Research: Genesis received over $1B worth of FTT from Alameda, FTX in last 3 months

Research: Genesis received over $1B worth of FTT from Alameda, FTX in last 3 months Research: Genesis received over $1B worth of FTT from Alameda, FTX in last 3 months

Arkham Intelligence dashboard shows that Genesis has been processing millions in stablecoin redemptions over the past few days.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

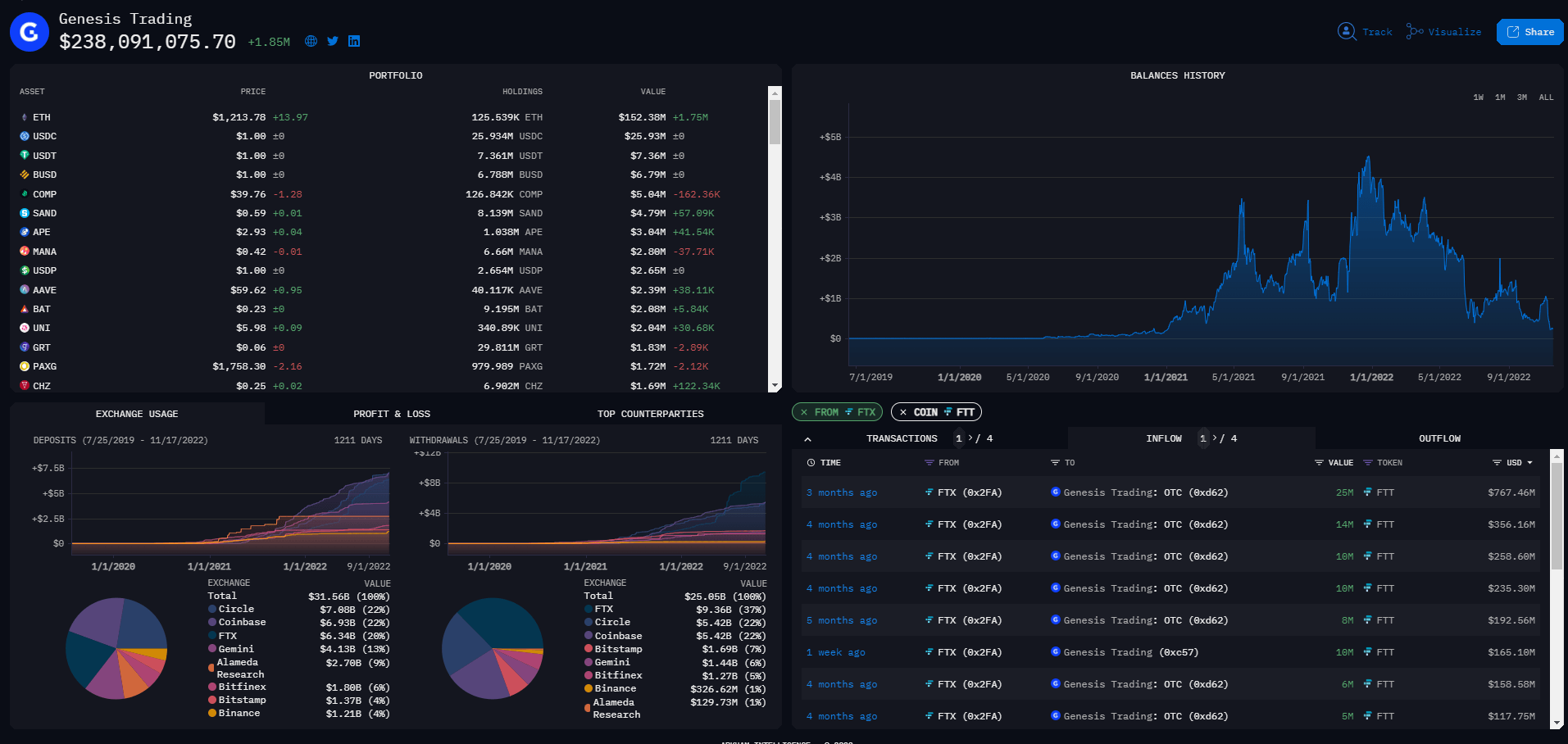

An analysis of the Arkham Intelligence dashboard CryptoSlate Research shows that popular crypto lender Genesis received billions in FTT tokens from bankrupt crypto firms Alameda Research and FTX over the past year.

For context, Genesis received $932.56 million worth of FTT tokens from FTX within the last three months, while it received $141.1 million worth of struggling tokens from Alameda Research during the same period.

