Cosmos (ATOM) surges 68% in 10 days: key factors behind its meteoric rally

Cosmos (ATOM) surges 68% in 10 days: key factors behind its meteoric rally Cosmos (ATOM) surges 68% in 10 days: key factors behind its meteoric rally

Photo by Vincentiu Solomon on Unsplash

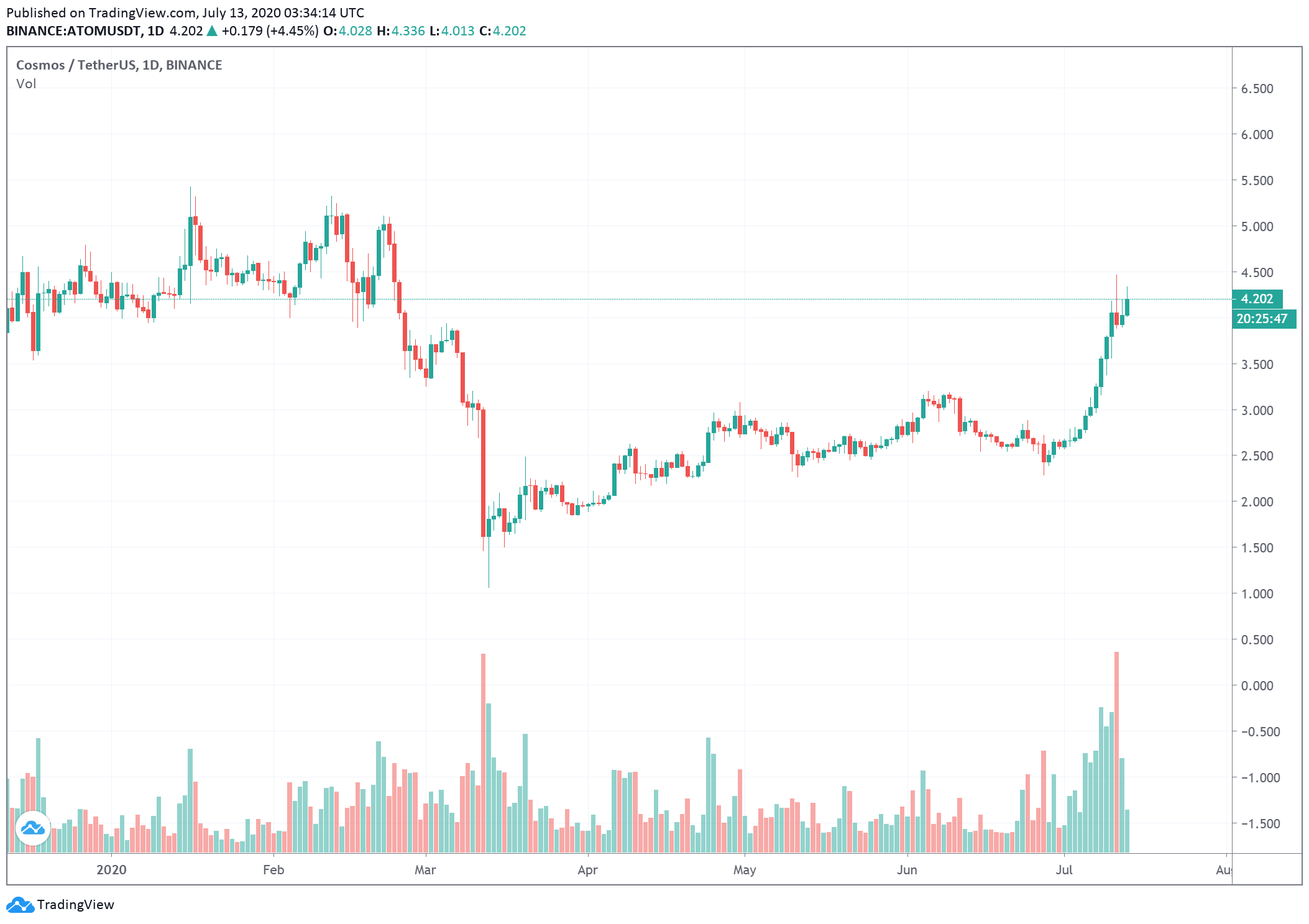

The price of ATOM, the native cryptocurrency of the Cosmos blockchain network, surged by 68% in merely ten days.

Since July 3, the price of ATOM has increased from $2.642 to $4.466 at its peak on July 11.

Cosmos is regarded as a potential competitor to Ethereum (ETH) and Cardano (ADA) because it focuses on scalability. The Cosmos protocol houses multiple blockchain networks in an ecosystem, to process a large number of transactions every second.

The recent uptrend of ATOM could be attributed to three major factors. The likely catalysts are the shifting narrative to scalability, a new decentralized finance (DeFi) protocol, and the perception of Cosmos as an alternative blockchain.

