A fortnight of dominance as Bitcoin fees continue to surpass Ethereum

A fortnight of dominance as Bitcoin fees continue to surpass Ethereum Quick Take

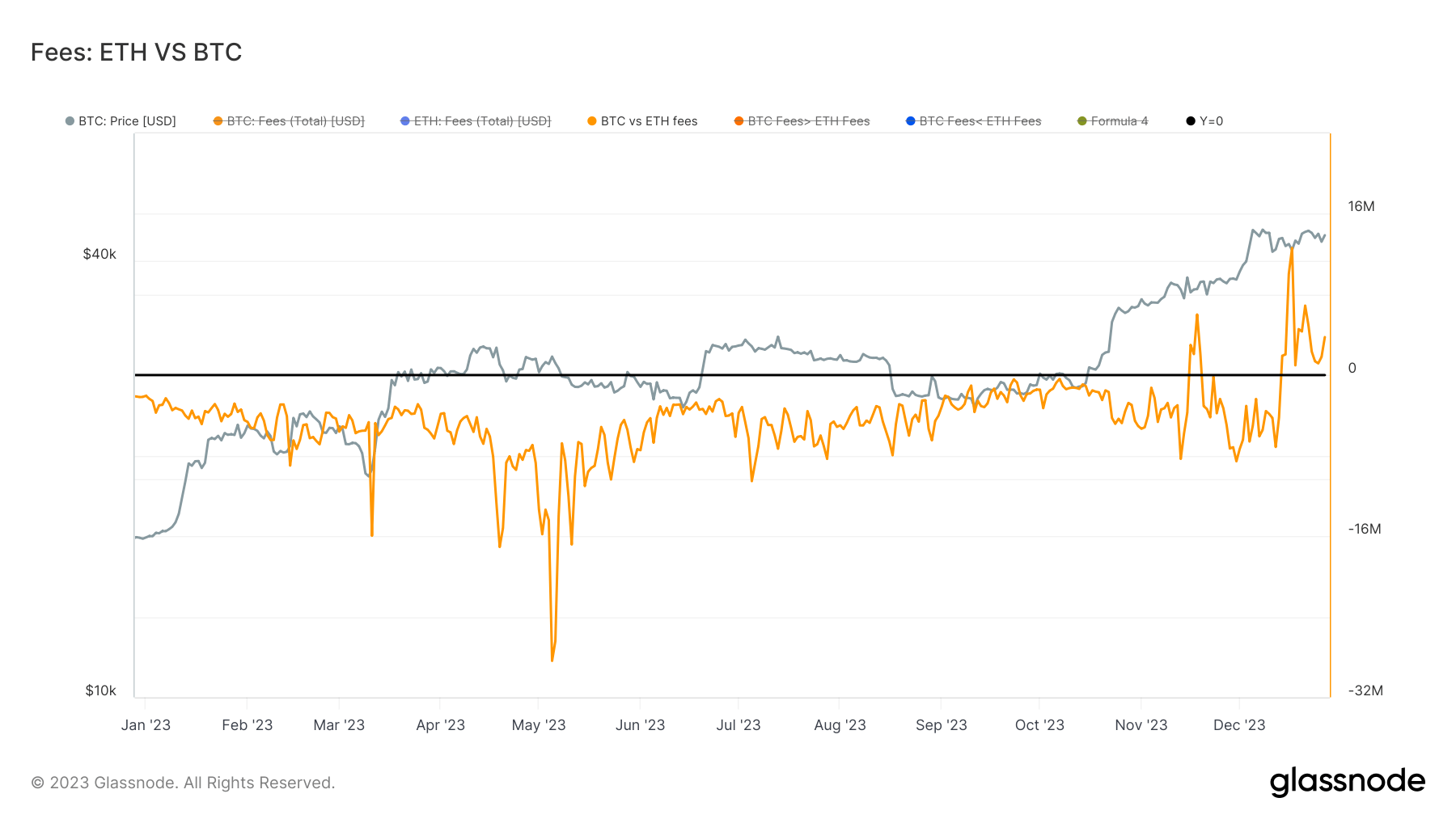

Bitcoin transaction fees continue to eclipse Ethereum after consistently outperforming for over two weeks.

This evolution has raised several important questions about the Bitcoin landscape. With Bitcoin fees reaching a high of $12 million on Dec. 27 and maintaining a steady seven-day average of $11 million, the implications for miners are significant.

The largest single-day fee generation for Bitcoin occurred recently on Dec. 16, raking in $24 million. Contrarily, Ethereum’s peak single-day fee generation was earlier in the year, back in May, when it exceeded $32 million.

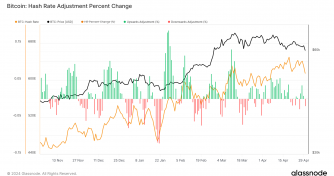

Miner fees are now outstripping block rewards, which has coincided with a dramatic upswing in miner stocks. This heightening of miner revenue, however, poses a query about its reflection in the share price, given the relatively recent onset of increased Bitcoin transaction fees. It is essential to consider how much of this surge in Bitcoin fees is already built into the miners’ soaring share prices and what this means for the future of the Bitcoin economy.