Bitcoin Breaks $10K Ceiling – Will This Be The Start of a New Bull Run?

Bitcoin Breaks $10K Ceiling – Will This Be The Start of a New Bull Run? Bitcoin Breaks $10K Ceiling – Will This Be The Start of a New Bull Run?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

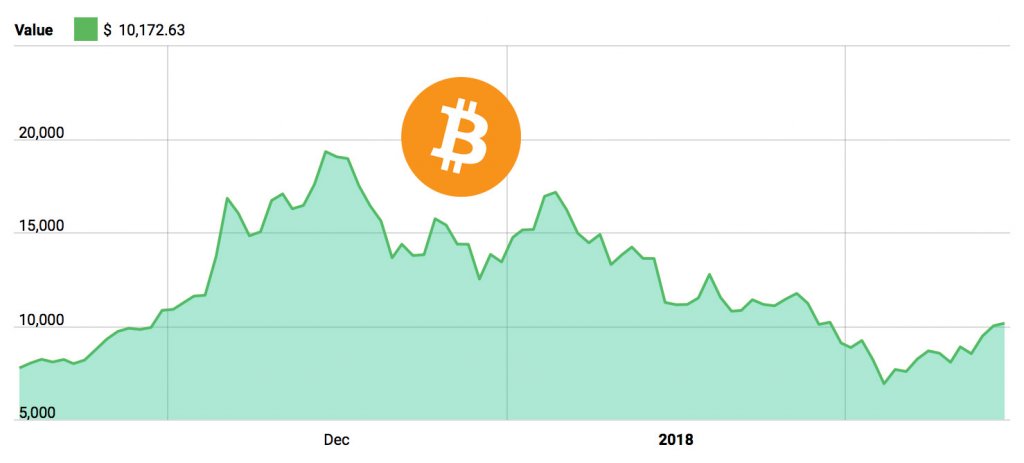

With Bitcoin smashing the $10K barrier again today, it seems that the currency is set to make another bull run in the market. After witnessing an impressive 9.2% increase in its value within a 24 hour span, some analysts are predicting this run to be short as this gain is being linked to a single trader.

While the value of Bitcoin may have hit $6K earlier this month, the recovery seems to have been swift and it now appears that we are going to witness another upheaval in the value of BTC, much like the one we saw in the November of 2017.

What’s driving Bitcoin’s resurgence, though? We’ll proceed to take a look at the key fundamental indicators that demonstrate BTC is set to skyrocket over the next few months:

1. Historical Performance Data

When Bitcoin first crossed the $10K threshold back in November 2017, its price dropped quite rapidly and then rose again to a strong $17K — all in the space of a week. If history has shown us anything its that Bitcoin defies all analytical predictions and transcends all mainstream market gossip.

2. Psychological Impetus

In the early days of 2017, so-called “financial experts” brushed cryptos like Ethereum and Bitcoin aside, calling them a transitional fad. However, crypto opponents are now due for a perspective shift since BTC has re-entered the $10K club. Casual investors have also taken notice of this and are now looking deeper into alt-assets, and ways in which they could possibly invest in this sector.

3. Large-Scale Investment

While initially relegated to the domain of individual investments, crypto markets are now being eyed by many financial institutions such as JP Morgan Chase. While in the past the company’s CEO Jamie Dimon has been quoted as calling Bitcoin a “ponzi scheme”, it now appears he has pivoted his position and is now calling the currency “very real”.

4. Scalability

In the past people have criticized the Bitcoin blockchain as being limited in terms of its transaction capabilities. However, all this is set to change with the implementation of the Lightning Network— a network that will create payment channels between network participants that can process thousands of transactions per second.

5. Media Influence

Mainstream media outlets are still trying to dissuade investors from diving into the crypto domain, but independent online news sources seem to have become the voice of a new free market. Forward leaning investors who have looked at the facts are now convinced that the blockchain revolution is here to stay for good.

Mati Greenspan, senior market analyst at eToro, told CNBC in a phone interview:

“FOMO (fear of missing out) is back in the markets. Crypto investors have been sitting on the sidelines waiting for a rally. Yesterday it was litecoin which had a clean break out from its resistance levels and investors jumped on and are still riding it today.”

Final Thoughts

In the past, regulatory bodies across the globe have played a massive role in manipulating the price of Bitcoin and other currencies. However, as the wave continues to spread, more and more figures of authority are taking notice of this revolution. As a result, the regulatory outlook for cryptocurrencies as a whole appears strong.

Whether it’s the Swedish government releasing its own cryptocurrency called the the “E-Krona” or whether its Arizona allowing its residents to pay their taxes in Bitcoin, the future for crypto and Bitcoin in particular seems to be strong.

For more information on Bitcoin, check out our coin profile.