A shifting narrative to scalability

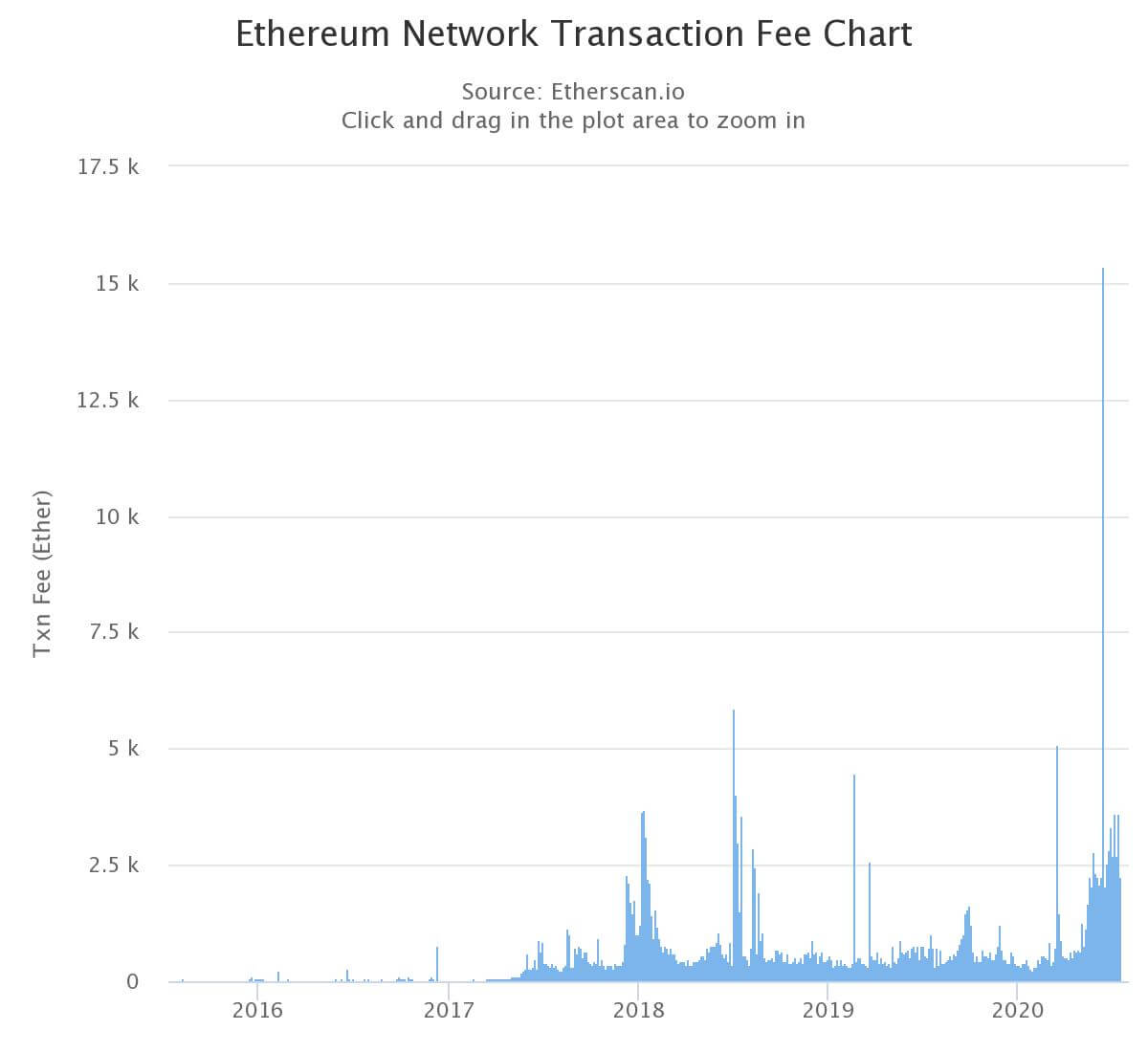

In the wake of exploding demand for DeFi services, fees across major blockchain networks, including Ethereum, increased.

Data from Etherscan shows the transaction fee on the Ethereum network rose substantially in recent weeks.

If transaction fees on Ethereum continue to increase, Todaro explained that the demand for scaling-focused blockchains could increase.

Blocktown Capital managing partner Joseph Todaro wrote:

“My scalability thesis kicks off with Cosmos. With ethereum transaction fees rising and a road map pushing into 2021, the narrative is shifting back to scalability today. Keep an eye on solid projects focused on scaling. They will start gaining considerable attention.”

Kelvin Koh, a partner at leading crypto fund based in Asia known as The Spartan Group, also mentioned Cosmos when asked about potential alternative blockchains for DeFi protocols.

Koh said:

“Cosmos, Polkadot. Not sure about other chains and quality of projects there.”

The release of a new DeFi protocol

On July 7, when the price of ATOM was at the beginning of its rally, Cosmos collaborated with Polkadot and Terra to launch a new DeFi protocol called Anchor.

At the Unitize blockchain conference, Cosmos, Polkadot, and Terra introduced Anchor. The DeFi protocol provides yield on stablecoin deposits through proof-of-stake (PoS), Messari reports.

Upon the launch of the DeFi protocol, the price of ATOM rose further from around $3 to $4.466 within three days after that.

Favorable market structure

Atop of the growing perception of Cosmos as an alternative PoS blockchain, traders say that the market structure of ATOM is compelling.

In early July, Michael van de Poppe, a full-time trader at the Amsterdam Stock Exchange, said the momentum of ATOM appears to be slowing down.

But, he previously said that if ATOM manages to remain above $3.50, a rally to $5 is a strong possibility.

Poppe said on July 10:

“Massive move here, however, it might be topped out soon. In that regard, the area around $3.05-3.10 would be interesting for a ‘buy the dip’ structure. Holding around there could fuel a rally towards $5.”

So far, ATOM has rallied to $4.446, holding the $3.93 resistance level, which dates back to the first week of March.

Cosmos Market Data

At the time of press 12:25 pm UTC on Jan. 1, 2021, Cosmos is ranked #21 by market cap and the price is up 5.18% over the past 24 hours. Cosmos has a market capitalization of $822.31 million with a 24-hour trading volume of $201.28 million. Learn more about Cosmos ›

Crypto Market Summary

At the time of press 12:25 pm UTC on Jan. 1, 2021, the total crypto market is valued at at $274.47 billion with a 24-hour volume of $60.58 billion. Bitcoin dominance is currently at 62.12%. Learn more about the crypto market ›