Research: Bitcoin remains under pressure ahead of CPI data; Michael Burry makes stagflation call

Research: Bitcoin remains under pressure ahead of CPI data; Michael Burry makes stagflation call Research: Bitcoin remains under pressure ahead of CPI data; Michael Burry makes stagflation call

Economists predict a slowdown in the pace of rate hikes, but questions linger over a full pivot, keeping pressure on risk assets for now.

RockSkater99 / CC BY-SA 4.0 / Wikimedia. Remixed by CryptoSlate

Analysts forecast a year-over-year increase of 6.5% in the U.S. Consumer Price Index (CPI) for December 2022 — with the Bureau of Labor Statistics’ official data releasing Jan. 12 — but 2023 could bring some upside as investor Michael Burry expects CPI to move lower this year but warned that any subsequent pivot on interest rates to stimulate economic activity would trigger a second inflationary spike.

November 2022’s actual CPI came in at 7.1%, less than the forecasted 7.3% rate. The better-than-expected result led to a jump in crypto prices during the announcement, with Bitcoin posting an immediate spike to $18,000 at the time.

Throughout this bear market, CPI data and interest rate announcements have been significant catalysts to crypto price volatility before, after, and during announcements. But to what extent?

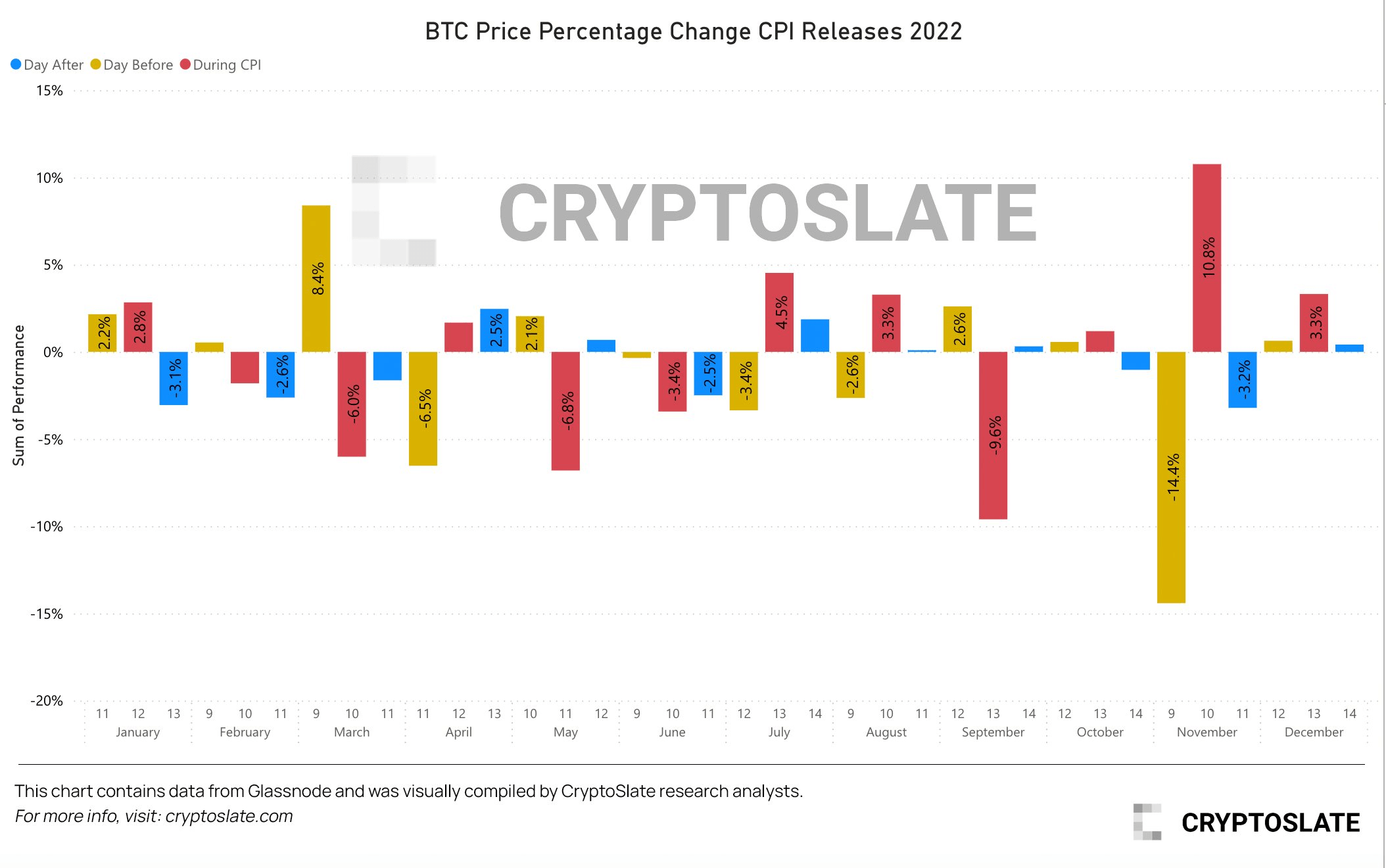

The chart below shows approximately half positive and half adverse effects on the Bitcoin price before the CPI announcement; this was also the case during the announcement.

By contrast, the day after the announcement tended to yield mostly adverse price effects, presumably as investors have had time to absorb the reality of elevated consumer prices and the subsequent continuation of interest rate hikes.

