Bitcoin ignores correlation with traditional finance with 84% rise in 2023

Bitcoin ignores correlation with traditional finance with 84% rise in 2023 Quick Take

This year has marked a noteworthy period for various financial assets, with several outperforming expectations amidst an atmosphere of bearish sentiment.

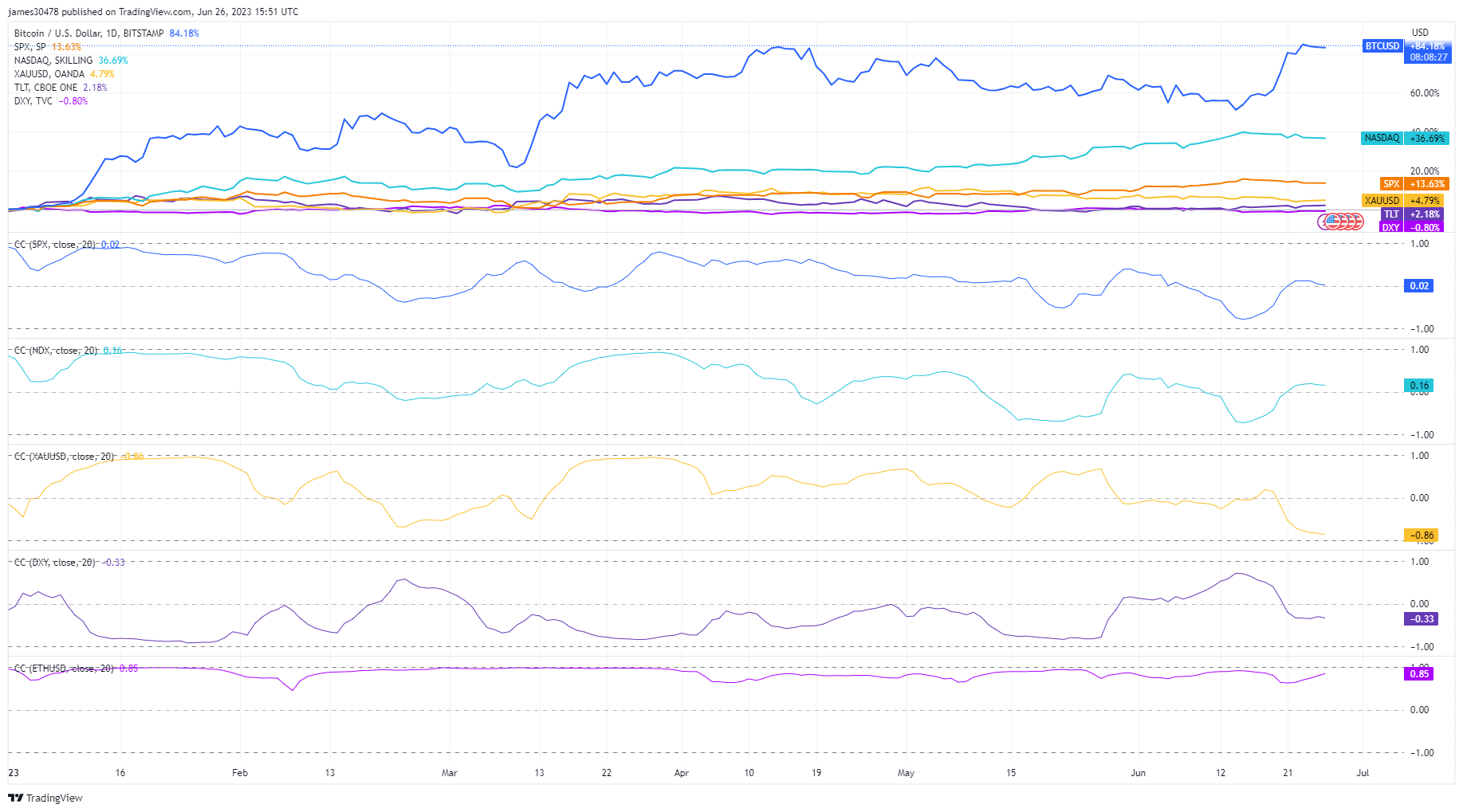

Bitcoin has emerged as a standout winner in this regard, reporting a remarkable 84% increase over the first half of the year. The crypto market, despite its unpredictable nature, has demonstrated impressive resilience and growth potential.

Simultaneously, the Nasdaq index has experienced one of its strongest years, recording a solid gain of 37%. Its performance further reinforces the enduring appeal of technology and innovation-driven stocks in the modern financial landscape.

The S&P 500 index has also performed well, albeit to a lesser extent than Bitcoin and Nasdaq, posting a decent 14% rise.

Gold, traditionally seen as a safe haven asset, witnessed a modest rise of 5%, demonstrating that investors still find value in this asset during times of market uncertainty.

The TLT or iShares 20+ Year Treasury Bond ETF has reported a modest increase of 2%. Meanwhile, the DXY (U.S. Dollar Index) has been the only asset under discussion that’s seen a decrease, dipping by 1%.

The first half of 2023 has clearly been a beneficial period for risk-associated assets, despite widespread bearish sentiment.

The correlation patterns of Bitcoin have diverged significantly from traditional assets during this period. Its relationship with U.S. equities has exhibited no correlation, and it has even shown an inverse correlation with gold. Additionally, Bitcoin has demonstrated an inverse correlation with the DXY. As a result, if the DXY begins to regain momentum, we could expect a corresponding pullback from Bitcoin.

This unusual correlation pattern underscores the unique characteristics of Bitcoin, further cementing its status as a distinctive asset class in the financial ecosystem.