Two $10 Million Bitcoin shorts opened at $10k: are whales anticipating a severe correction?

Two $10 Million Bitcoin shorts opened at $10k: are whales anticipating a severe correction? Two $10 Million Bitcoin shorts opened at $10k: are whales anticipating a severe correction?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

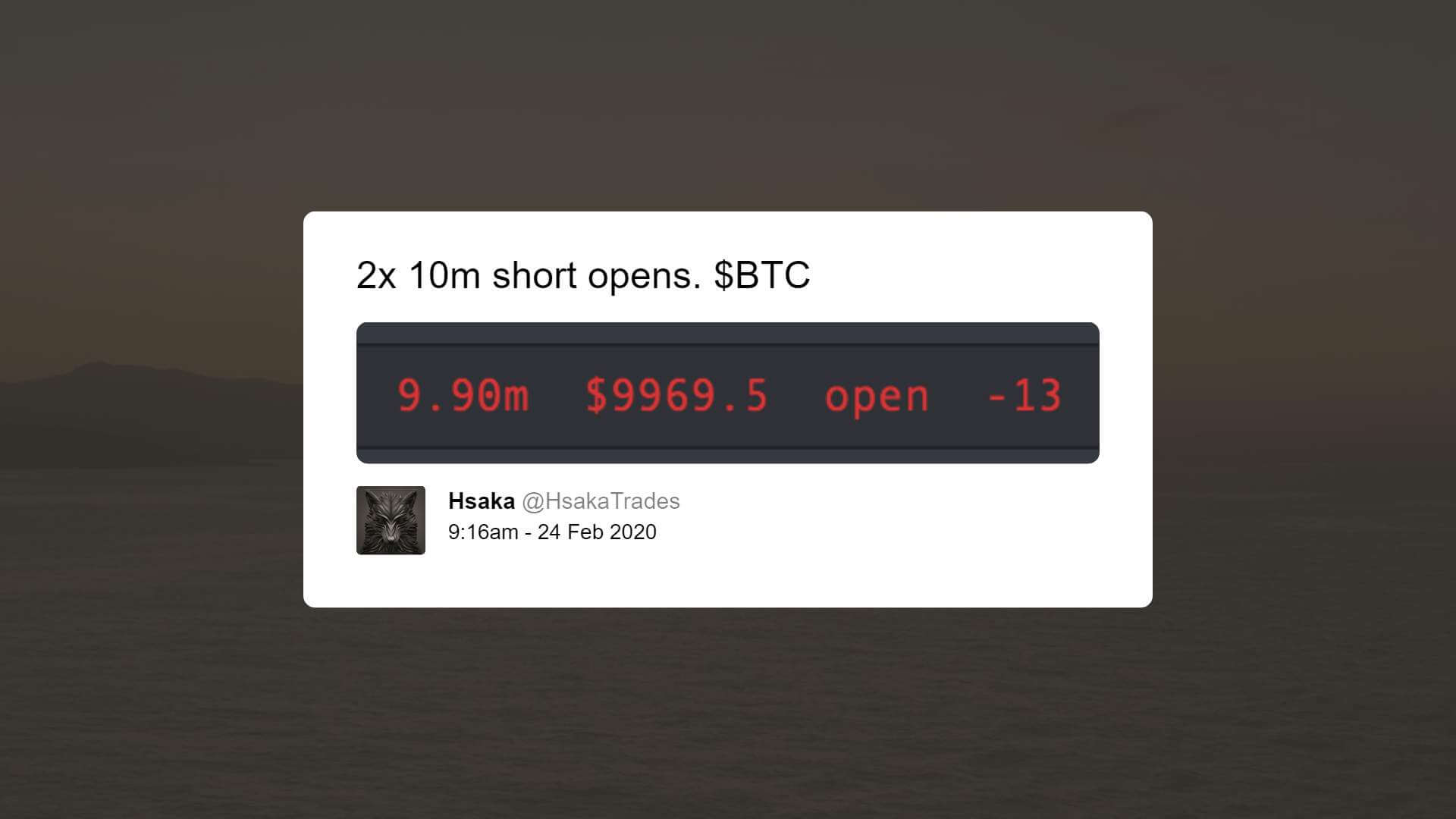

The bitcoin price recovered to around $10,000 right before the weekly close on February 24, closing at $9,945 on BitMEX. Almost immediately after it, two whales placed large $10 million shorts, anticipating the market to pullback.

When the bitcoin price plummeted from $10,331 to $9,260 on February 19 within merely hours, analysts attributed the overnight pullback to a single whale dumping large amounts of bitcoin at $10,300, on major margin trading platforms.

Are some whales expecting a big bitcoin pullback?

As said consistently by Joe007, the largest whale on Bitfinex, the bitcoin market is heavily leveraged and based on debt, as investors often utilize leverage in the range of 3x to 125x.

Following the near 10 percent drop of bitcoin on a single day, Joe007 noted that long and short squeezes in the cryptocurrency market tend to be intense, and traders should not be taken aback by it.

He said:

“What, did you think there was any chance of a short squeeze, just like in July 2019? Sorry to disappoint you.”

Due to the over-leveraged nature of the bitcoin market, it opens it up to sudden upside and downside movements in a short period of time.

Whales are possibly expecting the bitcoin price to go down after rejecting the $10,000 level upon the weekly close.

While the sentiment around the cryptocurrency market remains optimistic with the block reward halving on the horizon, there is an opposing narrative by traders that anticipate BTC to pull back before the halving.

The opposing theory of halving’s impact on price

After the bitcoin halving takes place in late April, the breakeven price of mining BTC spikes to more than $13,000.

Simply put, the bitcoin price has to be over $13,000 for miners to be profitable in mining bitcoin.

If the price of BTC remains below $10,000, miners will have to sustain their operations at a loss, especially if the miners have to sell the BTC they generate to cover costs.

In the perspective of miners, an ideal scenario would be to sell a portion of their bitcoin holdings before the halving while the price is high and finance 12 months of operations after the halving.

That allows miners to keep the vast majority of BTC they generate through mining while covering expenses.

Miners paying for costs in advance is not a new concept; Brian Kelly, the CEO at BKCM and contributor at CNBC’s Fast Money, previously said that some miners sold enough bitcoin in mid-2019 to not have to sell BTC for a full year.

Coincidentally, a month after Kelly’s statement, the bitcoin market crashed from around $13,000 to as low as $6,410.

Halving is one of the most important events concerning bitcoin and its price because it directly affects the supply of the dominant cryptocurrency.

While it poses a positive impact on the price of BTC in the long-term, its short-term effect remains to be seen.