How To Survive With Structured Products In Bear Markets

After the turbulence caused by the Terra collapse, the whole crypto market is now facing a dim future. The high growth driven by bull markets has passed, leaving investors that are unwilling to cut losses trapped with large amounts of slumping altcoins. Naturally, how to increase the value of their altcoins amid market downturns is now the top concern of every investor.

Disclaimer: This is a sponsored press release. Readers should conduct their own research prior to taking any actions related to the content mentioned in this article. Learn more ›

Structured Products, The Magic Tool in Bear Markets

Unlike stablecoins, native tokens have few scenarios that can increase their value with low risk outside their own ecosystem. Thus, holding tokens while profiting from selling options becomes one of the few low-risk investment opportunities in bear markets.

However, it is almost impossible for ordinary investors to master options trades or hedging strategies and become eligible sellers. As a result, structured products issued by professional market makers have become the most popular choice among investors. Structured products can be formed by various portfolios using options strategies, among which the covered call strategy is the most widely adopted.

Covered Call Option

First, let’s take a look at some terms used in options trading:

- Option: Right to trade the underlying asset at a set price before the expiry date

- Strike Price: The strike price is the set price. For call options, the strike price is higher than the real-time price. While for put options, the strike price is lower than the real-time price.

- Premium: The price buyers pay to the sellers for an option contract.

A covered call refers to a strategy in which the investor who sells a call option also owns the underlying asset. At expiry, if the settlement price is lower than the strike price, the seller can earn the premium received for writing the option. Though the price moves down, the seller can still gain extra tokens as income. If the settlement price is higher than the strike price, the seller can profit from the increment of the token’s value (denominated in USDT).

The ability to gain returns in both upturns and downturns makes the covered call strategy the most popular choice for structured products used to survive in bear markets.

Shield Vault — Launchpad for Permissionless Structured Products

Shield Vault is a launchpad by Shield, on which users can issue permissionless on-chain structured products, that is, Decentralized Option Vault (DOV). It allows projects or market makers to apply customized on-chain option strategies without permission, improving the risk-return profile of token holders by issuing diversified option vaults (SS-Vault/M-Vault/LP-Vault).

SS-Vault, a Foolproof Solution

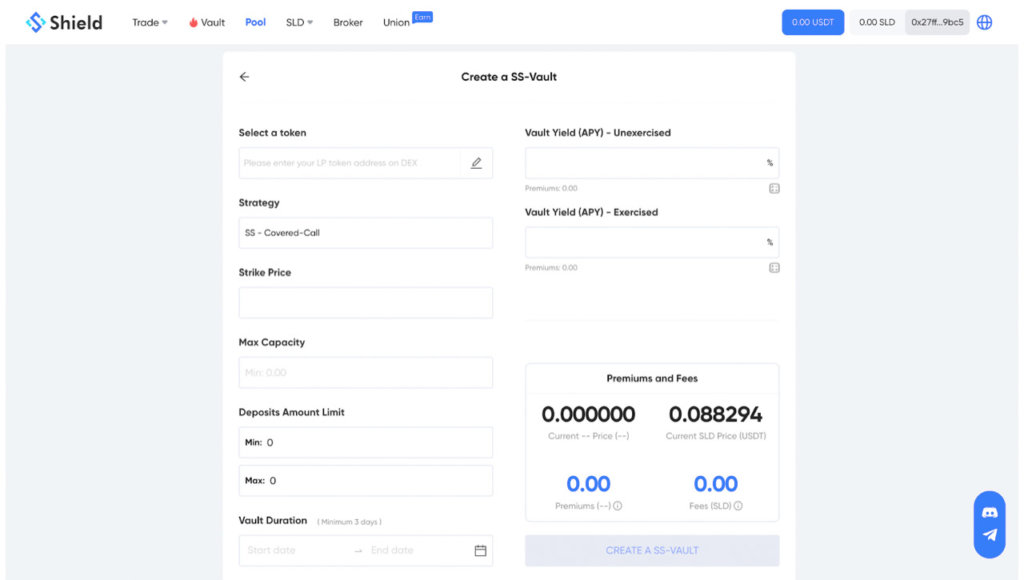

SS-Vault adopts the covered call strategy and is designed primarily for long-tail assets. Protocols can set different yields according to the strike price, and then issue option vaults that can help investors profit in both upturns and downturns. The interface for vault creation is as follows.

An example of SS-Vault:

Token: ABC

Vault Strategy: SS-Covered-Call

Deposit Price: 1 ABC = 1 USDT

Strike Price: 2 USDT

Vault Length: 30 Days

APY of Unexercised Vault (in ABC): 30%

APY of Exercised Vault (in USDT): 20%

Suppose Alice deposits 100 ABCs. After 30 days, she may receive two different returns depending on whether she exercises the vault:

Scenario 1:

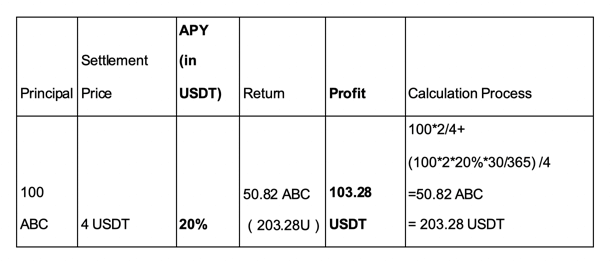

At expiry, the settlement price is higher or equal to the strike price, i.e., 2 USDT, and the vault is exercised:

Scenario2:

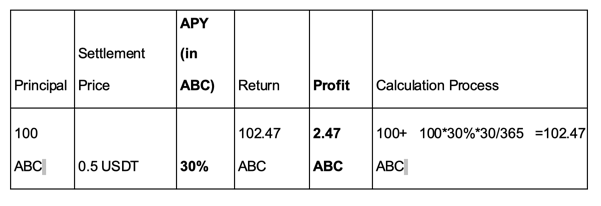

At expiry, the settlement price is lower than the strike price, and the vault is not exercised:

By staking the tokens, Alice can receive a premium at an annual rate of 20-30%. If the vault is not exercised, Alice can earn a profit of 2.47 ABC (30% APY); if it is , Alice can receive a profit of 103.28 U (20% APY). In anticipation of a bear market, Alice can keep HODLing her tokens, while winning some extra returns.

Traditional Single-sided Staking is Outdated

In traditional single-sided staking, protocols can not set rewards flexibly based on the real-time market prices. Excessive incentives trigger the sell-off expectation and consequently lead to a death spiral.

Shield’s SS-Vault revolutionized it with the adoption of options strategies:

- Flexible rewards setting based on strike price, more efficient control of market circulation.

- The maximum payoff is limited at the strike price, above which profits are recouped by the issuers. This breaks the death spiral expectation and strengthens holders’ confidence.

ASSEMBLE in Bear Markets

As a permissionless structured product, more and more protocols are employing Shield’s SS-Vault to retain holders who are selling their tokens and leaving. Meanwhile, more holders are proposing to issue Shield’s vaults in their communities.

Conclusion

Shield is using professional options strategies to build a product matrix of SS-Vault, M-Vault, and LP-Vault, reshaping the liquidity incentive methods in the secondary market, including traditional single-sided staking and LP token mining (Yield Farming). Shield not only offers token holders a magic tool to survive in bear markets but also brings a new possibility of the DeFi 3.0, a paradigm shift in secondary market liquidity management. Let’s wait and see.

Ro Khanna

Ro Khanna