Why Bitcoin traders fear a significant pullback for the first time in 2 months

Why Bitcoin traders fear a significant pullback for the first time in 2 months Why Bitcoin traders fear a significant pullback for the first time in 2 months

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Bitcoin price has dropped by around three percent overnight after it rejected $9,600. A handful of traders are now becoming cautious towards BTC for the first time since December 2019.

Here’s why a pullback for Bitcoin would make sense

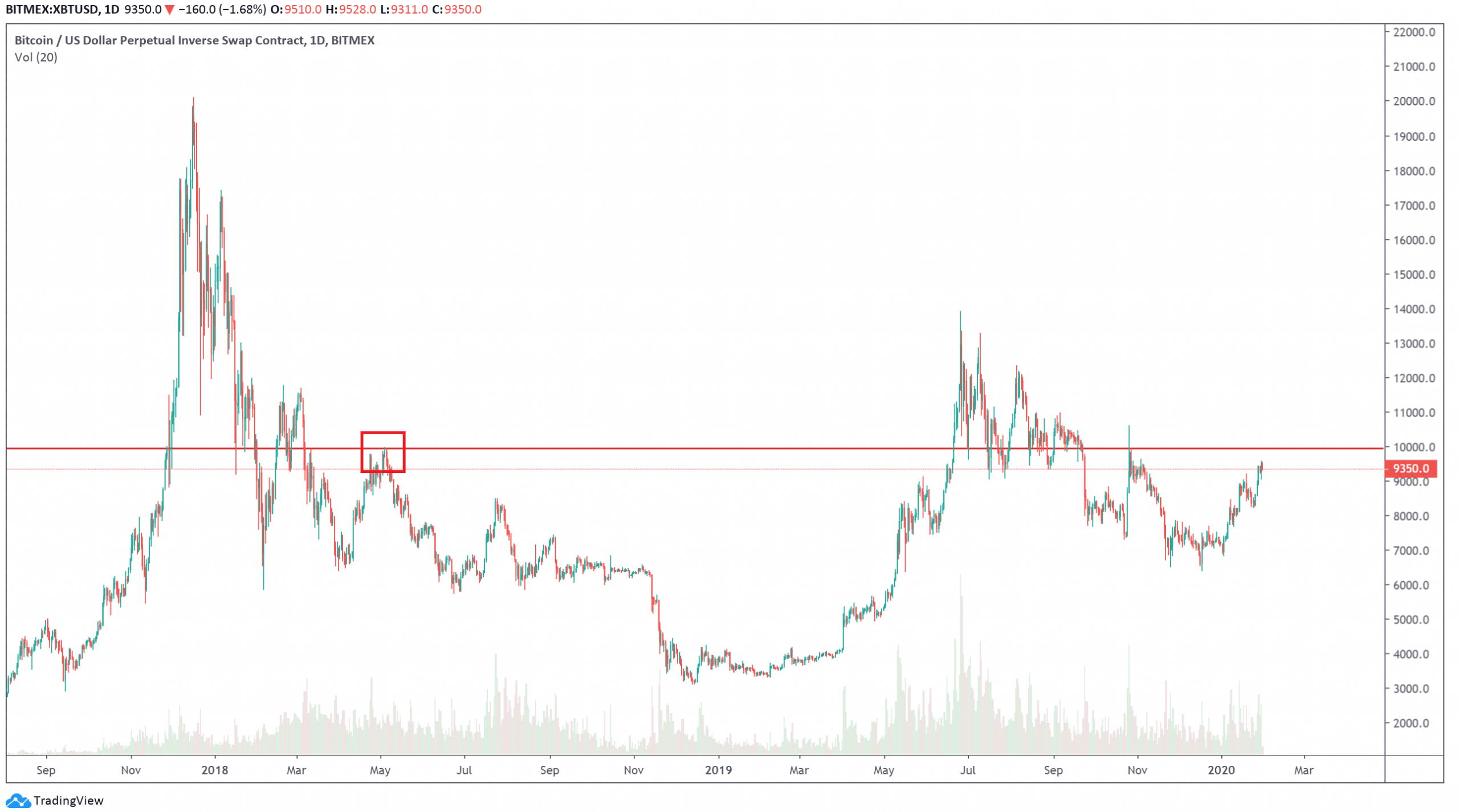

In May 2018, after the Bitcoin price rejected the $9,000 region, BTC went onto drop to the $6,000s and it took well over a year for the cryptocurrency to reclaim $9,000.

The $9,000 area has been a region of high trading activity throughout the past two years. With bitcoin coming off of a near 50 percent gain within less than two months, a pullback to lower level supports could be a strong possibility.

In November 2019, the Bitcoin price rejected the $9,900 level like it did in May 2018. While BTC wicked to $10,600 briefly, the main area of rejection for BTC was $9,900.

