Why Ethereum’s DeFi poster child MakerDAO was flipped by Compound

Why Ethereum’s DeFi poster child MakerDAO was flipped by Compound Why Ethereum’s DeFi poster child MakerDAO was flipped by Compound

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

It’s been quite the past week for Ethereum. While ETH’s price has stagnated, decentralized finance (DeFi) — one of the blockchain’s leading use cases — has grown exponentially.

Ex-Bloomberg journalist Camilla Russo noted on Jun. 19 that the value of tokens locked in DeFi applications has skyrocketed 40% in the past week alone. There is now $1.4 billion worth of digital assets locked in such applications.

Simultaneously, DeFi-centric tokens went parabolic, with one analyst sharing the chart below showing the performance of assets like Aave’s LEND, Kyber Network’s KNC, and others compared to BTC.

But driving this growth wasn’t DeFi’s poster child, MakerDAO, it was Compound.

The king of decentralized finance has been unseated

Driving DeFi’s growth this week was Compound, a decentralized money-market protocol that allows users to borrow and lend their assets.

The protocol didn’t change. What did change, though, was the public introduction of COMP — Compound’s governance token.

Prior to this past week, it was only held by investors and owners in the company that runs the DeFi protocol. But Compound this week made the token public, allowing users of the protocol to earn the altcoin.

And despite it being days from public launch, the Ethereum-based COMP has seen parabolic growth. This is due to the market’s expectations that Compound will become a leading DeFi protocol and may offer holders of COMP to earn dividends, one analyst explained.

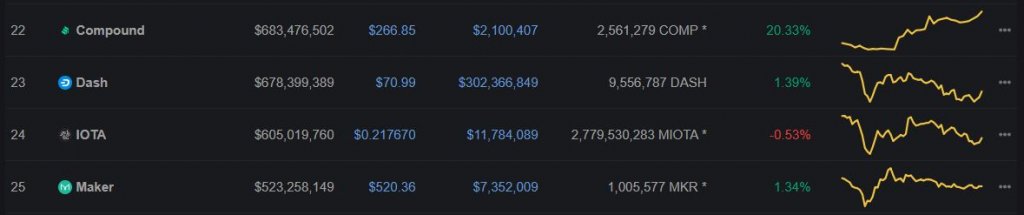

According to data from CoinMarketCap, the market capitalization of COMP recently eclipsed that of MakerDAO’s MKR token — long deemed the “king” of DeFi.

The former is now the 22nd largest cryptocurrency, trading more than 20 percent higher in the past 24 hours as the asset prepares to garner a coveted listing on Coinbase.

This win for Compound coincides with the value of cryptocurrency locked in it surpassing that of MakerDAO.

Importantly, COMP’s market is relatively illiquid compared to that of MKR, with a daily volume of $2.1 million compared to MKR’s $7.3 million and a relatively small group of supported exchanges.

It thus could have been manipulated higher by a small group of actors.

The growth isn’t sustainable

COMP’s parabolic growth over the past week has been predicated on expectations that DeFi will continue to see parabolic growth.

Unfortunately, this may not be the case. At least not yet.

A commenter responding to an open forum about DeFi’s growth over the past few weeks conducted by Ryan Sean Adams, founder of Mythos Capital, said:

Compound Market Data

At the time of press 2:37 pm UTC on Feb. 20, 2022, Compound is ranked #22 by market cap and the price is down 22.19% over the past 24 hours. Compound has a market capitalization of $715.43 million with a 24-hour trading volume of $3.86 million. Learn more about Compound ›

Crypto Market Summary

At the time of press 2:37 pm UTC on Feb. 20, 2022, the total crypto market is valued at at $271.99 billion with a 24-hour volume of $69.31 billion. Bitcoin dominance is currently at 64.60%. Learn more about the crypto market ›

Another remarked that DeFi is still too nascent to go mainstream, causing tokens and Ethereum itself to rally higher.