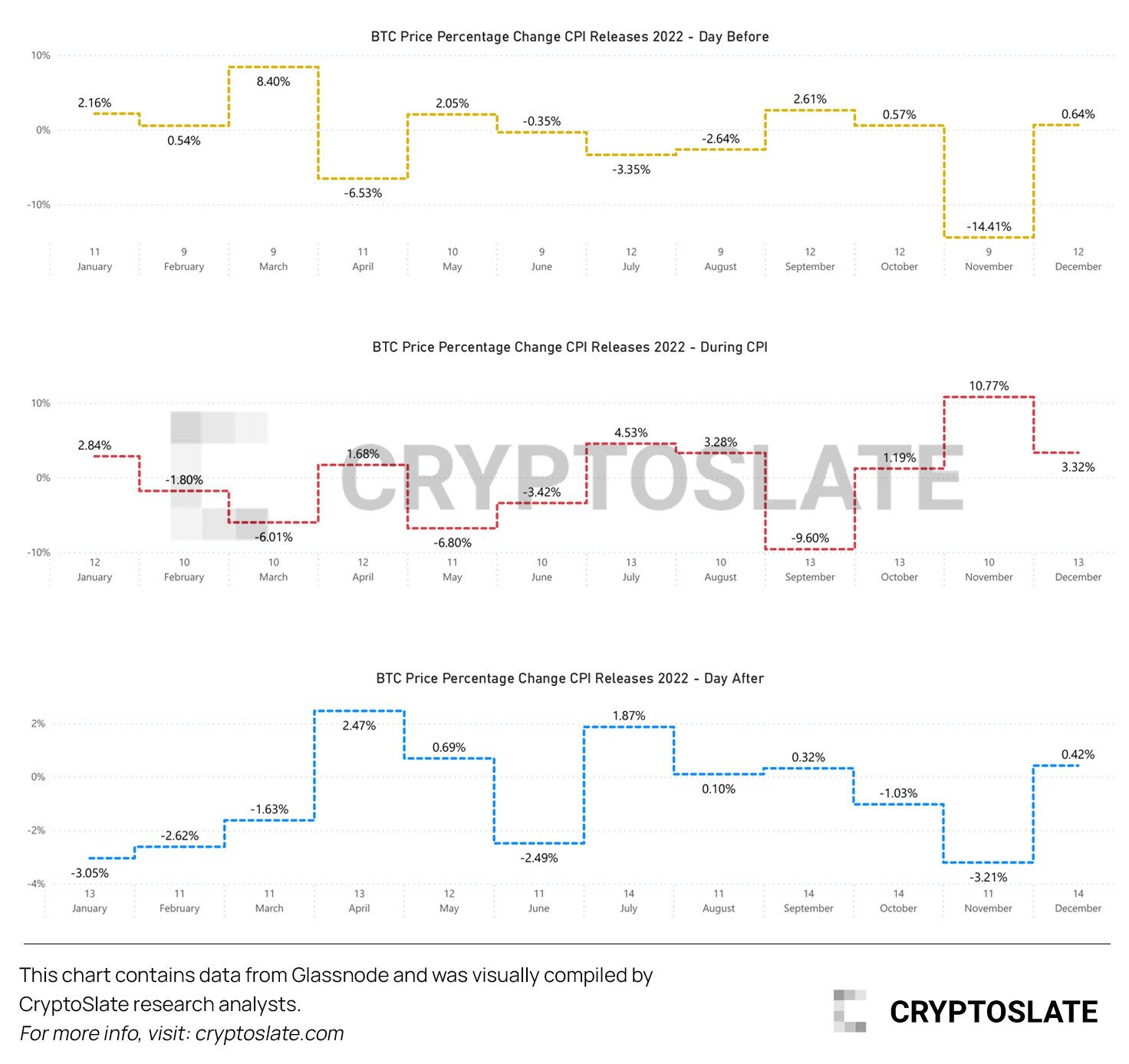

Separating the three categories of “Day Before, “During CPI,” and “Day After” into individual percentage change charts better depicts the previously stated findings.

Based on these patterns, there is no significant directional likelihood either before or during the CPI announcement. However, it is expected that Bitcoin will trend lower post-announcement.

Growing signs of stagflation

There is increasing evidence of stagflation, despite denials of a recession at the present time, including the White House redefinition of what constitutes a recession.

Stagflation refers to a combination of high inflation and economic stagnation, particularly high unemployment. This presents policymakers with a dilemma, in that measures to lower inflation could aggravate unemployment.

A recent article by Peter Schiff blamed our current economic woes on “those stimmy checks” triggering inflation, which has since morphed into stagflation. He pointed out that government spending, one way or another, must be paid for by the public.

Further, quoting work by Spanish Economist Daniel Lacalle, the article mentioned the reality of weaker growth trends, rising taxes, and severe inflation, particularly in respect of energy prices.

The last time things looked this bleak was during the stagflation of the 1970s. This decade was characterized by weak economic growth, high unemployment, and double-digit inflation.

A repeat of the 1970s?

Burry recently tweeted:

“Inflation peaked. But it is not the last peak of this cycle. We are likely to see CPI lower, possibly negative in 2H 2023, and the US in recession by any definition. Fed will cut and government will stimulate. And we will have another inflation spike. It’s not hard.“

