Ripple (XRP) wants to target less treasury, more SMEs after experiencing record on-demand liquidity volumes

Ripple (XRP) wants to target less treasury, more SMEs after experiencing record on-demand liquidity volumes Ripple (XRP) wants to target less treasury, more SMEs after experiencing record on-demand liquidity volumes

Photo by Denys Nevozhai on Unsplash

Ripple’s On-Demand Liquidity (ODL) corridors have witnessed major growth and facilitated instant, cross-border fund transfers. The protocol saw triple the usual transaction volumes compared to last quarter, as stated in the Q1 2020 XRP Markets Report.

Now, after extensive success in treasury payments, the San Francisco-based firm wants to cater to smaller-medium enterprises (SMEs), presumably startup ventures and mom-and-pop shops, after enjoying a bolstered growth among larger enterprise usage for its XRP-based ODL product.

Moving to SMEs

Per a blog post this Monday, Ripple noted institutions require global payments and liquidity to meet market demand “now more than ever.” The use of XRP, its native cryptocurrency, serves as a “bridging tool” in the ODL protocol, deploying funds to needed-areas at low costs and high security.

While ODL-related transaction volume may look a little different this month, our focus on supporting low-value, high-frequency payments is stronger than ever.

SVP of Product @ashgoblue explains how Ripple is evolving with the shifting global tide. https://t.co/9BBEQ0zW0l

— Ripple (@Ripple) June 8, 2020

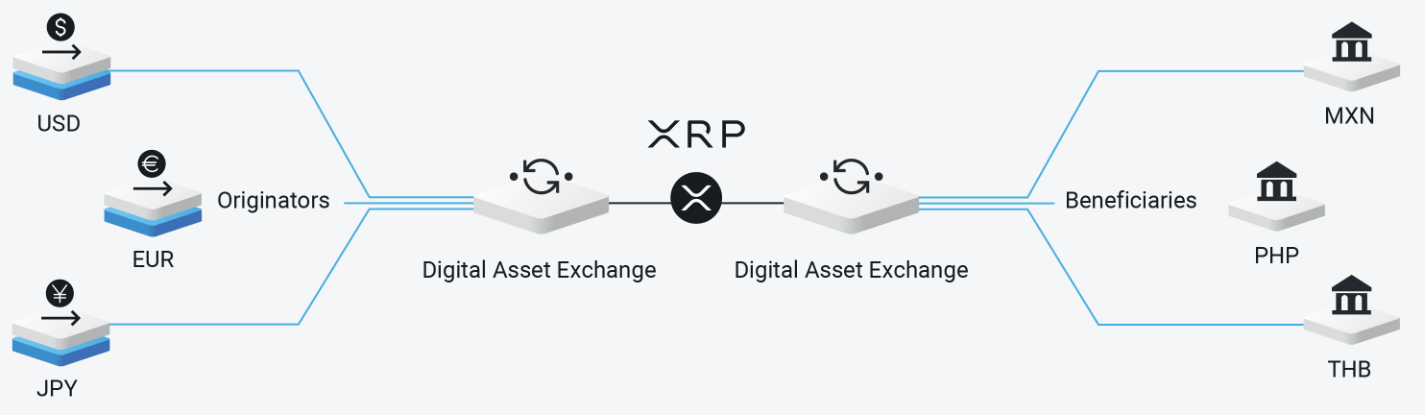

ODL uses XRP for cross-border transfer whenever a transaction is requested. Parties on either side send/receive funds in their respective fiat currencies, but the actual transfer is done via XRP. The solution serves as a global settlement network and operates over RippleNet.

Asheesh Birla, VP of Product at Ripple, revealed the firm has witnessed increased adoption in areas with volatile national currencies and a rising economy. He noted the firm will focus on “low-value, high-frequency payments with ODL.”

Birla added:

“In particular, we are reducing the emphasis on large treasury payments—which are traditionally used to fund businesses and services in the absence of real-time transfers—to support individual, low-value transactions, addressing the growing need in remittances and SME payments.”

However, he noted overall ODL transactions may see a fall due to the above. Regardless, ODL has enjoyed a great year thus far; volumes increased over 294 percent with XRP liquidity serving as the “lifeblood of Ripple’s ODL for cross-border payments.”

XRP/AUD sees ODL surge

Ripple’s ODL feature has seen increased growth in several areas, especially import/export centric economies like Australia.

Liquidity Index for BTC Markets XRP/AUD (28-day moving trend)

Day progress: 67%

Today so far: 7,595,973

All Time High: 16,089,305

Data: https://t.co/zlBcWd0sYI pic.twitter.com/fFvuZZSBmG— Liquidity Index Bot (@LiquidityB) June 8, 2020

Last month, volumes for the XRP/AUD reached a record high. Caroline Bowler of Australia-based BTCMarkets, a crypto exchange and Ripple ODL partner, revealed in an interview in May:

“I think we’re averaging about a 5% week-over-week growth since January in terms of volume coming through our exchange on XRP.”

Bowler added ODL volumes had averaged an 84 percent growth and a 15 percent rise in volume since the start of 2020. Most volume, she believed, came from businesses in Australia paying suppliers outside the country.

Meanwhile, Birla noted Ripple is onboarding new customers and corridors to the ODL framework. “Important” corridors, such as USD/MXN, USD/PXP, and EUR/USD, will see a “ramp up” in volumes, he concluded.