Bitcoin Lightning Capacity Rises 68% in 1 Month, Progress in Scaling and Micropayments

Photo by Dominik QN on Unsplash

The capacity of the Lightning Network, a micropayment channel that is compatible with Segregated Witness (SegWit) and a layer two scaling solution deployed on top of the Bitcoin protocol, has increased by 68 percent in the past 30 days.

Irek Zielinski, a software developer, and Bitcoin researcher, revealed the total sum of micropayment channels on the Lightning Network has risen from 23 BTC to 38.6 BTC, increasing by around 2.2 percent on average per day.

This is the most bullish graph in Bitcoin: Lighting Network capacity.

In last 30 days it went up from 23 to 38.6 BTC. That's grow of 68% in one month (or 2.2% a day!).Reason: to start with it was #reckless to even use real funds, now as environment matures capacity is flowing! pic.twitter.com/ektV3NsHrX

— Irek Zielinski (@irek_zie) July 7, 2018

Importance of Layer Two Scaling

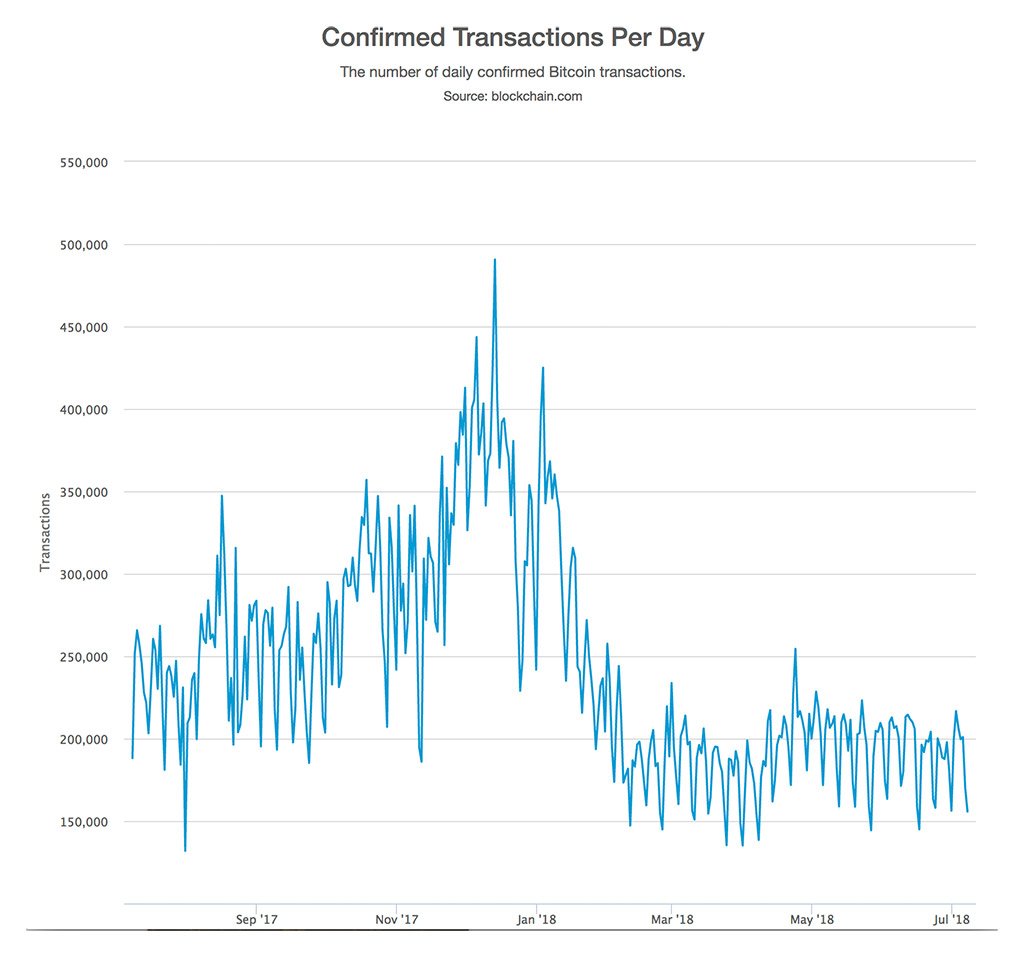

In December 2017, when the price of Bitcoin peaked at $20,000 after achieving a new all-time high and the valuation of the cryptocurrency market reached $850 billion, the transaction fee of Bitcoin surpassed $10 on average and reached $30 on large transactions.

As of July 2018, on widely utilized cryptocurrency wallets like Blockchain.info, it costs less than $0.1 to send a median-size payment. The low transaction fee can be attributed to the low mempool size and transaction volume of the Bitcoin network.

Eight months ago, the Bitcoin network was processing 500,000 transactions on a daily basis but recently, the Bitcoin network has been settling less than 150,000 transactions per day.

Hence, as the price of Bitcoin goes up in the upcoming months as experts like BitMEX CEO Arthur Hayes predict, the transaction fee of Bitcoin will rise simultaneously.

This is especially the case if the demand for Bitcoin rises during a strong rally, as it will be costly to process transactions on the main chain of Bitcoin once again.

Second Layer Scaling

Second layer scaling solutions like the Lightning Network are capable of processing small transactions efficiently, without imposing immense pressure on the main chain or the main Bitcoin network. Plasma on Ethereum operates similarly to Lightning – which is also created by the Lightning author.

Most major blockchain projects and developers are focusing on improving layer two solutions to ensure that in the next bull market – even amidst high demand and large spikes in daily volume – public blockchain networks will be able to handle small and large-scale on and off-chain.

The growth of the Lightning Network from 23 BTC to 38.6 BTC may seem like a minor improvement in its capacity, considering that in the past month, only $120,000 worth of Bitcoin was added to Lightning payment channels.

However, because Lightning micropayment channels typically settle payments in the $0.1 to $10 range, an increase of 15.6 BTC can be considered significant progress in a short period of time.

Progress Equals Adoption

As with any other technology in its infancy, experts and technology researchers have expressed their concerns over Lightning and the ability of the network to settle larger payments.

Diar, a digital currency analytics company, wrote in a study entitled Lightning Strikes, But Select Hubs Dominate Network Funds:

“But while the capacity and the number of nodes as well as channels are increasing steadily, the reliability of successfully routing a payment on the Lightning Network is still quite low, especially for larger amounts. The success rate for a payment for no more than a few dollars between random LN nodes is 70%”.

Moreover, Jeff Garzik, former Bitcoin Core developer and the co-founder of Bloq, a blockchain software company, also noted that a random individual became the biggest node operator on the Lightning Network by opening several channels worth $50,000.

"Some dude just became the biggest node on the #lightning network by opening channels worth ~ 50k USD" #bitcoin https://t.co/GuRSJhzbeI

— Jeff Garzik (@jgarzik) July 8, 2018

Garzik implied an issue covered by Diar, which suggested that at the current phase of development, a few channels own a substantial portion of the funds on the Lightning Network.

With steady growth, these issues can be resolved by the open-source community of Bitcoin developers and as long as platforms like Bitrefill continue to demonstrate the potential of Lightning on commercial applications and platforms, the capacity of Lightning will likely continue to increase rapidly.