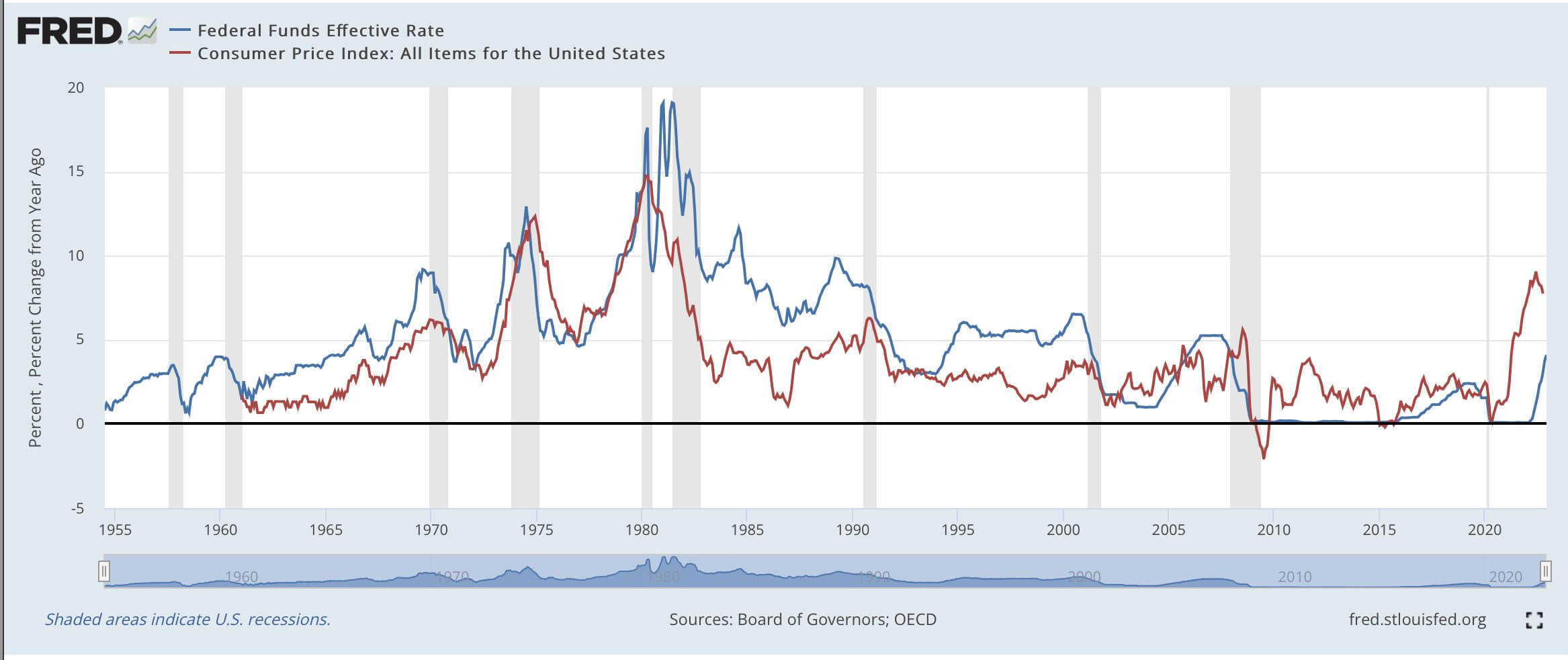

The scenario described by Burry occurred on three occasions during the 1970s. The chart below shows these three distinct inflationary waves peaking and then receding over the course of the decade.

It wasn’t until Paul Volcker, Fed President between 1975 and 1979, pushed for a funds rate above CPI that spiking consumer prices finally came under control.

