SBF claims smaller crypto exchanges will fail soon

SBF claims smaller crypto exchanges will fail soon SBF claims smaller crypto exchanges will fail soon

FTX founder Sam Bankman-Fried says some crypto exchanges are already secretly insolvent and will fail soon.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

FTX founder Sam Bankman-Fried told Forbes that some third-tier crypto exchanges are already insolvent and will fail soon.

Bankman-Fried declined to specify these exchanges and said:

“There are companies that are basically too far gone and it’s not practical to backstop them for reasons like a substantial hole in the balance sheet, regulatory issues, or that there is not much of a business left to be saved,”

Prominent crypto executives agree that there are too many coins and blockchains right now and that the bear market will eliminate the ones that don’t offer real value.

Bankman-Fried is the first crypto executive to point out that there are too many exchange platforms and that the market will get rid of most just as it shakes off most coins and blockchains.

Exchange platforms

In addition to exchange giants like Bankman-Fried’s FTX, there are more than 600 operational crypto exchanges.

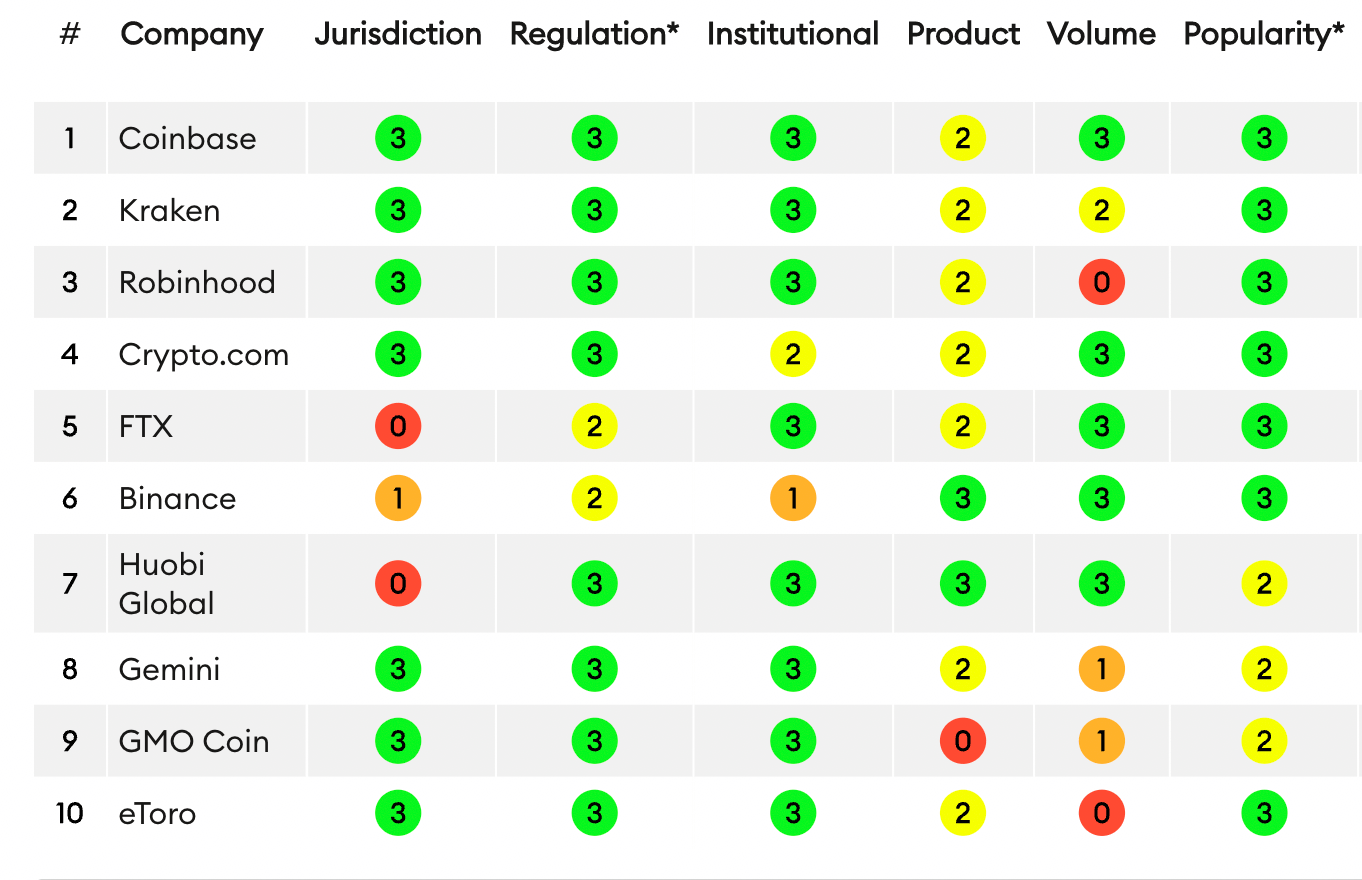

Forbes’ global crypto exchange rankings report examines the top 60 exchanges based on various criteria. The above chart shows the top 10 crypto exchanges as of March 16, 2022.

Bankman-Fried argued that many smaller exchanges are already failing at their finances and will have to announce bankruptcy soon. Most of these exchanges promised high yields to their customers, which was easy to keep up with during the bull market. However, these promises look like a ticket to bankruptcy now, as investors withdraw balances amid the downturn.

Earlier in June, an Australian exchange platform had to freeze operations permanently due to market conditions. Meanwhile, many crypto exchanges — including the top 10 — are choosing to downsize and laying off up to 25% of their staff.

Exchanges leaning on M&A

Bankman-Fried’s FTX and Binance seem to be the only ones doing okay in thSBFe current market conditions. They either already acquired other firms or discussed planning to increase their Mergers & Acquisitions.

FTX

FTX is already going big on M&A, as it acquires Robinhood and Voyager Digital, which chose to downsize, and a share of BlockFi.

FTX U.S. president Brett Harrison recently told CNBC:

“We’re doing that globally, in places like in Japan, Australia, in Dubai, different places where we’ve been able to either partner with local companies or sometimes do acquisitions to be able to get licenses that we need,”

Binance

Binance also speaks of leaning more towards M&A. Binance’s CEO Changpeng Zhao recently said:

“We have a very healthy war chest, we in fact are expanding hiring right now. If we are in a crypto winter, we will leverage that, we will use that to the max. […] we’re kicking into high gear in terms of M&A activity.”

Ripple

On the other hand, Ripple didn’t choose to downsize and said it was only thinking of M&A. However, the exchange didn’t alter its recruitment plan and continues to hire new staff.

Ripple CEO Brad Garlinghouse said that he expected the crypto space to move towards an M&A-based sector.