Ethereum plummets 6% after Bitcoin falls overnight: what’s causing the drop?

Ethereum plummets 6% after Bitcoin falls overnight: what’s causing the drop? Ethereum plummets 6% after Bitcoin falls overnight: what’s causing the drop?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

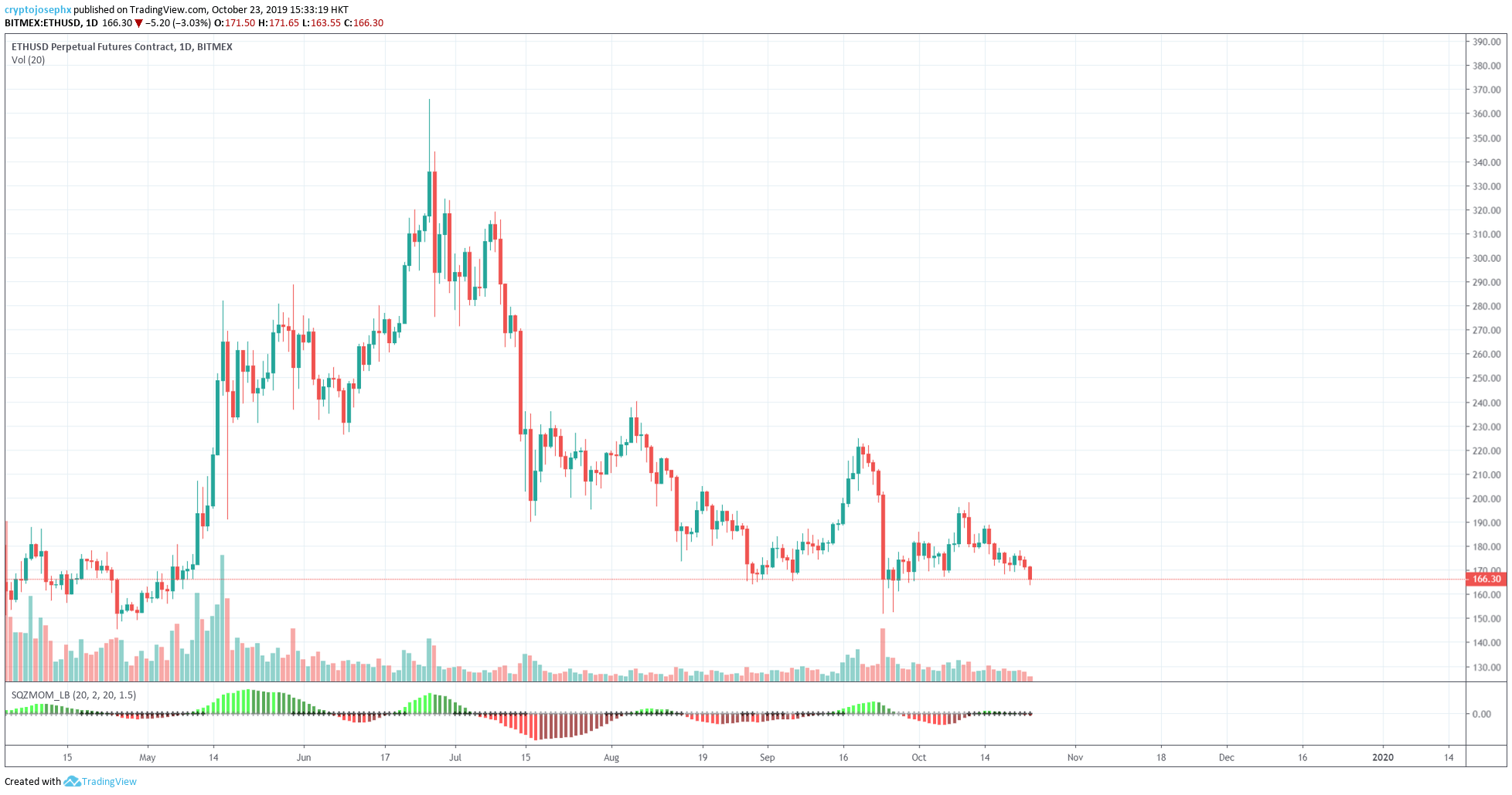

The Ethereum price (ETH) has dropped by nearly six percent within a 12-hour span following Bitcoin’s overnight three percent slip from $8,200 to $7,960.

Across major cryptocurrency exchanges like BitMEX, Binance, and Coinbase, the price of Ethereum slipped from $173 to $163, recording a large drop following the daily close.

The sharp pullback of Ethereum is likely to have been triggered by a minor drop of Bitcoin, which was seemingly demonstrating signs of a trend reversal to the upside as it surged past $8,300.

Volumes are still low, making a fast reversal for Ethereum unlikely

The daily trading volume of both Bitcoin and Ethereum are hovering around yearly lows on BitMEX, which is known to have a major effect on the price trend of the cryptocurrency market due to its futures contracts.

Usually, when Bitcoin shows a sideways movement during an extended period, the Ethereum price tends to show a spike in volatility.

Throughout October, the price of Bitcoin has remained relatively stable in a tight range between $7,800 to $8,300, creating an ideal environment for Ethereum and other major cryptocurrencies in general to see higher volatility.

Yet, the Ethereum price struggled to show signs of a breakout to the upside and its low volume intensified the downward movement, ultimately leaving the asset vulnerable to a short term pullback.

Previously, as CryptoSlate reported, technical analysts including Dave the Wave said that the Ethereum price is likely to correct all the way down to below $150 if the bitcoin price makes its way to the low $7,000 region.

Based on the trend of the cryptocurrency market in general, which lost $50 billion in market capitalization since September, both assets are forecasted to see a build-up of sell-pressure.

Josh Rager, a cryptocurrency trader, and analyst said:

“As you can see with not only Bollinger bands but also historical volatility (HV) that a major move is brewing With a slow sideways market, we’ll see descending HV that indicates a strong reaction in price action ahead and rise in volatility.”

Until Oct. 22, many traders anticipated the volatility of bitcoin to result in an upside movement. However, as Bitcoin showed rejection at a low resistance level, traders have begun to expect a deeper pullback.

Case of medium-term optimism for ETH

According to a price action trader, Ethereum is lacking signs of being overpriced or overbought and is in a neutral zone. The trader said:

“Ethereum currently shows no major signs of being overpriced, overbought or overvalued. The market is currently relatively conservative. I think ETH 2.0 is a few months away, I think we see scalability fixed & futures going live in the same month. Never a coincidence.”

As Ethereum 2.0 comes closer, investors anticipate that it would alleviate some of the pressure on the price of the asset.

Ethereum Market Data

At the time of press 4:09 pm UTC on Dec. 7, 2019, Ethereum is ranked #2 by market cap and the price is up 16.49% over the past 24 hours. Ethereum has a market capitalization of $20.49 billion with a 24-hour trading volume of $14.07 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 4:09 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $256.2 billion with a 24-hour volume of $141.21 billion. Bitcoin dominance is currently at 68.50%. Learn more about the crypto market ›