ETF anticipation fails to lift prices as market faces $220 million in liquidations

ETF anticipation fails to lift prices as market faces $220 million in liquidations Quick Take

The crypto industry is eagerly awaiting the approval of a spot in the Bitcoin Exchange Traded Fund (ETF) in the first weeks of January.

While the market has been expecting institutions to push Bitcoin’s price up in anticipation of the ETF, no such trend has been observed.

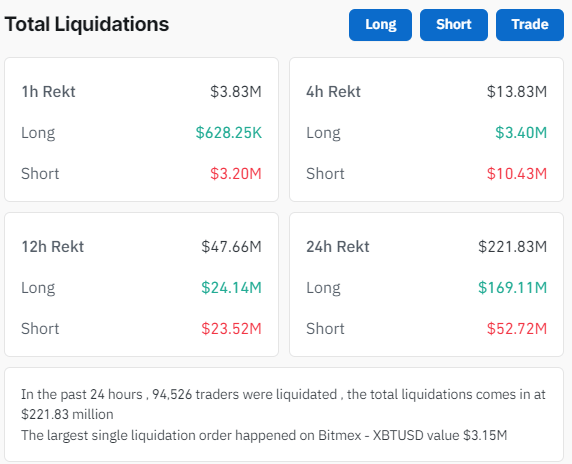

Recently, the market has witnessed significant leverage, leading to a large volume of liquidations. Over the past 24 hours, more than $220 million has been liquidated in the digital asset market, according to Coinglass. This trend of high leverage and subsequent liquidations has been apparent for the past few weeks.

Bitcoin’s price fell below $42,000, a significant drop that can be attributed to these large-scale liquidations resulting from the aforementioned high leverage.

This illustrates the dynamic and speculative nature of the crypto market, strongly influenced by factors such as trading trends, potential regulatory changes, and their cumulative impact on digital asset prices.