Bakkt volume soars by 17% as institutional interest in crypto flourishes

Bakkt volume soars by 17% as institutional interest in crypto flourishes Bakkt volume soars by 17% as institutional interest in crypto flourishes

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin and the crypto market’s multi-month consolidation period have provided investors with an accumulation opportunity, and it appears that institutional and retail investors have both taken advantage of this.

According to new data, trading volume on Bakkt has been rocketing higher in recent times. Over the past week, the institutionally aimed platform has seen a 17 percent rise in its total futures volume, as well as an 18 percent climb in its total open interest.

Bakkt isn’t the only platform seeing heightened institutional activity, as futures on the CME have also been rising, with their premium continuing to support the notion that large investors are adopting a “buy-and-hold” strategy when it comes to the benchmark crypto.

Bakkt incurs rising trading volume

Since Bakkt’s launch in late-2019, the platform has not been utilized by institutional investors at the rate many investors had anticipated.

This trend may be starting to shift, however, as the platform has seen a notable rise in both its open interest and the trading volume for its monthly Bitcoin futures product.

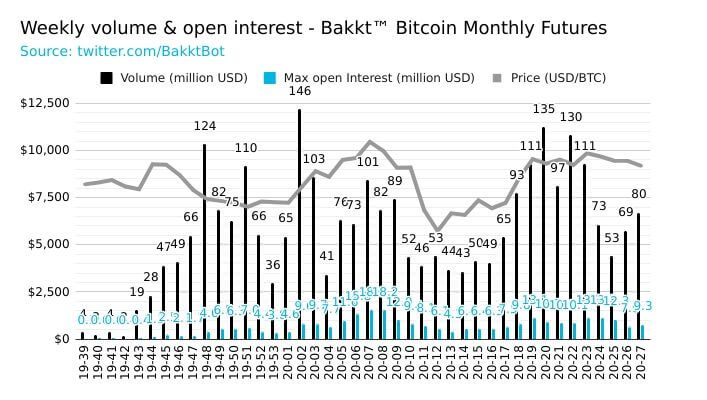

According to the Bakkt Volume Bot – which is a program that tracks the key statistics relating to the platform – total volume on the platform last week was $80 million, marking a 17 percent rise from the prior week.

Open interest for the crypto’s monthly futures also rose, climbing by 18 percent as another $9.3 million was added.

“This week’s summary of Bakkt Bitcoin Monthly Futures: Total volume: $80 million (+17%). Max open interest: $9.3 million (+18%)”

While looking at volume on the platform, it is still down significantly from where it was just a couple of months ago but has been trending up over the past several weeks.

This uptrend has come about despite Bitcoin and the aggregated crypto market falling into a narrowing consolidation phase.

It appears that institutional investors are growing increasingly keen on building up a more substantial holding before the crypto sees a spike in volatility.

BTC futures premium shows that institutions are growing more involved in crypto

Bakkt’s rising volume isn’t the only sign of heightened institutional involvement in the crypto markets.

Bitcoin’s premium seen while looking at the CME throughout June also supports this notion, showing that this investor base is taking a “buy-and-hold” approach to the digital asset.

A recent Bloomberg Crypto Outlook report noted that BTC futures averaged at a one percent premium throughout the past month.

“A stabilizing premium in the Bitcoin futures price is supporting the market and indicates more institutional buy-and-hold interest… Our graphic depicts futures averaging just over 1% above the Bloomberg price (XBTUSD).”

The potential accumulation trend seen throughout the past couple of months may have laid the groundwork for the cryptocurrency to see a sharp upwards movement in the weeks and months ahead.