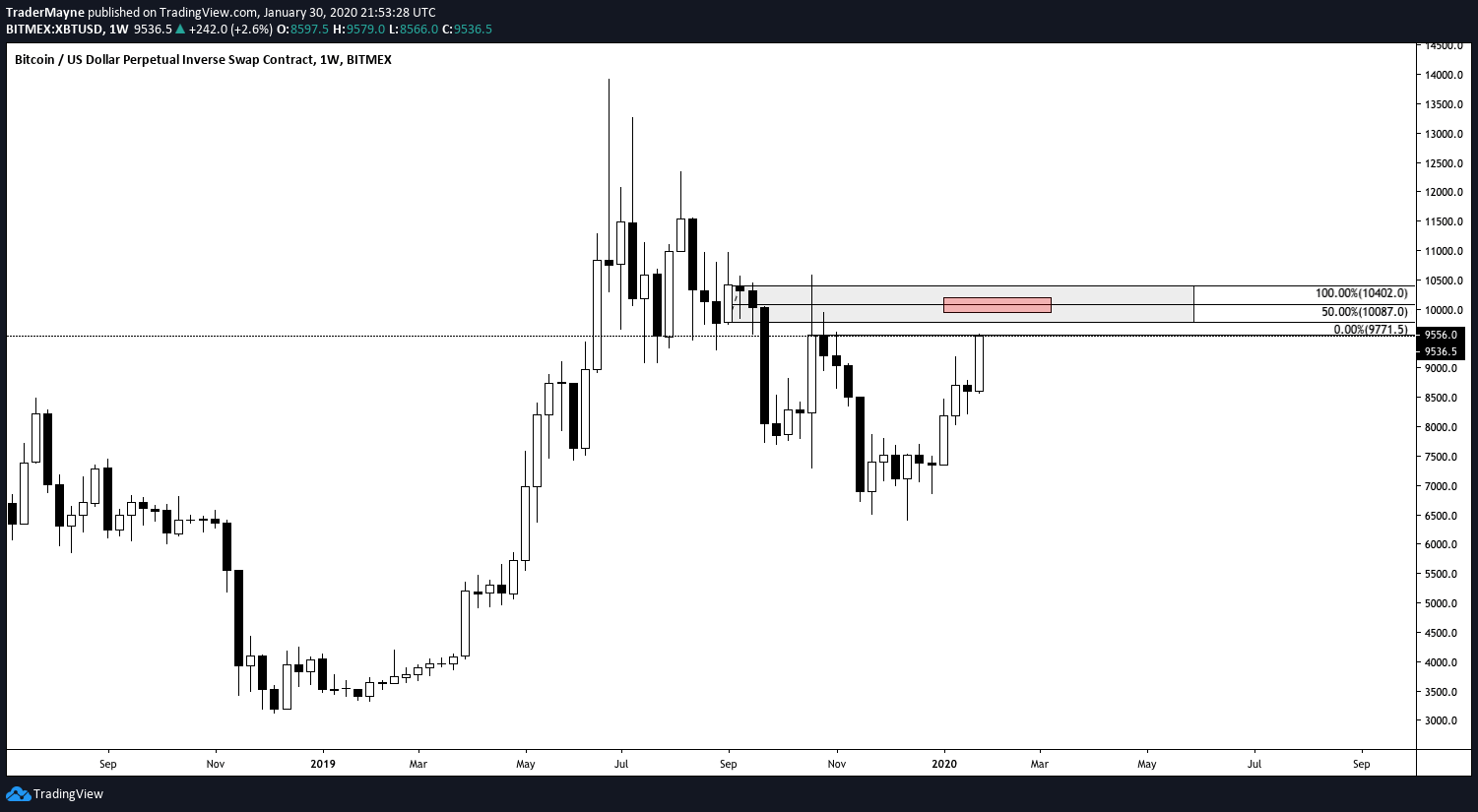

Some traders are waiting for Bitcoin to reach the $9,900 to $10,100 range. One technical analyst known as “Mayne” said the $10,000 level is likely to be where BTC rejects heavily.

He said:

“Last 5 months have conditioned people to short every pump, causing many to miss this 30% move. Shorting dips in an uptrend is low probability, look at my feed in August to September. I was longing pumps in a downtrend. We’re approaching a HH on the weekly. Short the red, no sooner.”

However, other traders have said that the Bitcoin price does not have to reach $10,000, which is considered to be a psychological level by most investors, to see a steep downtrend.

If the Bitcoin price rejects at $9,600, and possibly even at $9,900, it could mean the resumption of a downward trend since July 2019.

