Investment Bank Doomsayers Predict Crypto Extinction Event in “Mass Market Wipe Out”

Investment Bank Doomsayers Predict Crypto Extinction Event in “Mass Market Wipe Out” Investment Bank Doomsayers Predict Crypto Extinction Event in “Mass Market Wipe Out”

Photo from Yuri B on Pixabay

Cryptocurrency market observers may be calling for an impending bull run, but despite total market cap surging beyond the $430 billion mark, some financial analysts remain unconvinced. According to investment banking company GP Bullhound, cryptocurrency prices are set to suffer a massive 90% correction that will lead to a “mass market wipe out” in the next 12 months.

In a recent report entitled “Token frenzy, the fuel of the blockchain”, GP Bullhound analysts have presented a bearish prediction that despite the impending maturation of ICO funding and the establishment of “token of assets” offerings as a new “killer app,” cryptocurrencies are headed toward an extinction event that very few companies will survive:

“Cryptocurrencies will experience a heavy correction of up to 90 per cent in the next 12 months and very few companies will survive this correction. While this correction will be critical to cutting through the hype, its lack of impact on financial institutions will create new phenomena that we have never seen in any previous bubble burst”

2018 Will Overturn the ICO Model

The GP Bullhound report, although bearish at first glance, does present a nuanced perspective of the current state of the cryptocurrency ecosystem that highlights some of the most pressing issues facing the blockchain sector today.

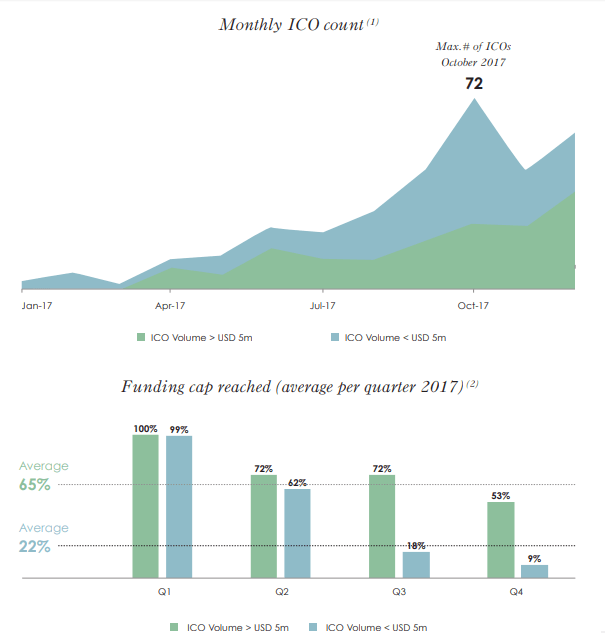

One of the most notable calls presented within the report is the inevitable maturation of the ICO market, with an emphasis on the increasing presence of large-scale ICOs.

The report also predicts the launch of the first corporate ICO within the next 12 months, anticipating the creation of an alliance of several corporate entities within the luxury goods, automotive, or raw materials sector:

“This (corporate) ICO will also likely be the first ICO based upon a consortium chain which will see several corporates join forces in a private, permissioned blockchain before setting the protocol free for the wider universe of early adopters”

A key element of the GP Bullhound “year in blockchain” outlook is the restructuring of the ICO model. The report highlights the inefficiency and unsustainability of the current ICO model, stating “no longer will companies be able to launch an ICO off the back of a white paper.” According to GP Bullhound, the key to successful ICO execution will involve organization track records, transparency, and founder credibility.

The report also predicts that sale of tokens in initial coin offerings will become defunct. The purpose of token issuance, according to GP Bullhound, is to create network effects — a goal that the sale of tokens “with no utility value” is unable to achieve efficiently. As current airdrop models demonstrate immediate impact and rapid growth, GP Bullhound predicts that airdrops will become the “new normal” for token distribution.

Crypto-Decimation Will Lead to Survival of the Fittest

Despite the negative outlook of the report, GP Bullhound present the “mass market wipeout” not as a true extinction event, but as a “thinning of the herd,” predicting that after the “‘crypto-winter” passes, growth dynamics for the precious few survivors will be unprecedented.

One of the most interesting points presented by the investment firm in the report is the breakdown of key issues facing blockchain technology that must be overcome in order to enable mass adoption. According to GP Bullhound, scalability, exchange decentralization, the promotion and implementation of secure privacy protocols, effective governance, and consensus efficiency are pivotal to the wide-scale adoption of distributed ledger technology.

GP Bullhound’s predictions regarding the disruption of the ICO model and the emergence of a new token distribution paradigm are in line with the current movement of the ICO market, which is experiencing increasing pressure from regulatory bodies around the world. As investors adapt and respond to fraudulent or unsuccessful ICO models, de facto requirements for the launch of an ICO are beginning to manifest that reflect the predictions made by the investment firm regarding the future ICO model.

The potential occurrence of a “mass market wipe out,” however, is debatable. The GP Bullhound report itself anticipates a “paradigm shift” that brings greater levels of venture capital and smart money into the blockchain industry — specifically at a pre-ICO level:

“Average equity funding pre-ICO will rise to over USD 20m for successful ICOs in 2018”

The destiny of altcoins may very well fall in line with GP Bullhound’s predictions of a wipeout — Ethereum co-founder Vitalik Buterin has explicitly stated that many altcoin valuations are “far ahead of accomplishments,” which could potentially result in a dramatic and sudden correction.