$13 billion in Bitcoin longs were liquidated in 2019; what does it mean for 2020?

$13 billion in Bitcoin longs were liquidated in 2019; what does it mean for 2020? $13 billion in Bitcoin longs were liquidated in 2019; what does it mean for 2020?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

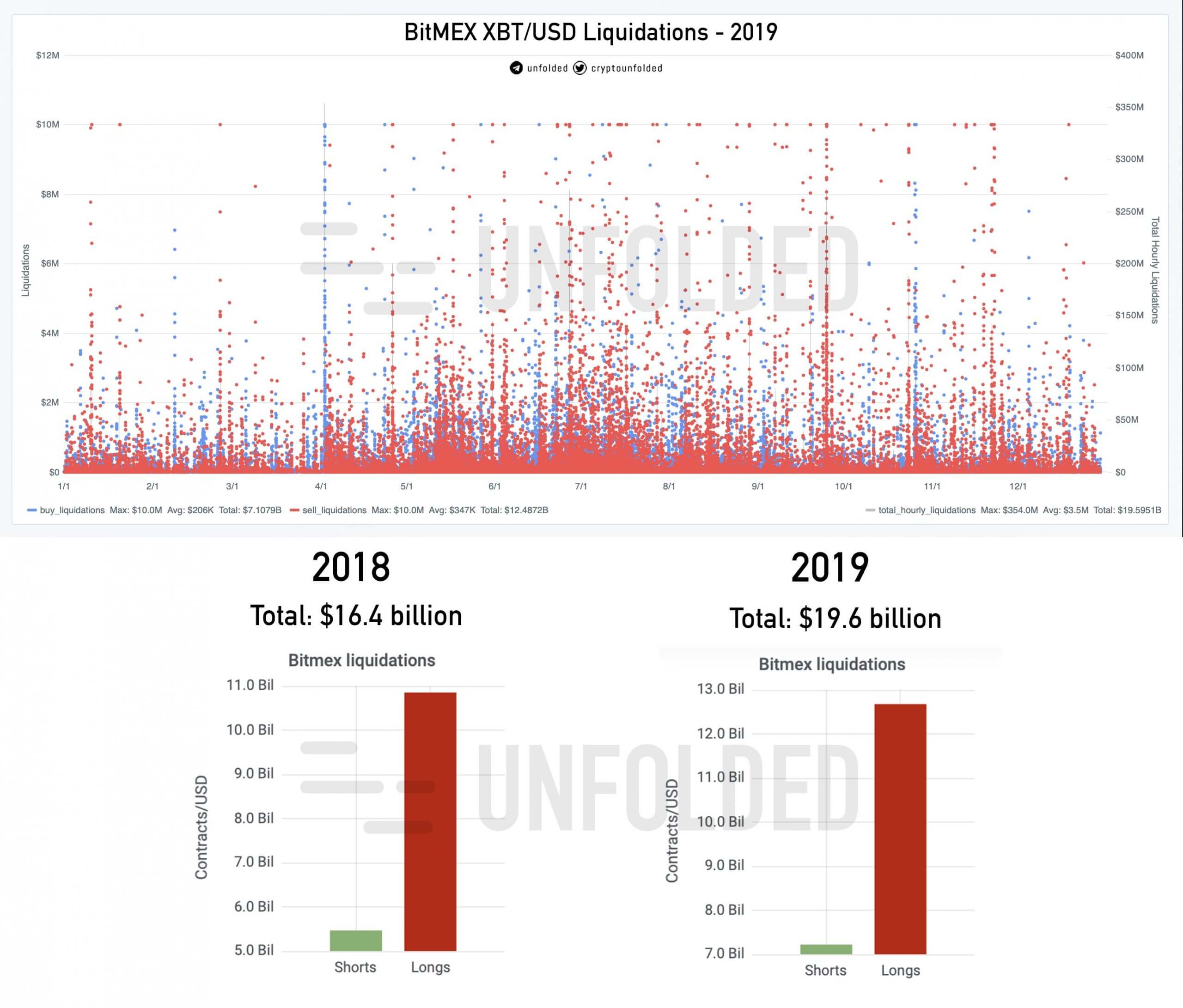

For a second consecutive year, long liquidations dwarfed that of shorts by more than two-fold. In 2018, long liquidations reached $11 billion by the year’s end while short liquidations hovered at $5 billion. In 2019, long liquidations have totaled nearly $13 billion.

What precedent does it set for the trend of Bitcoin in 2020?

Bitcoin started out strongly in 2019, rising to as high as $13,900 by June. However, in the latter half of the year, the momentum of the dominant cryptocurrency started to dwindle. Volumes dropped, overall interest in crypto noticeably declined, and deal value in the industry plunged in the final quarter of the year.

As the sentiment around Bitcoin started to turn around, it led investors to reminisce about the events that led up to the intense crypto market correction in late 2018.

Last December, the bitcoin price fell from around $6,500 to the low $3,000s within a single month, possibly due to miner capitulation and a sell-off during the holiday season. As such, investors were concerned that a similar trend could occur in late 2019.

In the short-term, while a pullback is expected, technical analysts generally do not anticipate BTC revisiting the $4ks like it did in late 2018.

Still, it may establish a sluggish precedent for bitcoin heading into 2020. The sentiment around the market could struggle to recover until the block reward halving of bitcoin occurs in May 2020.

The significant amount of liquidations of long contracts compared to shorts indicate that many investors were confident that BTC would maintain its upward trend throughout the second half of 2019.

The weaker-than-expected performance of BTC may have also led the mainstream to lose interest in the asset class in the second half of the year.

Analysts at Unfolded said:

“Through the course of the year, ~$20 billion got liquidated on @BitMEXdotcom , a ~20% increase since last year. Assuming an average leverage of 25x: ~$800 million of user funds got liquidation on BitMEX during 2019.”

It shows the abrupt drop in the price of BTC from $13,900 to sub $7,000s caught investors off guard. Considering that, BTC has defended the $6,000s fairly well as an important support level.

Positive around BTC in 2020

Investors like billionaire CEO of Galaxy Capital Michael Novogratz expect the Bitcoin price to reclaim $12,000 by the end of 2020. Others, like Tim Draper, Tom Lee, and Brian Kelly suggested $100,000 to $250,000 as the long-term target of BTC in the upcoming years.

As the narrative of the block reward halving in May 2020 continues to build, investors have become increasingly optimistic about the medium-term trend of BTC.

Arkham Intelligence

Arkham Intelligence

Farside Investors

Farside Investors

CryptoQuant

CryptoQuant

CoinGlass

CoinGlass