This “dry powder” could spark the crypto market’s next parabolic rally when lit

This “dry powder” could spark the crypto market’s next parabolic rally when lit This “dry powder” could spark the crypto market’s next parabolic rally when lit

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Crypto investors have long been looking towards different narratives to support the notion that the market is just a stone’s throw away from finding itself caught within the next major parabolic uptrend – although the vast majority of these theories have been invalidated throughout the past few years.

Despite Bitcoin’s “safe haven” narrative showing signs of faltering, and its imminent halving event not catalyzing any notable upwards momentum, there is one fundamental development that has been occurring that is quite notable.

The growth in the amount of stablecoins currently sitting on exchanges may be an overlooked factor that could ultimately have a major impact on the crypto market, potentially acting as “dry power” that fuels the next upswing.

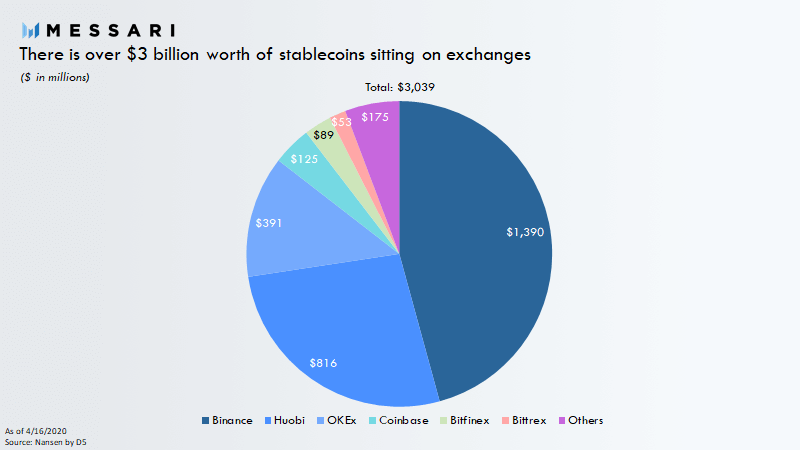

Stablecoin balances on exchanges exceed $3 billion

In theory, stablecoins can be used as transactional tools that allow users to exchange value digitally without being exposed to the volatility seen by cryptocurrencies like Bitcoin.

It is important to note, however, that their current utility primarily stems from investors and traders who utilize them for trading purposes, anchoring their capital during times of bearishness or turbulence amongst traditional cryptocurrencies.

Stablecoins have also garnered some popularity within the DeFi ecosystem, being used to collateralize loan positions.

The growth in their popularity on these two fronts has led there to be over $3 billion worth of these tokens on exchanges, a significant number.

A recent chart from blockchain data and analytics firm Messari highlights this, showing the distribution of these funds across the top crypto exchanges.

This number specifically references the stablecoins that are being actively held within exchange wallets and does not fully highlight the magnitude of the stablecoin ecosystem, as many are locked within DeFi positions or held in non-exchange wallets.

Could these tokens fuel the next crypto market uptrend?

The growing value of these tokens sidelined on exchanges suggests that many traders exiting their crypto positions are not fully exiting the markets, but are rather just looking to hedge against Bitcoin and other cryptocurrencies seeing further downside.

Ryan Selkis spoke about this in a recent tweet, explaining that the growth in on-exchange stablecoin balances marks the crypto economy having more “dry powder” than ever.

“There’s now $3 billion+ of stablecoins sitting on exchanges. If investors wanted to cash out of crypto completely, they would have withdrawn funds to banks. Instead, we’ve got more dry powder held in the crypto economy than ever before. In both real and market cap % terms.”

This factor does certainly give investors a reason to be optimistic, although this number will have to grow further in order for it to have a significant impact on the market, as it currently only accounts for a small fraction of the aggregated market’s size.