Why the Bitcoin price just dropped below $9k in steep reversal, liquidating $83 million in longs

Why the Bitcoin price just dropped below $9k in steep reversal, liquidating $83 million in longs Why the Bitcoin price just dropped below $9k in steep reversal, liquidating $83 million in longs

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The Bitcoin price just dropped below the $9,000 level, hitting $8,964 on BitMEX. The sentiment around the cryptocurrency market noticeably declined after BTC rejected the $10,000 resistance level three times in a span of 15 days.

What’s triggering the trend reversal?

Within a span of minutes, BitMEX recorded around $83 million worth of long liquidations from 226 positions. Briefly, before dropping to sub-$9,000, the Bitcoin price spiked to $9,275, trapping a large number of longs before plummeting by around $300 within less than 30 minutes.

The bear trap caused a large short-term downside movement, creating significant volatility within hours. But, the main catalyst behind the plunge in the Bitcoin price from $10,500 to $8,000s in the past two weeks has been the rally itself.

The Bitcoin price increased at a rapid pace from $6,410 to $10,500, by around 63 percent against the USD.

As noted by several whales — individual investors who hold large amounts of Bitcoin — the rally was not backed with sufficient fiat inflow on spot exchanges and over-the-counter (OTC) trading platforms.

The upsurge was primarily fueled by spoof or fake buy orders at key support levels, inorganically pushing the price up. Spoofing is not legal in the stock market, made illegal in the U.S. by the Dodd-Frank Act of 2010 under Section 747, as it is considered to be a blatant attempt at manipulation.

Whether the upsurge was purely a result of manipulation from start to finish remains unclear, but the pattern of spoof orders at key levels indicates that spoofing was responsible for most of the upsurge.

When the Bitcoin price goes up at such a fast pace in a short period of time, it is often met with a brutal correction that kicks off months of consolidation.

From January to February, oversold alternative cryptocurrencies (altcoins) also went onto rally by more than 100 percent against the USD on average. That left the entire cryptocurrency market more vulnerable to a steeper crash.

What’s next for Bitcoin?

Traders are generally exploring $8,500 and $7,500 as two levels that have deep liquidity for Bitcoin. The Bitcoin market tends to move towards an area that has the most amount of buy orders and liquidity.

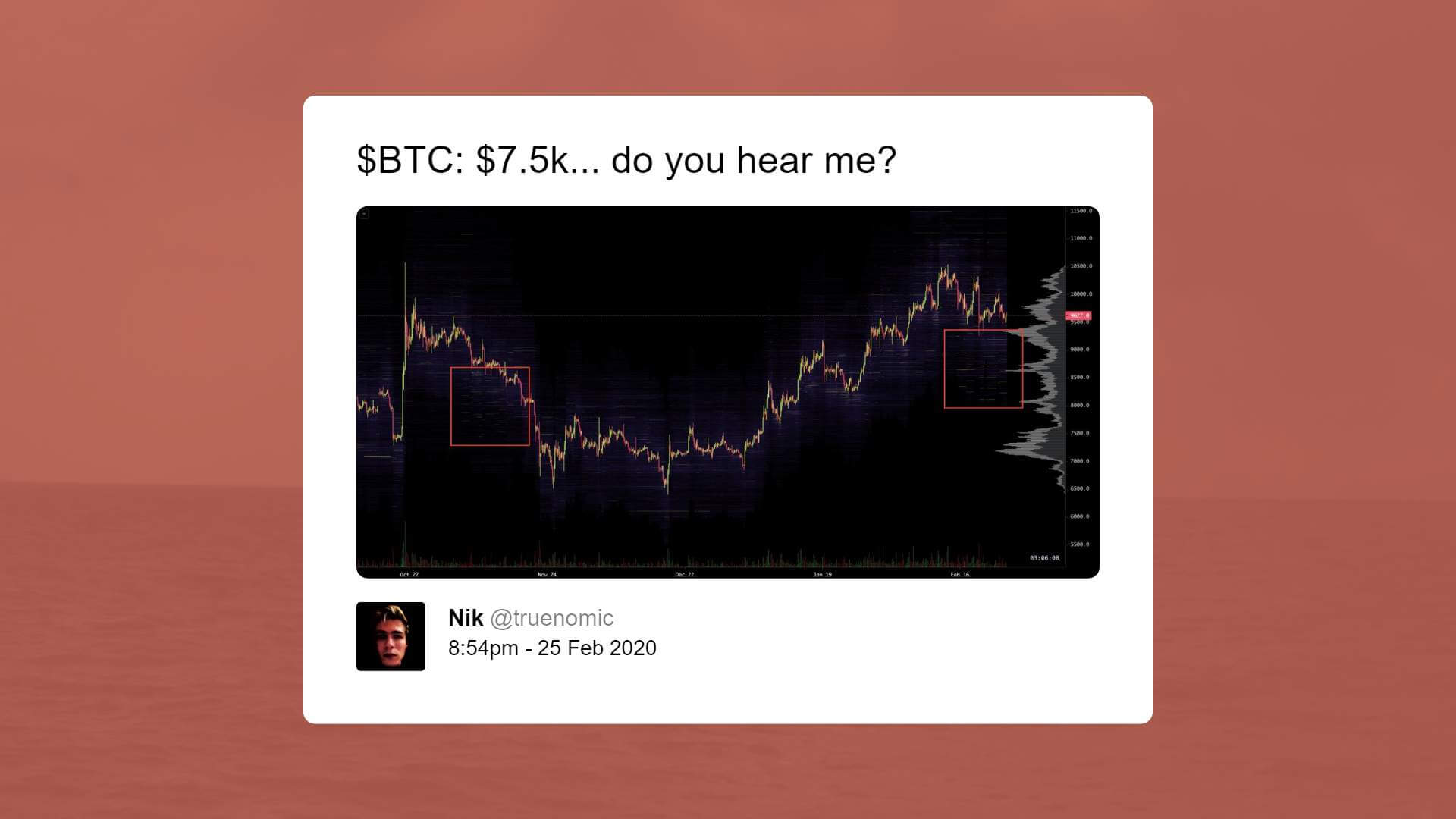

According to Nik Yaremchuk, an on-chain analyst at Adaptive Fund, there is large liquidity at $7,500, which was previously tested when the Bitcoin price consolidated from $10,500 in late 2019.

The $7,500 level is also an area of high trading activity history based on the price action of Bitcoin throughout the past two years.

Bitcoin Market Data

At the time of press 1:21 am UTC on Feb. 28, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.73% over the past 24 hours. Bitcoin has a market capitalization of $161.26 billion with a 24-hour trading volume of $43.71 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:21 am UTC on Feb. 28, 2020, the total crypto market is valued at at $252.44 billion with a 24-hour volume of $162.33 billion. Bitcoin dominance is currently at 63.87%. Learn more about the crypto market ›