Bitcoin whale: only this sole fundamental factor would trigger sustainable rally

Bitcoin whale: only this sole fundamental factor would trigger sustainable rally Bitcoin whale: only this sole fundamental factor would trigger sustainable rally

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

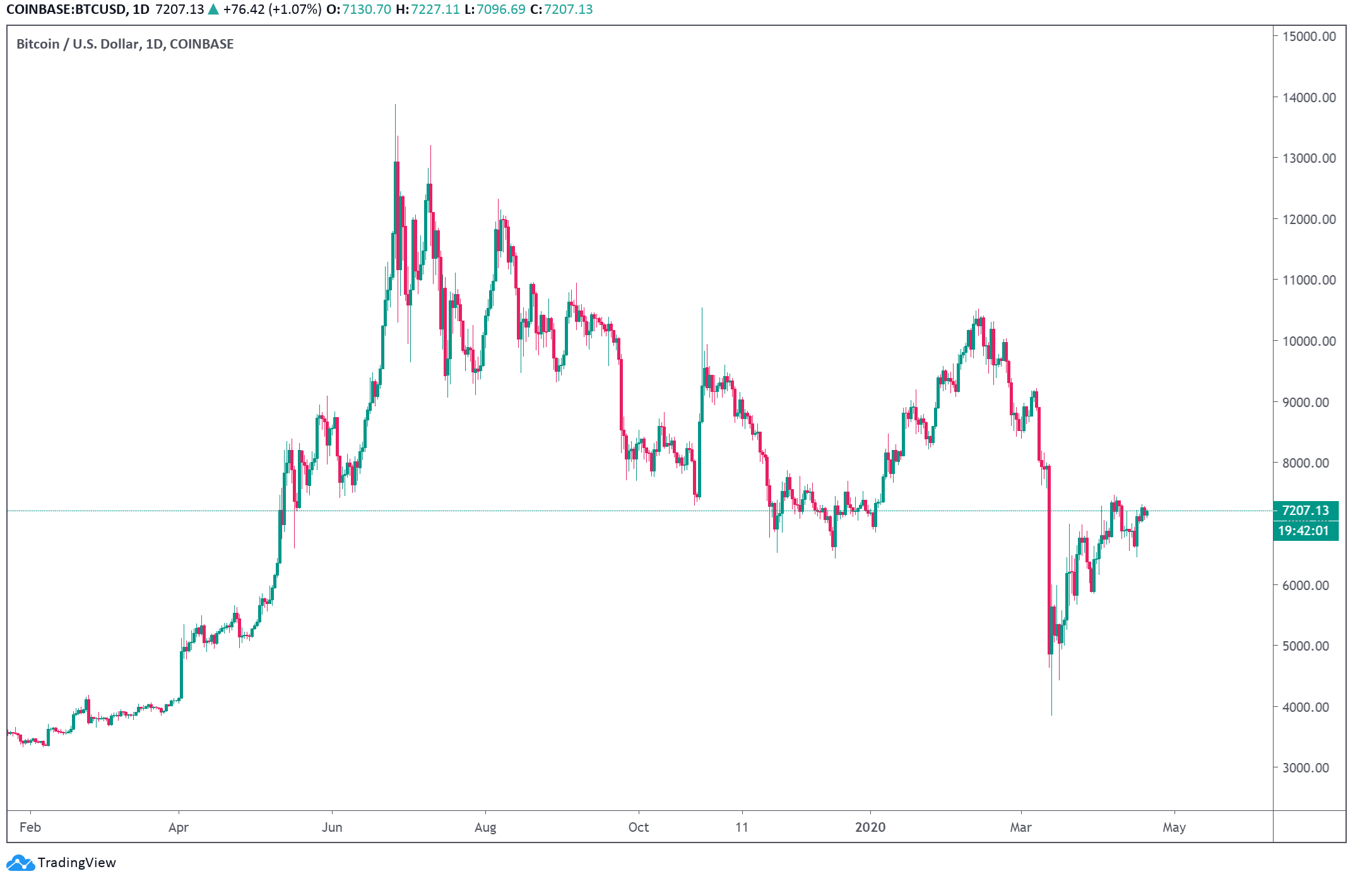

The Bitcoin price has been stagnant since April 2, rejecting the $7,300 to $7,400 resistance area three times in a span of 18 days. Joe007, arguably the biggest whale on Bitfinex, is holding a large short position, and is anticipating BTC to see a near-term correction.

When asked if a 50 percent price increase from the current price at $7,170 would invalidate the bearish case for Bitcoin, the whale said that not even that would indicate a clear trend reversal.

So what does Bitcoin need to show to see an actual extended rally?

A large portion of the global volume of the Bitcoin market is facilitated by futures exchanges that support high leverage of up to 125x. That means, investors can trade BTC with a significant amount of borrowed capital or debt.

The problem with the high leverage-based market structure of Bitcoin is that when BTC sees a large move to either the upside or downside, it causes a cascade of liquidations and triggers a significant price movement in a short period of time.

In October 2019, the Bitcoin price abruptly increased from around $7,400 to $10,600 within a 48-hour span. While many analysts considered it to be an effect of Chinese President Xi Jinping’s unexpected call for blockchain development, it is entirely possible that large BTC traders used the so-called “Xi pump” narrative to abrupt spike the price of Bitcoin.

For that reason, Joe007 explained that for the short-term bearish case of Bitcoin to be disproved, it would have to be supplemented with real volume across the board.

He said:

“50% organic move up in BTC with decent volume would definite invalidate bearish case. 50%+ [sh*tcoin] pump or yet another leverage-driven run-up on razor-thin volume like Jan-Feb, not so much.”

Actual retail volume or buy orders is a crucial indicator that real investors in the market are absorbing the remaining supply of Bitcoin.

If the Bitcoin price rises substantially without large retail volume and primarily driven by highly leveraged futures, it becomes vulnerable to a 2019-esque fall when price steeply dropped from $10,600 to $6,400.

As such, for Bitcoin to see an extended rally with solid momentum in the medium-term, a noticeable increase in retail and institutional volume would be critical.

Institutions have been buying BTC

According to the official Q1 2020 report from Grayscale, around 88 percent of capital inflows into their products such as Grayscale Bitcoin Trust came from institutions from January to March of this year.

The report read:

“88% of inflows this quarter came from institutional investors, the overwhelming majority of which were hedge funds. The mandate and strategic focus of these funds is broadly mixed and includes Multi-Strat, Global Macro, Arbitrage, Long/Short Equity, Event Driven, and Crypto-focused funds.”

The absorption of the BTC supply by institutions could potentially be a factor for sustained medium-term growth of Bitcoin given that institutions typically invest in assets with a long-term strategy.

In the past several weeks, institutions have also paid substantial premiums to invest in crypto assets, indicating that the demand cryptocurrencies remains high.