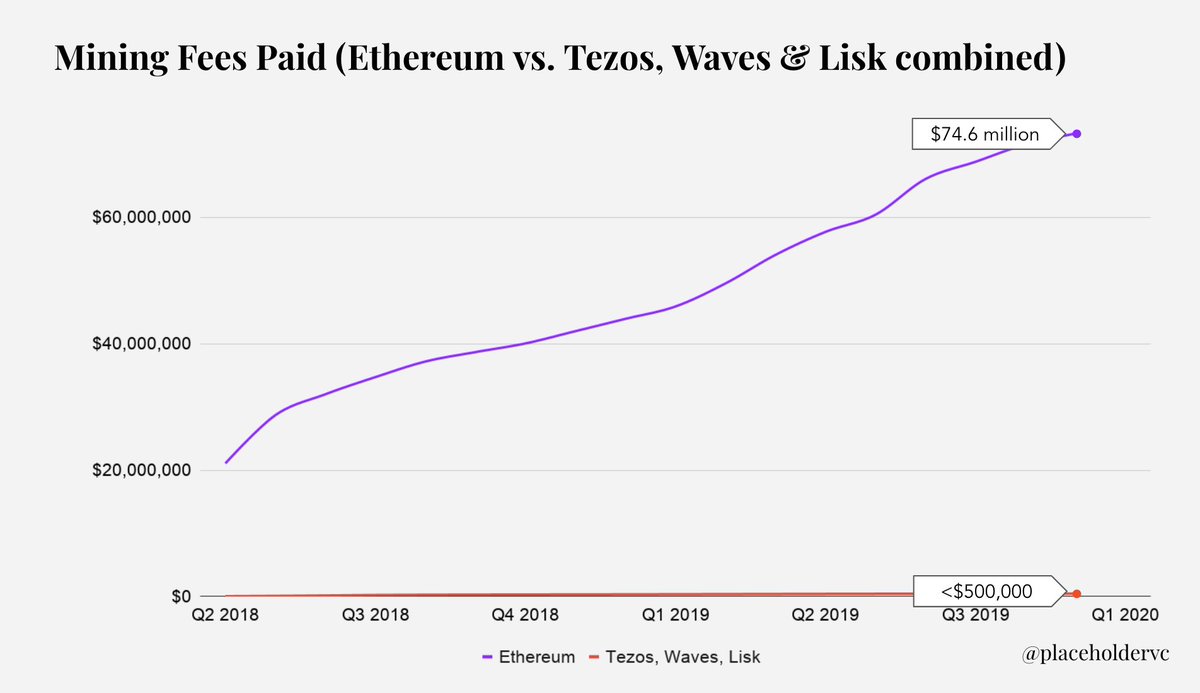

Below is a Dec. 2019 chart created by Placeholder, which indicates the aggregate mining fees paid by Ethereum against Tezos, Waves, and Lisk. As can be seen, the latter three cryptocurrencies have seen less than $500,000 in mining fees paid while Ethereum’s mining fees paid metric is well above $70 million.

On the chart, which shows that competitors of Ethereum are currently failing to get users to pay for transactions, Burniske wrote:

“Ethereum is orders of magnitude ahead of any of its competitors in terms of people willing to pay for its utility. Speculation may buoy “Ethereum Killers” for a while, but for many it will eventually become clear the emperor has no clothes.”

3/ #Ethereum is orders of magnitude ahead of any of its competitors in terms of people willing to pay for its utility.

Speculation may buoy "Ethereum Killers" for a while, but for many it will eventually become clear the emperor has no clothes: https://t.co/dyfTh9kZ92

— Chris Burniske (@cburniske) May 9, 2020

ETH 2.0 could compound concerns of competing chains

The troubles that Ethereum killers face may only be compounded by the 2.0 upgrade the blockchain is expected to start this year.

ETH 2.0 is expected to implement and work with technologies like Proof of Stake, sharding, and more to exponentially increase the speed, transaction throughput, and decentralization of the network. This will give it potentially more performance than blockchains attempting to encroach on its market share.

Analysts expect the upgrade to have a massive economic shift not only in the crypto space but in the broader global economy as well, though there is no clear timeline on the full-blown release of the upgrade.

The ball is in Ethereum’s court

It isn’t only Ethereum’s miner fees that indicate the smart contract blockchain ball is currently in the court of ETH, so to say.

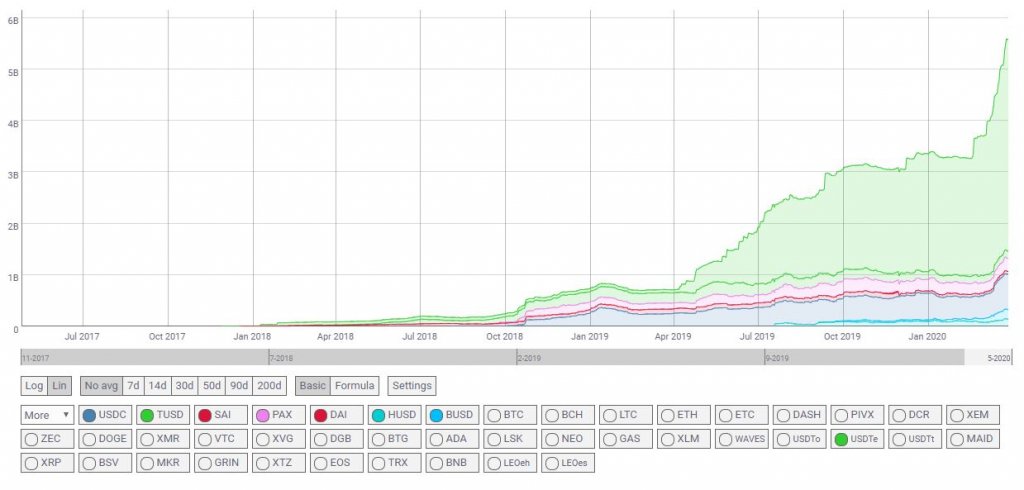

Arguably, the clearest evidence to suggest that Ethereum is the best among its class is Tether.

There was a time that Tether’s USDT stablecoin was mainly based on Bitcoin, but the company has shunned the blockchain, along with Tron, EOS, Algorand, and others, to make Ethereum the network on which it bases a majority of its stablecoins. This is due to ETH’s network effect of active users and accessible infrastructure.

There’s also the simple fact that Ethereum has support from buyers, especially institutional players, that other blockchains might not have.

Per previous reports from CryptoSlate, angel investor and professor Adam Cochran found that “wallets associated with major players such as JPMorgan Chase, Reddit, IBM, Microsoft, Amazon, and Walmart” are accumulating the cryptocurrency.

In a similar vein, Grayscale reported that it had received over $100 million for its Ethereum’s fund in Q1 of this year alone, most of which came from players classically defined as “institutional.”

On a broader scale, Cochran found that “existing whales (large holders) have increased their position by more than 4 percent in the past six months,” which reportedly amounts to $550 million worth of ETH purchased.