Drawing on this, investor Bill Druckenmiller recently pointed out that once inflation exceeds 5%, it has never retreated until the Fed funds rate was taken above it, which begs the question, why are interest rates not at 9%?

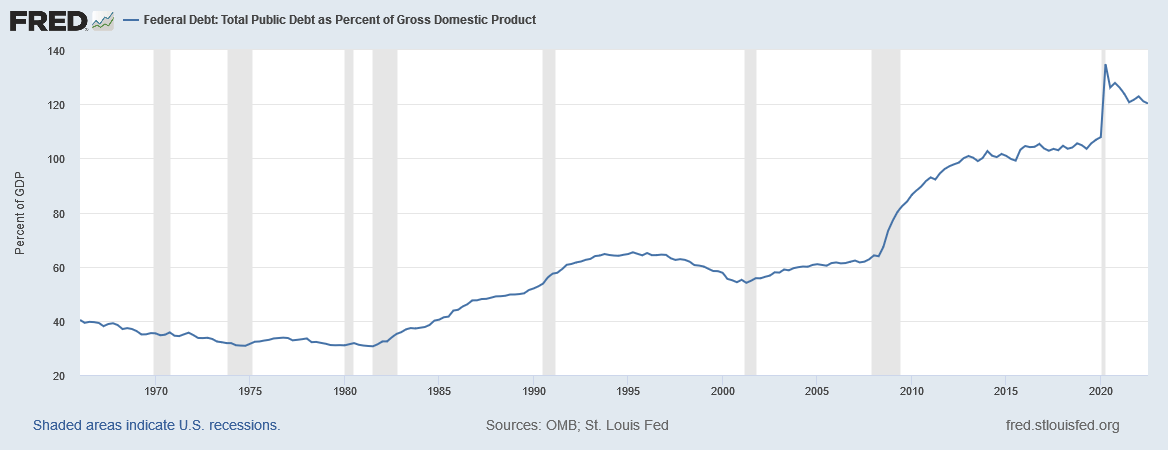

During the 1970s, debt to GDP ranged between 30% and 35%, enabling Volcker leeway for taking rates as high as 19%. Now, with a debt to GDP of 120%, taking interest rates above CPI inflation would destroy the economy.