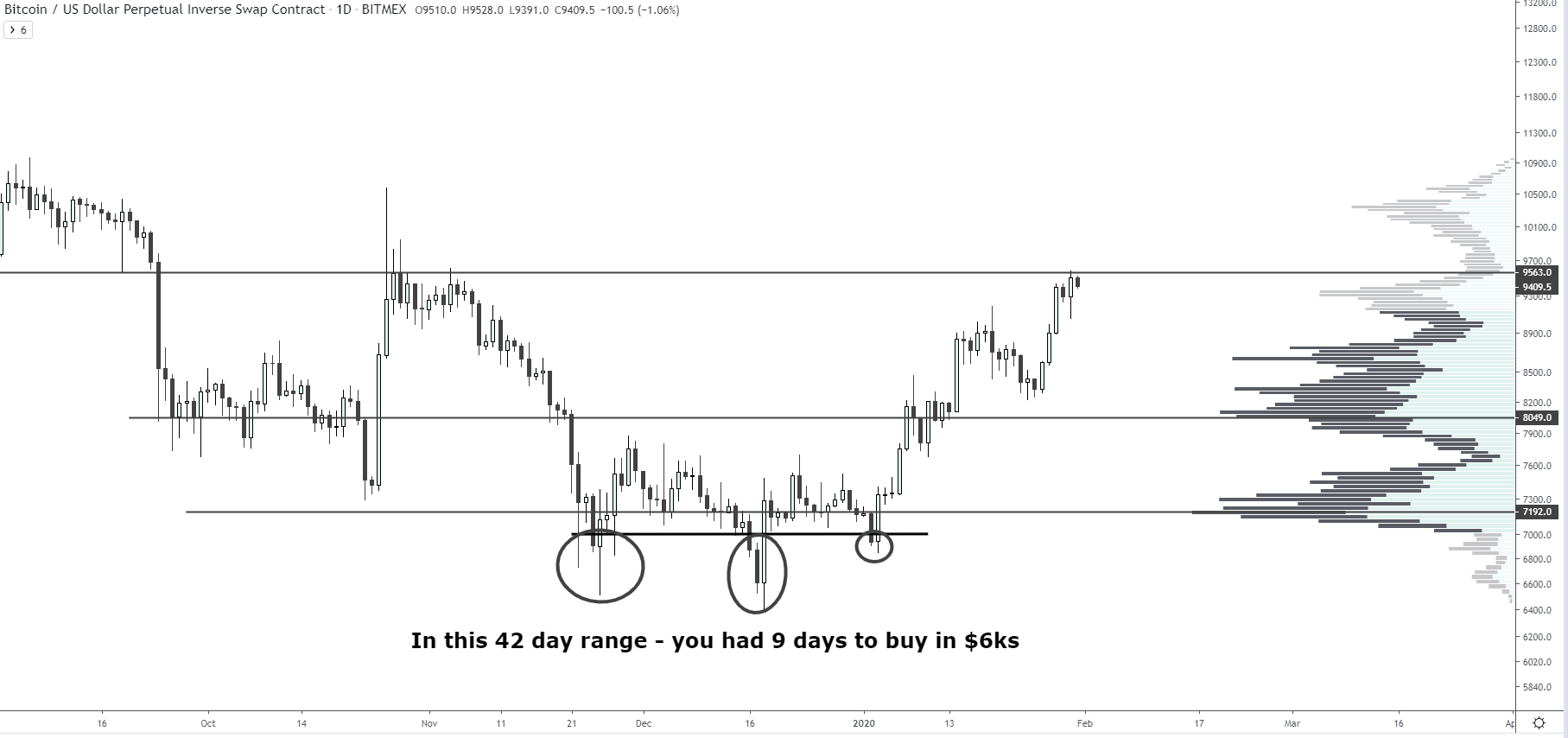

As noted by prominent cryptocurrency technical analyst Josh Rager, the “bottom” for Bitcoin at $6,410 was established in a much shorter period than the $3,150 bottom in 2018.

Rager explained:

“You had 9 days to buy Bitcoin in the $6ks during a 42-day range. This is a lot less time than you had to buy at under $3500 during the November/December 2018 bottom.”

The shorter bottoming out phase in 2019 could be an argument for bears that the bottom is not in just yet. But, the argument comes back around to the difference in the landscape of the cryptocurrency market between now and two years ago.

Not so fast: the variables

The one variable that could differentiate the price trend of BTC from 2020 to 2018 would be the upcoming block reward halving in May. At this point, the Bitcoin price has likely priced in the halving to some extent, as seen in its intense upsurge throughout the last 60 days.

The halving will still have a significant impact on the circulating supply of Bitcoin and the scarcity of the asset. As such, whether the Bitcoin price further reacts to the halving as the market moves closer to May remains to be seen.

Bitcoin Market Data

At the time of press 6:49 am UTC on Jan. 31, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.38% over the past 24 hours. Bitcoin has a market capitalization of $170.47 billion with a 24-hour trading volume of $32.53 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:49 am UTC on Jan. 31, 2020, the total crypto market is valued at at $258.56 billion with a 24-hour volume of $124.61 billion. Bitcoin dominance is currently at 65.92%. Learn more about the crypto market ›