DeFi Saver Unveils ETH Saver: The Premier Non-Custodial App for Leveraged ETH Staking

Disclaimer: This is a sponsored press release. Readers should conduct their own research prior to taking any actions related to the content mentioned in this article. Learn more ›

Middletown, United States, September 29th, 2023, Chainwire — DeFi Saver, a popular Ethereum DeFi management app, introduces a new fully non-custodial app focused on leveraged staking called ETH Saver.

DeFi Saver, one of the leading applications for creating, managing, and tracking DeFi positions on Ethereum, recently announced a dedicated ETH leveraged staking app – ETH Saver.

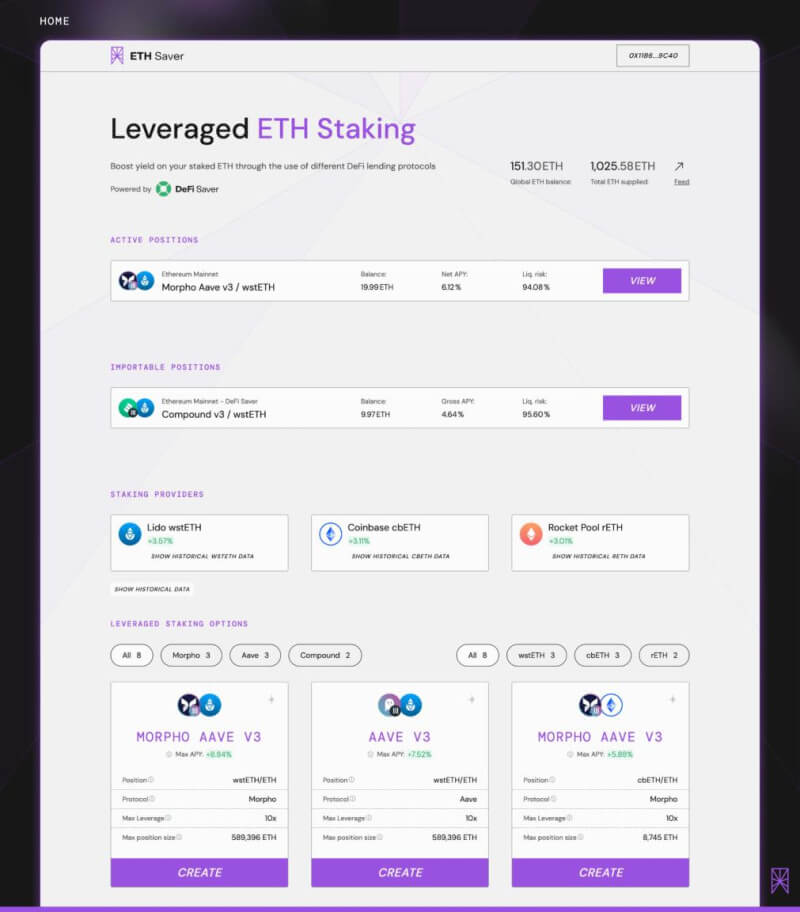

ETH Saver is a new non-custodial application that provides simplified access to various leveraged staking strategies. The app builds on top of existing DeFi Saver architecture and utilizes liquid staking tokens such as wstETH (Lido), rETH (Rocketpool), and cbETH (Coinbase), as well as multiple lending protocols, including Compound, Aave, and Morpho.

Built as a one-stop dashboard for boosting ETH staking yield, ETH Saver comes with multiple one-click management tools for creating, managing, closing, shifting, and tracking leveraged staking positions.

As a successor of the leverage staking page on DeFi Saver, ETH Saver is based on the same DeFi Saver’s modular, audited architecture that the team rolled out on the Mainnet in early 2021, now used in a more streamlined UI.

“Our goal was to create a go-to leveraged ETH staking dashboard oriented on simplicity, and transparency while keeping the users in full control over their assets, with all features one would expect from a DeFi power tool like DeFi Saver.” – Nikola Vukovic, lead frontend developer at DeFi Saver and ETH Saver project lead

Leveraged ETH staking strategy has been one of the most popular strategies in DeFi ever since the inception of the Beacon Chain and liquid staking, mainly because of the gap between ETH borrow rates on DeFi money markets like Aave & Compound and ETH staking APY.

Creating a dedicated leveraged ETH staking application brings an opportunity to aggregate and compare relevant historical on-chain data analytics users can find helpful while choosing the lending protocol, liquid staking token, and desired leverage. ETH Saver offers just that, as well as information about the position itself including profit & loss tracking, liquidation risk data, historical performance, etc.

Following the per-user approach to risk management, ETH Saver comes with no asset pooling, leaving the users with full control over their funds. While providing isolated risk, the app offers various one-click tools making the process of managing this kind of position as convenient as possible.

With this release, any users with supported leveraged staking positions currently open through DeFi Saver can simply migrate their positions to ETH Saver in one click when wanted.

Moving forward, the team plans to keep expanding support for ETH Saver by adding new underlying lending protocols enabling this kind of strategy like Spark protocol, as well as introducing new automated features like automated leverage management and stop loss & take profit strategies. The inclusion of information regarding discounts for all supported liquid staking tokens is on the agenda, too.

Users can also expect to see an ETH Saver rolling out on L2 solutions in the coming months, providing simplified access to boosted ETH staking yield with significantly lower transaction costs.

As a reminder, ETH Saver was launched by the same team that’s behind DeFi Saver, an app that provides various one-click options for increasing the ETH staking yield in a fully non-custodial way.

Find more details at: www.ethsaver.com

About DeFi Saver

DeFi Saver is an asset management application for decentralized finance (DeFi) protocols, focused on creating, managing, and tracking positions in lending protocols.

We support some of the largest DeFi protocols on Ethereum, including MakerDAO, Aave, Liquity, Compound and Reflexer, with new integrations always being considered.

Some of the specific things you can do with DeFi Saver include:

- Managing your debt positions in MakerDAO, Aave, Liquity, Compound, and Reflexer with access to our signature leveraging and deleveraging options (Boost and Repay), as well as different automated position management options.

- Moving your position between different protocols or converting your supplied or borrowed assets using our Loan Shifter.

- Earning interest on your stablecoins (DAI, USDC, USDT, mUSD) in our Smart Savings dashboard that provides access to yield earning protocols such as mStable, Yearn and Convex and includes a simple 1-tx option of moving funds between supported protocols.

- Creating custom complex transactions made up of actions such as flash loans, asset swaps, and other DeFi protocol interactions using our Recipe Creator.

- Swapping any tokens in our separate Exchange.

Find out more about DeFi Saver at:

Discord | Twitter | DeFi Saver Website | Blog

Contact

Product Marketing

Filip Josipovic

DeFi Saver Inc.

[email protected]

Ro Khanna

Ro Khanna