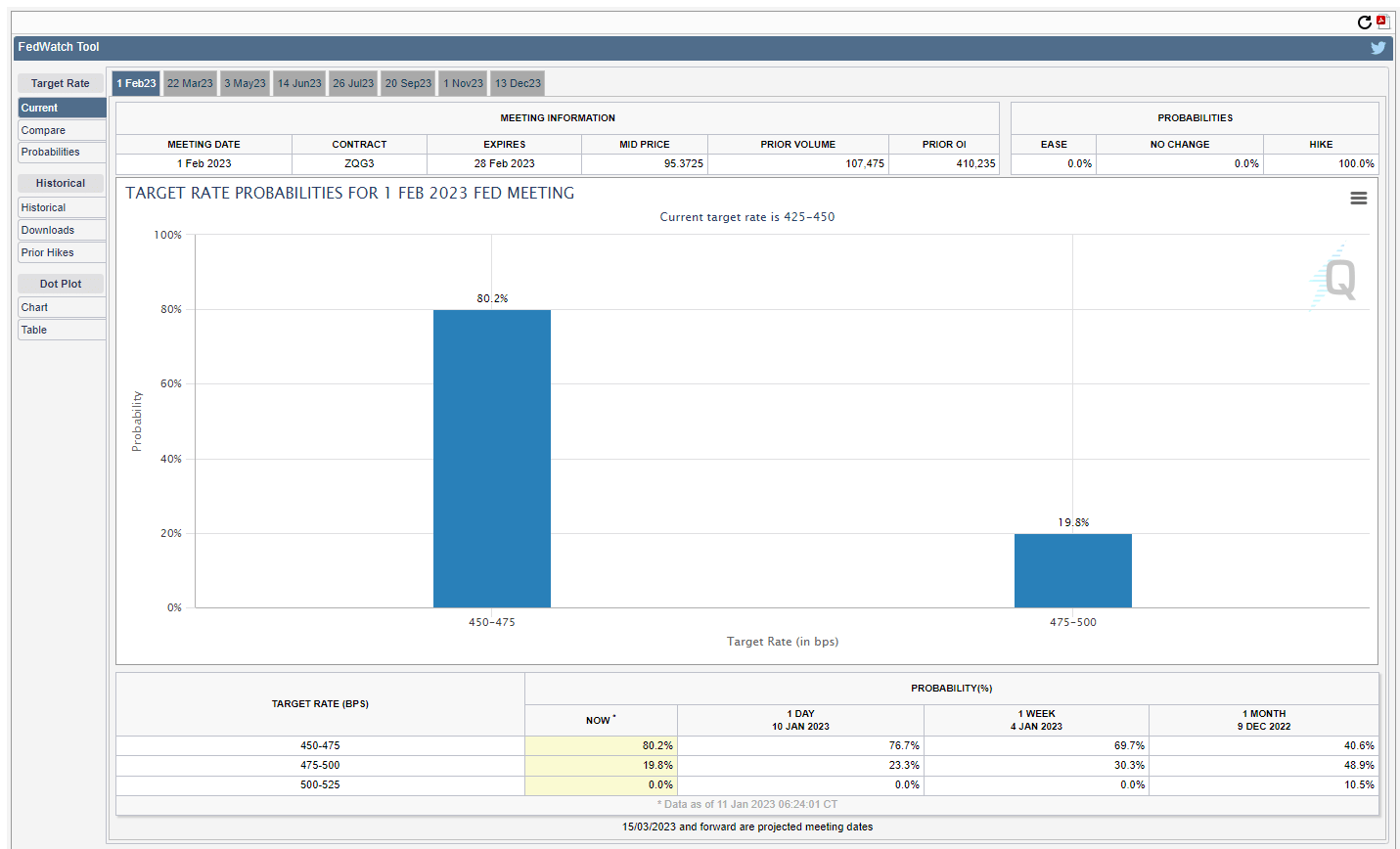

The next FOMC meeting is due to conclude on Feb. 1. Currently, analysts are 4/1 in favor of a 25 basis point hike, supporting the narrative that a slowdown in the pace of rate hikes is playing out.

Nonetheless, previous comments by Fed Chair Jerome Powell, in which he spoke of rates “higher for longer,” suggest, despite a slowdown in pace, we have yet to reach the terminal rate. Equally, there is no indication of how long the Fed intends to stay at the terminal rate once it has been reached.

Regardless of Burry’s prediction, from the current perspective, a pivot seems a long way away, keeping pressure on risk assets, including Bitcoin, at this time.