DeFi’s shocking growth has boosted one small sector of crypto tokens

DeFi’s shocking growth has boosted one small sector of crypto tokens DeFi’s shocking growth has boosted one small sector of crypto tokens

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

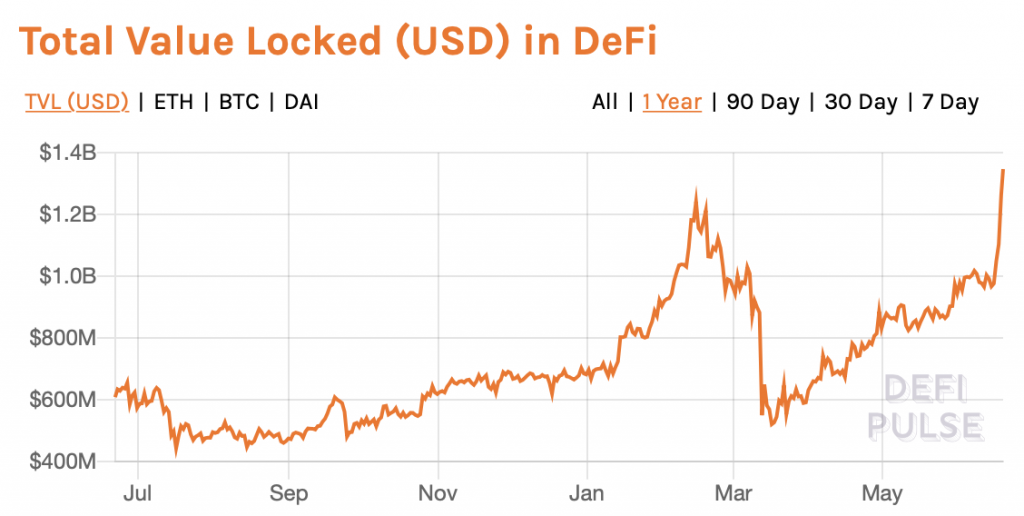

Throughout 2019, the decentralized finance (DeFi) trend gained major momentum, with the total value of crypto locked within DeFi-related loans climbing towards $1 billion by the end of the year, before surmounting this milestone in January.

This number dropped significantly in mid-March, concurrently with the capitulatory plunge seen by the aggregated crypto market.

The market-wide meltdown caused nearly $700 million to be pulled from DeFi-related loans, with much of this value loss coming about as the result of position liquidations.

In the time since then, the trend has reemerged with vengeance, as the total locked value was just able to rocket to fresh all-time highs today.

One notable byproduct of this rebound in DeFi’s popularity has been a rapid price surge in crypto tokens that are associated with this sector.

DeFi sees massive growth over past three months following crypto market meltdown

Crypto market participants have been pouring money into the DeFi ecosystem over the past several months alongside the market’s recovery.

This trend is clearly seen while looking towards the total value of crypto locked within collateralized DeFi loans, which just surpassed its previously established all-time highs – rising to $1.35 billion today.

This number has been steadily increasing over the past few months, but it went parabolic today.

Data from defipulse.com indicates that a good portion of these freshly appropriated funds come from the newly launched Compound.

Most DeFi inititives are part of the Ethereum ecosystem in some way, and many investors point to the sector’s growth as a reason why the crypto is fundamentally robust.

As CryptoSlate reported previously, some prominent investors believe that this could cause Ethereum’s price to balloon by up to 4,000%.

DeFi-related tokens enter early-stages of a bull market

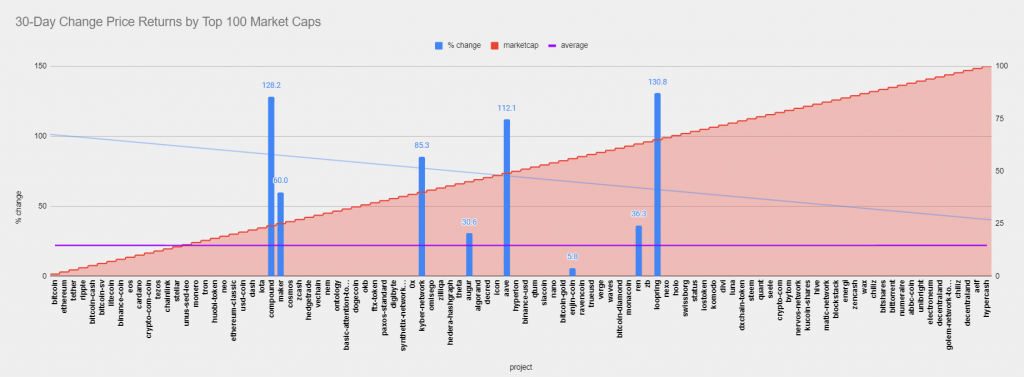

The growth the decentralized finance sector has seen over the past few months has provided altcoins related to this ecosystem with a serious price boost.

According to data from analytics platform Santiment, the top DeFi crypto tokens have risen by 22% over the past 30 days on average. A few of these tokens in particular have far exceeded these gains, including the Compound (COMP) token.

“DeFi projects have absolutely exploded in the previous 30 days. To give some perspective, the top 100 blockchains have averaged a +22% return. COMP, MKR, KNC, REP, AAVE, REN, and LRC have respectively exceeded this 30d average by a wide margin.”

It is likely that these crypto tokens’ price action will be largely attached to the health of the aggregated DeFi ecosystem in the months ahead.