Why major Bitcoin futures exchange Bybit is integrating Chainlink price feed

Why major Bitcoin futures exchange Bybit is integrating Chainlink price feed Why major Bitcoin futures exchange Bybit is integrating Chainlink price feed

Photo by Daan Huttinga on Unsplash

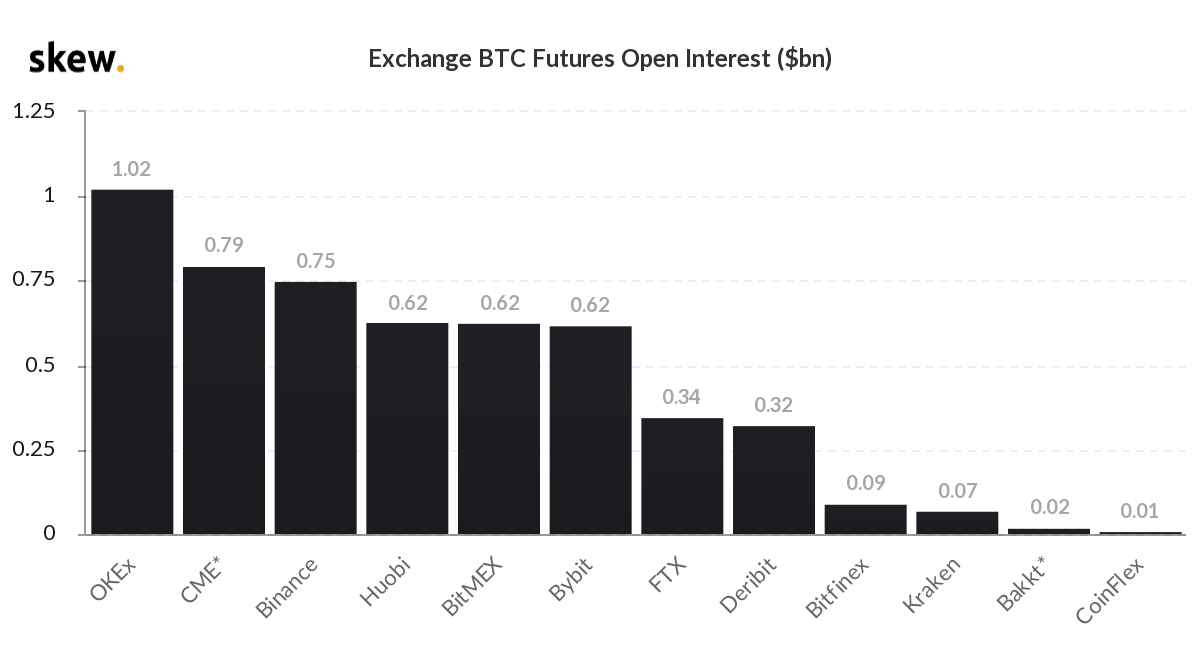

Bybit, the top six Bitcoin futures exchange by open interest and daily volume, is integrating the price feeds of Chainlink (LINK).

As a blockchain optimized to provide oracles to decentralized finance (DeFi) protocols, Chainlink allows platforms to retrieve reliable market data.

By integrating Chainlink’s Price Reference Data, traders would access additional price data and index apart from Bybit’s internal index.

In times of extreme volatility, traders would be able to access price data from the DeFi market, which could serve as a useful alternative index.

Deepening collaboration between Chainlink and Bybit

The benefit of having an alternative price index to the exchange’s independent feed is that traders can gain access to various data points. As Bybit explains:

“These Chainlink-powered decentralized price feeds are the most referenced data points in the DeFi market, currently securing over $3B in user funds for many of the leading DeFi applications.”

Initially, Bybit would integrate seven trading pairs from the Chainlink price feed, including BTC/USD, ETH/USD, XRP/USD, and EOS/USD. The team noted:

“The initial integration of Chainlink price feeds is live for the following markets: BTC/USD, ETH/USD, XRP/USD, EOS/USD, LTC/USD, XTZ/USD and LINK/USD. This gives our traders secure, reliable and transparent price indexes that are completely separate from Bybit’s internal operations.”

Ben Zhou, the CEO of Bybit, said the collaboration between Chainlink and Bybit would allow traders to gain more resources by accessing price reference data from the DeFi market. He said:

“By integrating Chainlink, we are able to provide an accurate source of price data that is highly decentralized and transparent, expanding the amount of resources our traders have access to.”

LINK dominance in the price feed and oracle market grows

The recent partnership between Bybit and Chainlink demonstrates the growing dominance of LINK in the market data and oracle market.

