CryptoSlate Wrapped Daily: Avalanche’s Amazon partnership; Silvergate’s $4.3B bailout

CryptoSlate Wrapped Daily: Avalanche’s Amazon partnership; Silvergate’s $4.3B bailout CryptoSlate Wrapped Daily: Avalanche’s Amazon partnership; Silvergate’s $4.3B bailout

Avalanche has partnered with Amazon's AWS on enterprise use, while Silvergate has disclosed a large bailout from Federal Home Loan Bank. Read these and other stories in today's edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptoverse for Jan. 11 saw Avalanche announce a partnership with AWS as Silvergate revealed that it received a $4.3 billion bailout from a San Francisco Bank. Meanwhile, Robinhood is delisting and selling its BSV, WazirX has published its proof-of-reserves report, and FTX has recovered $5 billion. Plus, research on Bitcoin prices and their relation to the Consumer Price Index (CPI).

CryptoSlate Top Stories

Avalanche gains 20% in hours after Amazon partnership announcement

Avalanche (AVAX) grew by 20% in a few hours after Ava Labs’ partnership with Amazon Web Services went live.

The partnership will help to scale blockchain adoption across enterprises, institutions, and governments, according to reports. With Ava Labs joining the AWS Partner Network (APN), it will be able to deploy products on AWS with more than 100,000 partners worldwide.

Silvergate received a $4.3B bailout after FTX collapse

Silvergate Bank received $4.3 billion from the San Francisco-based Federal Home Loan Bank last year, following the collapse of crypto exchange FTX, according to the firm’s Q4, 2022 flings.

Silvergate’s business model focuses on providing banking services to crypto exchanges and investors. Around 90% of the bank’s deposits come from crypto.

At the end of the third quarter, Silvergate’s 10 biggest depositors, including Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle, represented about half of the bank’s deposits. As a result of the FTX collapse, Silvergate was in a critical position, as it held deposits for both FTX and Alameda Research.

Robinhood to market sell BSV after delisting Craig Wright’s Bitcoin variation

Users of the popular stock and crypto trading app Robinhood are reacting to the announcement that the platform will delist Craig Wright’s Bitcoin SV (BSV) on Jan. 25.

A Robinhood spokesperson further told CryptoSlate that any BCV held on the platform by customers after the deadline will be “sold at market value and credited to their Robinhood buying power.”

The change comes as a part of Robinhood’s routine review of its crypto products, meaning BSV will continue to be tradeable on the app until the deadline. However, it also highlighted that investors residing in Hawaii, Nevada, and New York have limited capabilities to trade BSV.

Bitcoin worth $120M withdrawn from exchanges on Jan. 10

Around $120 million worth of Bitcoin (BTC ) was withdrawn from crypto exchanges on Jan. 10, according to Glassnode’s data.

Roughly $50 million of the withdrawals came from Binance, while $30 million was pulled from Coinbase.

There have been more BTC outflows than inflows on crypto exchanges since the beginning of 2023. The most significant BTC inflow was around $80 million, which occurred on Jan. 4 –however, exchanges saw outflows worth roughly $40 million on the same day.

On other days, the firms have mostly seen more outflows than inflows.

WazirX publishes proof of reserves of assets worth $285M

Indian-based crypto exchange WazirX has published its Proof-of-Reserves (PoR) report, which shows it holds about $285 million worth of crypto assets.

WazirX noted that about 90% of users’ assets (worth $259.15 million) are held in wallets at Binance, while the remaining 10% ($26.54 million)are stored in hot and warm wallets.

WazirX noted that it has sufficient reserve funds to meet users’ withdrawal demands at any time, as it has more than 1:1 reserve holdings of users’ assets.

FTX attorney announces $5B in assets recovered

FTX recovered over $5 billion comprised of cash, investment securities and liquid cryptocurrencies, according to Reuters.

“We have located over $5 billion of cash, liquid cryptocurrency and liquid investments securities.”

Andy Dietderich — an FTX attorney — provided the update to the case on Jan. 11, informing a bankruptcy judge in Delaware at the start of the FTX Senate Banking hearing.

Dietderich also said that FTX plans to sell non-strategic investments that had a book value of $4.6 billion, although the company’s books have been described as unreliable.

Binance-Voyager deal gets initial court approval despite SEC objections

The U.S. bankruptcy court for the Southern District of New York provided an initial greenlight for the Binance-Voyager deal on Jan. 10, Reuters reported.

Judge Michael Wiles approved the disclosure statements that explained the various aspects of the deal.

However, Judge Wiles asked the attorneys working on the deal to revise the proposed order before he gives final approval. The deal will be finalized at a future court hearing. Until then, the judge asked Voyager to seek the votes of all its creditors on the sale of its $1 billion assets to Binance.

