These fundamental factors have sparked a massive Ethereum accumulation trend

These fundamental factors have sparked a massive Ethereum accumulation trend These fundamental factors have sparked a massive Ethereum accumulation trend

Image by Miloslav Hamřík from Pixabay

Ethereum has been seeing a massive influx of new users and investors in recent times. This has been driven by the growing popularity of Decentralized Finance (DeFi) as well as heightened on-chain stablecoin issuance.

This also comes as the highly anticipated transition to Ethereum 2.0 looms on the horizon, with the testnet being launched in the coming several months.

Analysts do tend to believe that fundamental strength like the imminent launch of the new blockchain version and growing utility will help boost it in the near future.

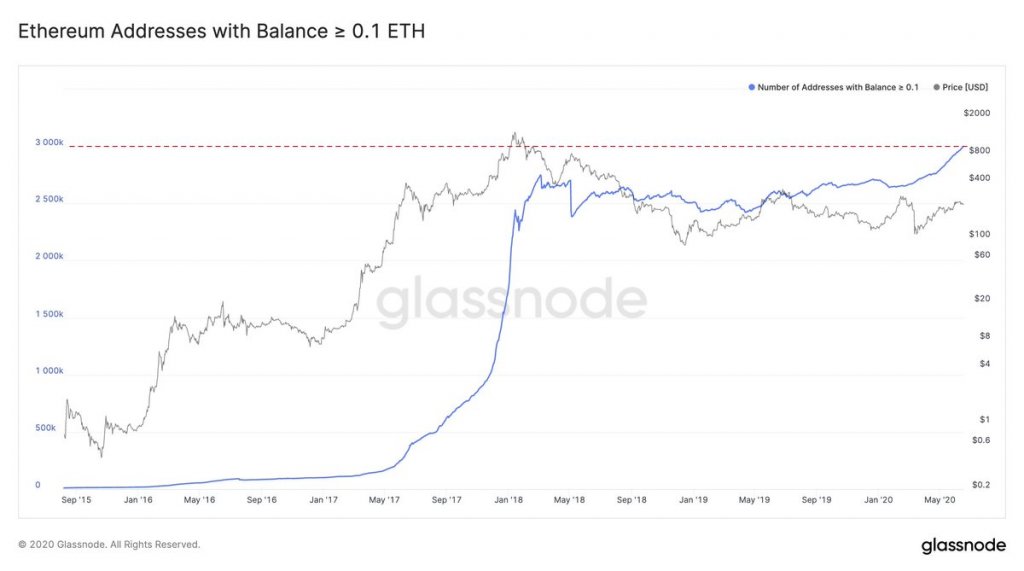

Investors seem to concur with this notion as well, as the number of wallets holding over 0.1 ETH just passed the 3 million mark for the first time ever – marking a nearly 11 percent climb over the past six months.

Ethereum sees massive accumulation amongst retail investors

Ethereum’s price action has been rather lackluster as of late. The cryptocurrency has been closely tracking Bitcoin, stuck within a trading range between $230 and $250.

This has marked an extension of the consolidation seen throughout the past several weeks.

It does appear to be highly likely that where it trends next will be dependent on Bitcoin, as the two assets have been closely correlated over the past several weeks.

Regardless of this, retail investors appear to see promise in Ethereum’s future outlook, as data shows that they have been heavily accumulating it over the past few months.

Analytics firm Glassnode spoke about this data in a recent post, explaining that the number of ETH addresses holding over 0.1 ETH just crossed a major milestone, marking a nearly 11 percent climb from the start of the year.

“The number of Ethereum addresses (EOAs) holding at least 0.1 ETH just crossed the 3 million mark for the first time. It has grown by 10.9% since the beginning of the year.”

Factors driving this ETH accumulation trend

There are likely a couple of simple trends backing the Ethereum accumulation trend seen amongst retail investors.

The rise of DeFi’s popularity is certainly one of them, as users can lend and borrow money in a peer to peer fashion – with these loans often requiring ETH collateral.

The upcoming launch of ETH 2.0 is also widely expected to create some upwards price momentum, so this may be another influential factor to consider.

Kyle Davies – co-founder of Three Arrows Capital – explained in a recent tweet that Ethereum’s organic usage has been rocketing as of late, which is a sign of fundamental strength that will only grow as ETH 2.0 approaches.

“As both USDT and DeFi on ETH have exhibited phenomenal growth, ETH gas usage has skyrocketed to all-time highs. Unlike previous cycles, this usage is organic. Scalability on ETH will continue to be tested as we head into ETH 2.0 and beyond.”

This organic usage will undoubtedly bolster its fundamental outlook, making Ethereum a more attractive investment proposition to market participants.