Largest Bitcoin ETP outflow since March as profit taking continues

Largest Bitcoin ETP outflow since March as profit taking continues Largest Bitcoin ETP outflow since March as profit taking continues

Digital asset market reports largest Bitcoin outflow since March, while altcoins witness promising inflows.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

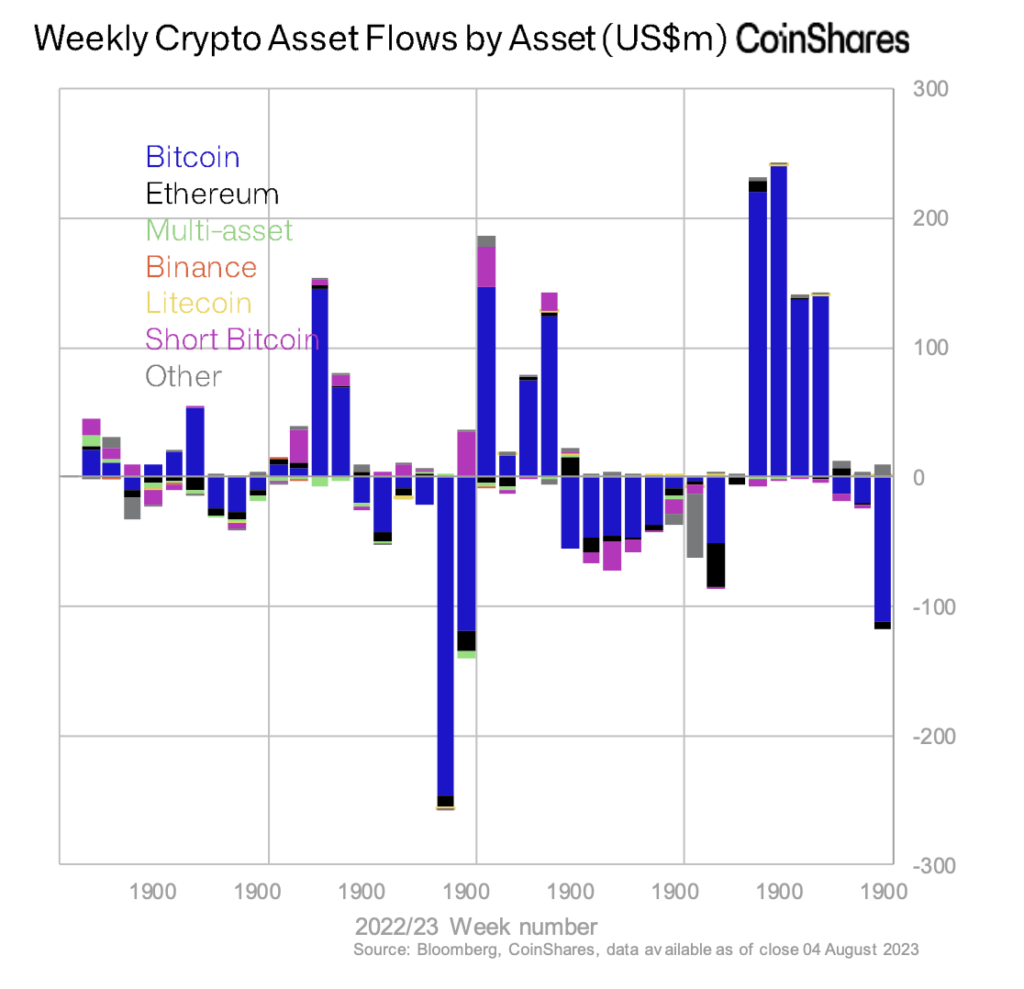

The exchange-traded digital asset market has seen considerable outflows this week, marking a total of $107 million, illustrating an accelerated pace of ongoing profit-taking over the past weeks.

CoinShares’ Digital Asset Fund Flows Weekly report stated that Bitcoin took center stage with outflows amounting to $111 million, recording the most significant weekly outflows since March this year.

However, painting a broader picture of the market, the altcoins seem to show signs of improvement in sentiment, partly offsetting the outflows in Bitcoin and Ethereum.

Specifically, Solana emerged as a significant player, witnessing its largest weekly inflows since March 2022, amounting to $9.5m. XRP and Litecoin also experienced noteworthy inflows, underlining the diversified interest among investors.

The report further highlighted that the outflows were primarily focused on two Exchange Traded Product (ETP) providers in Germany and Canada, which saw outflows of $71 million and $29 million, respectively.

While Bitcoin remained the primary focus, Ethereum also experienced outflows totaling $6 million, bringing the total outflows in both Bitcoin and Ethereum to $117 million last week.

This shift in investment trend can be seen against the backdrop of the summer slowdown. Weekly trading volumes in investment products are 36% below the year-to-date (YTD) average. However, the broader on-exchange market volumes suffered more, down 62% relative to the YTD average.

In contrast, Uniswap and Cardano saw smaller outflows of $0.8 million and $0.3 million, respectively. These outflows perhaps indicate a more cautious stance by investors towards these altcoins.

These considerable shifts in the digital asset flows indicate an intriguing development in the crypto markets as investors presently prefer certain altcoins over conventional behemoths, Bitcoin and Ethereum.

CoinShares analyst James Butterfill presents his analysis of weekly crypto ETP flows weekly on the CoinShares Medium blog.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass