November has historically been Bitcoin’s best performing month; will this one be different?

November has historically been Bitcoin’s best performing month; will this one be different? November has historically been Bitcoin’s best performing month; will this one be different?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

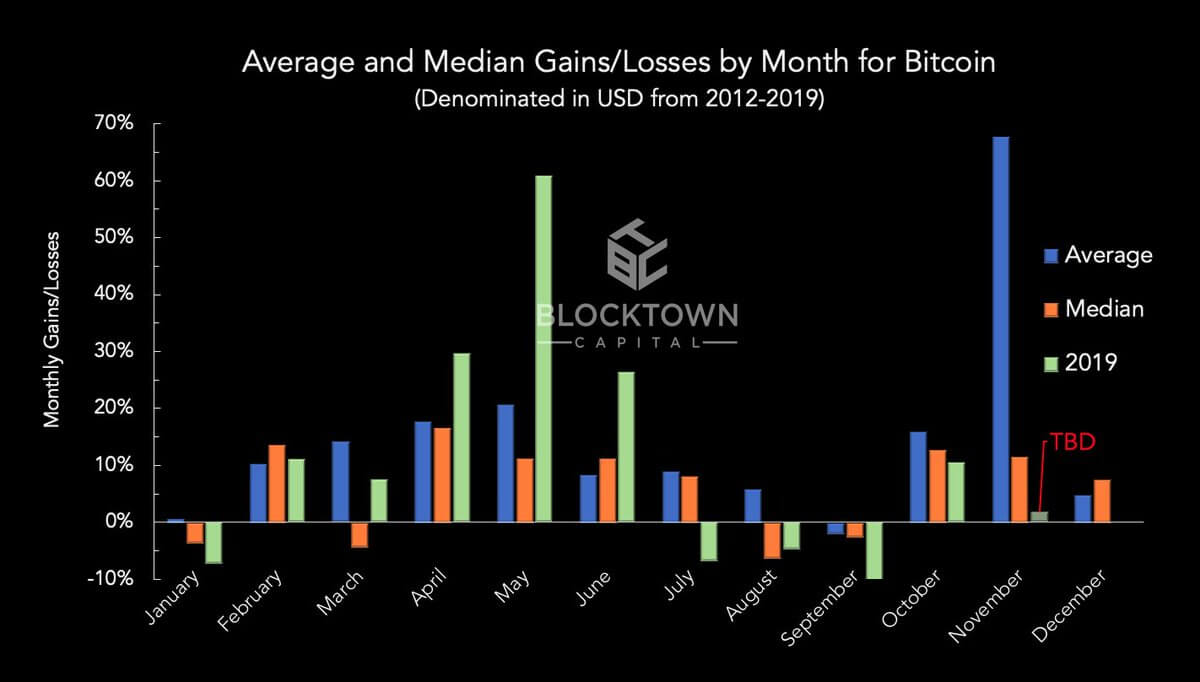

According to James Todaro, Managing Partner at Blocktown Capital, November has been one of the best performing months for Bitcoin. However, traders remain divided on where the dominant cryptocurrency could go. Todaro said:

“November has been historically one of bitcoin’s greatest performing months dating back to 2012. November 2018 was the main (and memorable) exception. BTC is presently up only 1.5% for November 2019…What will the next 3 weeks bring?”

Last November, the Bitcoin price fell from around $6,500 to $3,700 by more than 43 percent against the U.S. dollar, after ranging for nearly three months in between $6,000 and $7,000.

Why analysts are divided on how Bitcoin would perform this November

Bitcoin is up by more than 100 percent year-to-date, increasing from sub-$4,000 to $9,300 from January.

Still, some technical analysts remain cautious about whether Bitcoin could overcome the “psychological level” at $10,000 in the short term, as sell pressure builds with stacked limit sell orders on major cryptocurrency trading platforms.

Josh Rager, a cryptocurrency trader, noted that before investors begin to lean towards a bullish scenario for bitcoin, it is important to take into consideration the abrupt 10 percent drop in the price of BTC on CME earlier this week.

In a quick gap close, the price of BTC dropped to $8,350 on the CME futures market, supplemented with large sell orders. He said:

“Interesting situation in the market with the CME Bitcoin futures price gap being ‘filled’ – though price didn’t close through it. These were large sell orders so before you get mega bull on this you need to ask yourself why did this happen.”

BTC has been ranging with high volatility throughout the past two weeks, unable to break above key resistance levels to climb above $10,000 nor break below $9,200, a solid support level.

