Kyber Network (KNC) launches new market maker protocol with high capital efficiency

Kyber Network (KNC) launches new market maker protocol with high capital efficiency Kyber Network (KNC) launches new market maker protocol with high capital efficiency

Kyber launched a new DeFi innovation known as a Dynamic Market Maker (DMM) to give high capital efficiency to liquidity providers.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Blockchain-based liquidity protocol Kyber Network announced the release of the world’s first Dynamic Market Maker (DMM). The newest feature is designed for liquidity providers to optimize fees, maximize earnings, and enable high capital efficiency.

Following extensive research into the benefits of DMMs over automated market makers (AMMs), Loi Luu, co-founder of Kyber Network, concluded that the new liquidity protocol would pave the way for anyone to take full advantage of the nascent decentralized finance (DeFi) market sector.

“Kyber DMM protocol allows anyone to be a liquidity provider with the advantages of dynamic fees and very high capital efficiency, and we believe this will empower a whole new generation of liquidity providers, takers, and developers to effectively engage in the world of decentralized finance,” said Luu.

Kyber’s newest protocol allows liquidity providers to adjust fees based on market conditions to reduce the impermanent loss that can occur on AMMs like Uniswap during high price volatility. It also enables dynamic fine-tuning of trading parameters to improve capital efficiency and reduce slippage.

Essentially, liquidity providers would now be able to earn more protocol fees relative to their contribution size while takers enjoy reduced slippage.

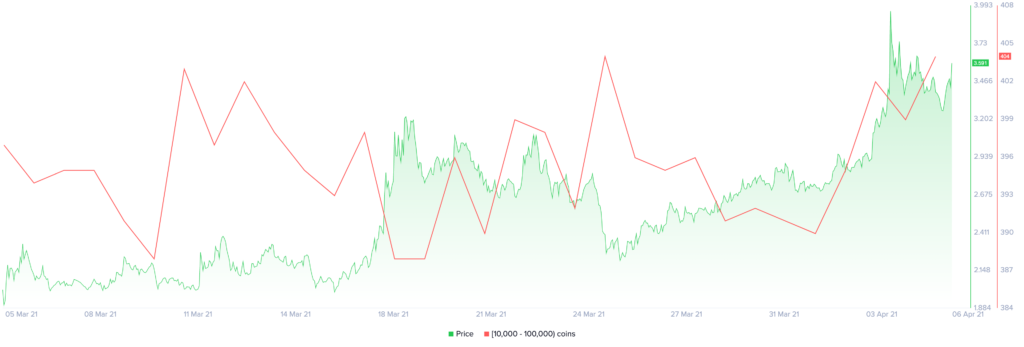

Mid-Sized Whales Go Into Buying Spree

Kyber’s supply distribution chart shows that insiders may have prepared for a bullish market reaction to the recent developments. The number of addresses with 10,000 to 100,000 KNC surged by 1.20% in the past 24 hours.

Roughly five new mid-sized whales holding up to $360,000 worth of KNC have joined the network within such a short period, pushing prices up by nearly 13%.

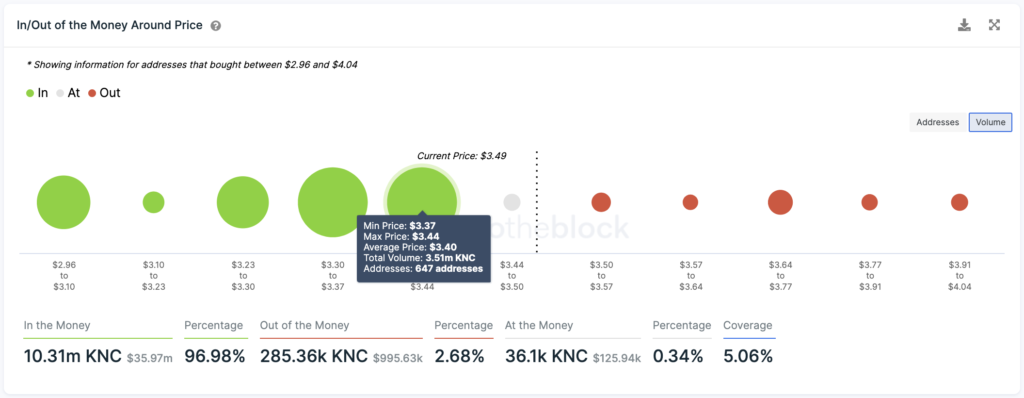

The mounting buying pressure helped Kyber regain a crucial area of support. IntoTheBlock’s In/Out of the Money Around Price (IOMAP) shows that this cryptocurrency was able to move past the $3.40 barrier.

Here, roughly 647 addresses are holding over 3.50 million KNC.

As long as the $3.40 demand wall holds, Kyber Network could continue advancing further since there is little to no resistance barrier ahead based on the IOMAP cohorts.

Kyber Network Crystal v2 Market Data

At the time of press 3:36 pm UTC on Apr. 5, 2021, Kyber Network Crystal v2 is ranked #113 by market cap and the price is up 3.64% over the past 24 hours. Kyber Network Crystal v2 has a market capitalization of $746.68 million with a 24-hour trading volume of $162.74 million. Learn more about Kyber Network Crystal v2 ›

Crypto Market Summary

At the time of press 3:36 pm UTC on Apr. 5, 2021, the total crypto market is valued at at $1.99 trillion with a 24-hour volume of $166.66 billion. Bitcoin dominance is currently at 55.87%. Learn more about the crypto market ›