Researcher: these 6 things will supercharge Ethereum to a completely new level

Researcher: these 6 things will supercharge Ethereum to a completely new level Researcher: these 6 things will supercharge Ethereum to a completely new level

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

According to Gnosis Product Lead and Researcher Eric Conner, Ethereum has all six fundamental factors for significant growth in the medium to long-term.

What are the six major factors to grow Ethereum?

Conner noted that the following six elements would drive the growth of Ethereum throughout the next 12 months:

- The rapid rise of decentralized finance (DeFi)

- Privacy solutions on mainnet

- Second-layer scaling

- Ethereum 2.0 launch

- Superior monetary policy with Ethereum 2.0

- The struggle of competitors to combat the growth of ETH

All of the abovementioned factors align with the vision of the Ethereum open-source developer ecosystem to evolve the blockchain network into a more efficient protocol in processing data.

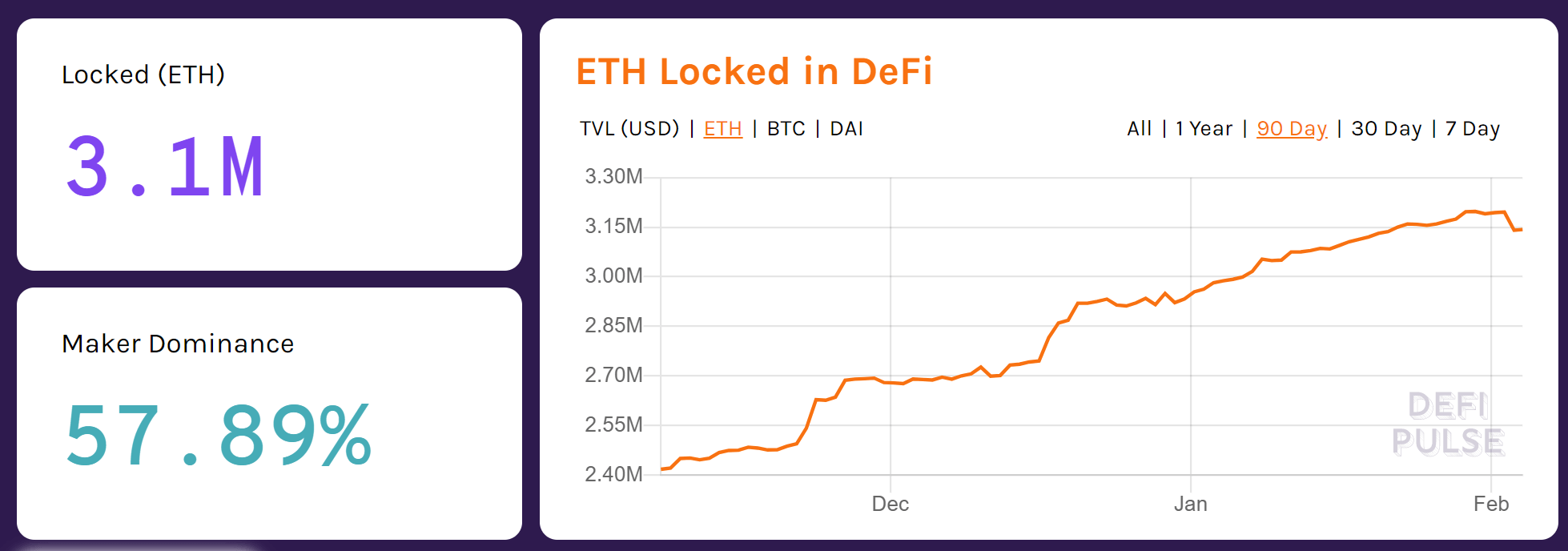

Throughout the past year, DeFi has seen explosive expansion. Data from DefiPulse indicate 3.1 million ETH are currently locked in DeFi apps. That is equivalent to $589 million at the price of ETH at $190. For DeFi to work seamlessly, which includes virtually all financial services including loans, payments, derivatives, and more, scalability, ETH 2.0, and better monetary policy are crucial.

Scalability is important because, with DeFi, confidential information such as payment data are processed on-chain. As the number of users increases, it may overload Ethereum, causing the network to clog. Improvements in monetary policy and Ethereum 2.0 are more obscure concepts for many users and investors. But, they are highly necessary especially if the usage of DeFi increase even more from current levels.

Monetary policy, or as some investors describe it as economic bandwidth, refers to the total supply of Ethereum and what percentage of it is used in decentralized applications (DApps).

If the supply of Ethereum is not sufficient to support the fast adoption of DeFi, Lucas Campbell at Fitzner Blockchain Consulting explained it places a burden on the Ethereum network to withhold all of the demand.

He said:

“If permissionless finance is Ethereum’s value-driving use case, the biggest money protocols each consuming 5-10% of total economic bandwidth to fuel global finance isn’t out of the question. However, in order for Ether to successfully deliver permissionless, trustless finance to the world it will require a massive amount of economic bandwidth to support it.”

Assuming that DeFi will continue to be the primary use case of Ethereum throughout the years to come, scalability is basics and other elements such as monetary policy or economic bandwidth will have to improve similarly.

Conner emphasized that Ethereum has all of the elements to become successful in supporting significant demand for DeFi, which would allow it to retain the position as the top smart contracts blockchain protocol in the global market.

The “weakness” of ETH

Compared to smaller blockchain networks with tighter developer communities and well-funded operations, it is generally harder to propose, implement, and integrate changes into the Ethereum blockchain.

The same challenge exists for every major blockchain network including bitcoin. As such, one may consider that Ethereum is at a disadvantage over smaller blockchain networks in the speed in which it can implement new changes.

Ethereum Market Data

At the time of press 9:32 am UTC on Apr. 25, 2020, Ethereum is ranked #2 by market cap and the price is down 0.39% over the past 24 hours. Ethereum has a market capitalization of $20.74 billion with a 24-hour trading volume of $11.68 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 9:32 am UTC on Apr. 25, 2020, the total crypto market is valued at at $258.61 billion with a 24-hour volume of $107.17 billion. Bitcoin dominance is currently at 64.77%. Learn more about the crypto market ›