Short term bear, medium to long term bull

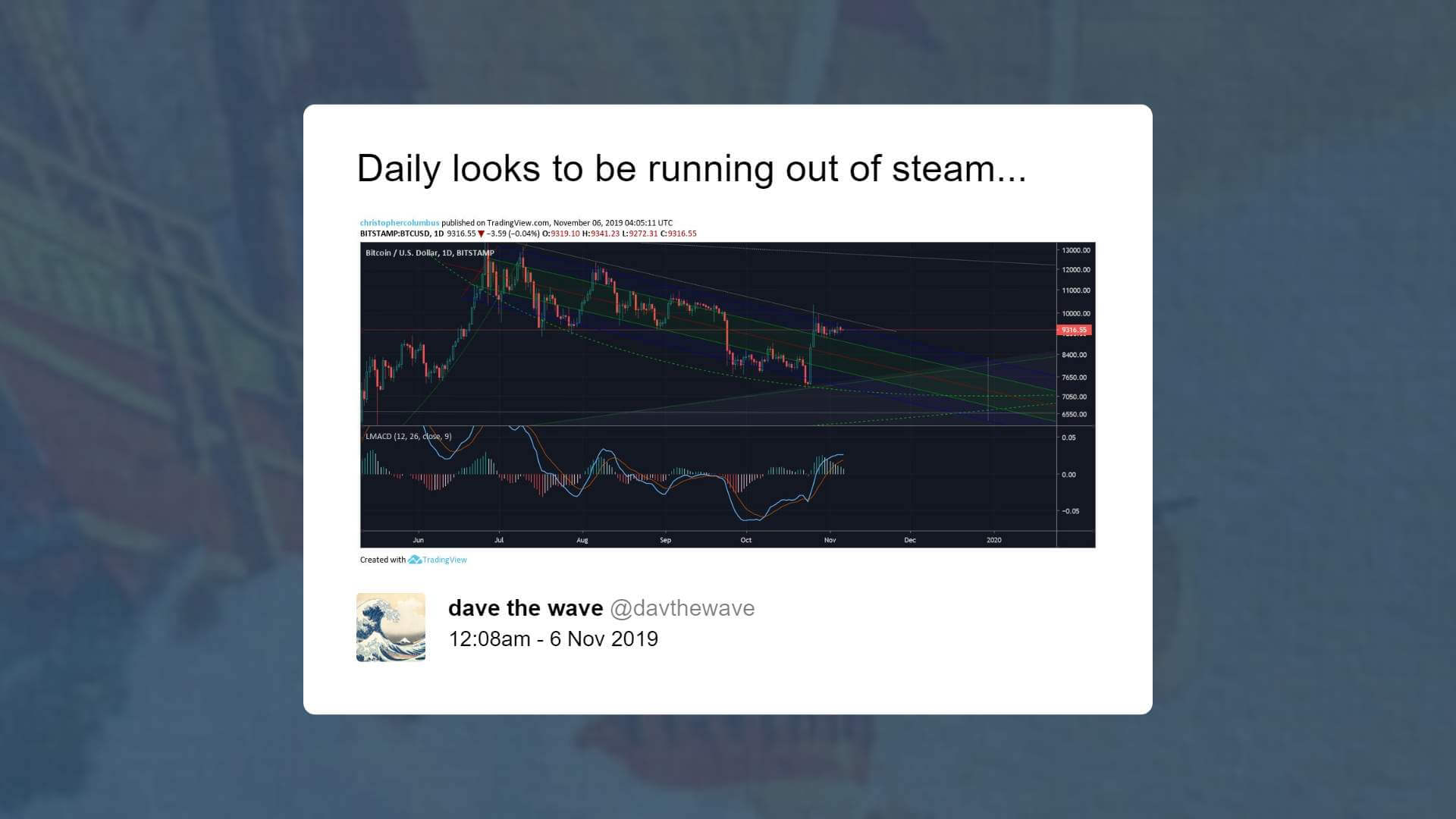

As said by a trader who operates as “Dave the Wave,” most traders who lean bearish for the short term trend of Bitcoin remain bullish for the medium to long term. He said:

“Daily still down though the longer term on the weekly is up. Interestingly, the weekly Gaussian is tracking the log curve and the cyclical/ mean curve on the chart. In sum – short term, down; medium-term, up.”

One variable in the medium to long term trend of Bitcoin on the side of fundamentals is governments that were previously prohibiting most industries related to cryptocurrencies slowly opening up to BTC.

This week, the government of China removed Bitcoin mining as one of the industries the government wanted to remove last year.

China’s National Development and Reform Commission has removed #cryptocurrrency mining from the list of industries they want to eliminate. Bullish for #Bitcoin. pic.twitter.com/FHpzB5g6CD

— Samson Mow (@Excellion) November 6, 2019

However, rising hash rate, an imminent block reward halving, and rising growth potential of the mining sector are all positive factors that are unlikely to have any impact on BTC in the short term.

Hence, currently, many traders seem to be cautiously optimistic towards BTC, with orders on BitMEX and other margin trading platforms indicating that more investors are expecting the asset to go up.