The crypto lender recently halted all customer withdrawals due to the FTX’s collapse. Genesis stated that the incident resulted in “abnormal withdrawal requests” that exceeded its liquidity.

Meanwhile, reports revealed that the lender had failed to get an emergency loan of $1 billion from investors in the wake of the collapse.

Meanwhile, the extent of FTX’s collapse on Genesis business is telling when one considers the value of trading assets under its possession.

At its peak, Genesis trading assets were almost $5 billion. As of press time, the firm’s trading assets are worth roughly $238 million, according to the Arkham Intelligence dashboard.

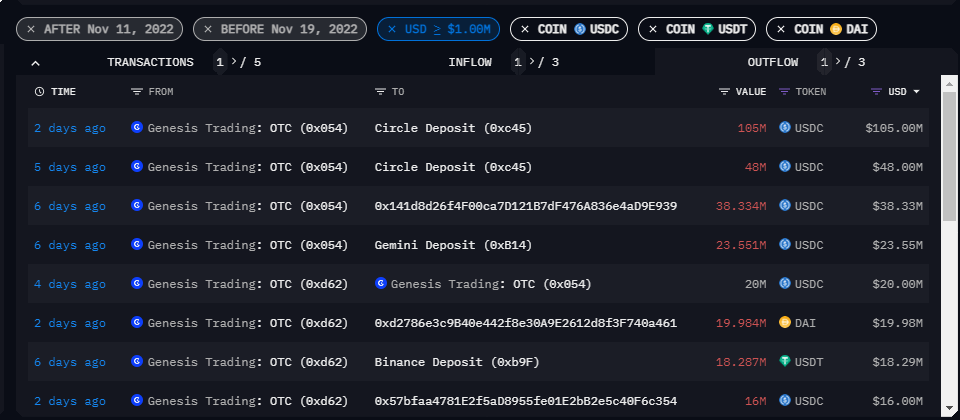

Genesis is processing large amounts of redemptions

On Nov. 16, a Genesis-labelled address processed its single-largest transactions. Arkham Intelligence tweeted on Nov. 18 that over $100 million in USDCoin (USDC) were transferred to the Genesis over-the-counter (OTC) address, and that address subsequently deposited $105 million USDC to Circle.

Arkham said this was likely a large customer that withdrew from the Genesis OTC platform.

CryptoSlate Research’s look at the Genesis trading dashboard on Arkham’s Intelligence platform showed that the large transaction was not a one-off. Instead, it was one among many such redemptions the lender had processed recently

According to the dashboard, Genesis OTC has processed $250.9 million USDC redemption within the last seven days. During the same period, the OTC also processed $18.3 million USDT redemption and $20 million DAI redemption.

Cumulatively, the OTC processed roughly $290 million in stablecoin redemptions over seven days.

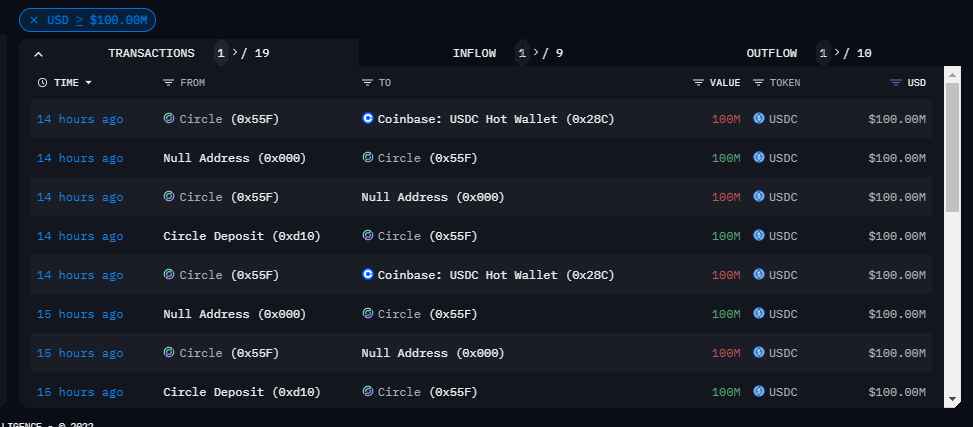

Meanwhile, Circle is also seeing massive USDC redemptions for fiat as it has been burning millions of USDC.

Arkham Intelligence said USDC is burned when USD is redeemed as fiat. The dashboard shows that the stablecoin issuer has burned $100 million twice in the last 24 hours.

Farside Investors

Farside Investors

CoinGlass

CoinGlass