Throughout 2020, due to the resurgence of decentralized finance (DeFi), Chainlink has seen massive growth in users, partnerships, and market capitalization.

Since July, the price of LINK, the native token of the Chainlink blockchain network, rose from $4.7 to $12, rising by more than two-fold.

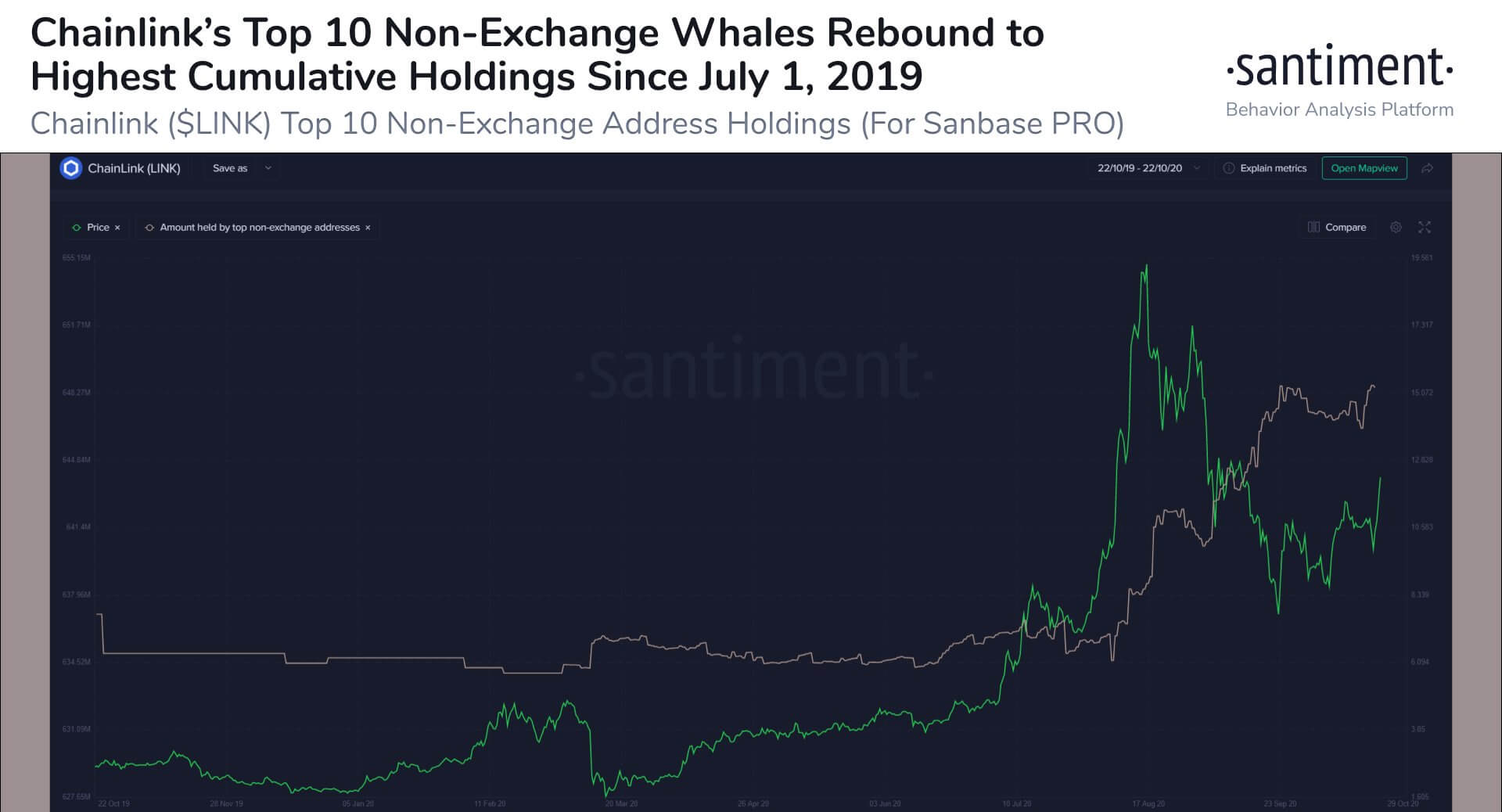

On-chain analysts state that the market sentiment around LINK has further strengthened in the past week.

On October 23, the price of LINK rose by 12.5% after whales accumulated more of the cryptocurrency. Since then, the top six cryptocurrency has remained resilient. Santiment researchers said:

“LINK’s price is +12.5% thus far today, and it comes following its top 10 non-exchange whales hitting their highest total holdings since July 1, 2019. The 648.6M #Chainlink tokens being held in non-exchange wallets suggests ever-increasing confidence.”