Research Highlight

Research: Bitcoin remains under pressure ahead of CPI data; Michael Burry makes stagflation call

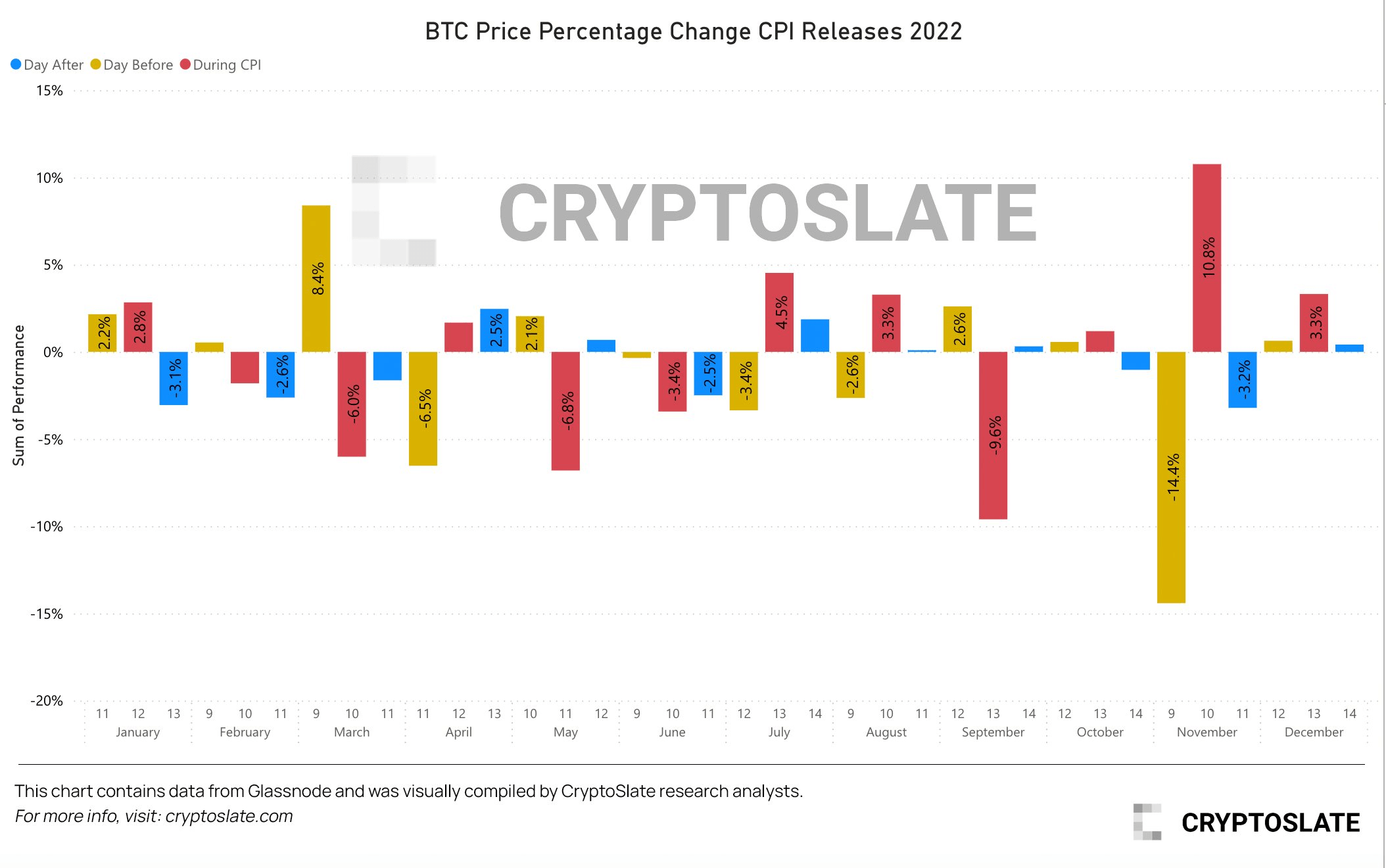

Analysts forecast a year-over-year increase of 6.5% in the U.S. Consumer Price Index (CPI) for December 2022 — with the Bureau of Labor Statistics’ official data releasing Jan. 12 — but 2023 could bring some upside as investor Michael Burry expects CPI to move lower this year but warned that any subsequent pivot on interest rates to stimulate economic activity would trigger a second inflationary spike.

November 2022’s actual CPI came in at 7.1%, less than the forecasted 7.3% rate. The better-than-expected result led to a jump in crypto prices during the announcement, with Bitcoin posting an immediate spike to $18,000 at the time.

Throughout this bear market, CPI data and interest rate announcements have been significant catalysts to crypto price volatility before, after, and during announcements. But to what extent?

The chart below shows approximately half positive and half adverse effects on the Bitcoin price before the CPI announcement; this was also the case during the announcement.

By contrast, the day after the announcement tended to yield mostly adverse price effects, presumably as investors have had time to absorb the reality of elevated consumer prices and the subsequent continuation of interest rate hikes.

Crypto Market

In the last 24 hours, Bitcoin (BTC) rose 0.49% to trade at $17,545.89, while Ethereum (ETH) was up 0.1% at $1,342.12.

Biggest Gainers (24h)

- SingularityNET (AGIX): 39.04%

- Ergo (ERO): 27.02%

- Voyager Token (VOY): 24.71%

Biggest Losers (24h)

- Gala (GALA): -11.82%

- Lido DAO Token: -10.23%

- Bitcoin SV (BSV): -9.8%