Options see 5% chance Bitcoin will hit $20,000 in 2020: Will it happen?

Options see 5% chance Bitcoin will hit $20,000 in 2020: Will it happen? Options see 5% chance Bitcoin will hit $20,000 in 2020: Will it happen?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

In February, when Bitcoin had retaken $10,000, traders were convinced that the cryptocurrency was well on its way to revisit and surmount the $20,000 all-time high established in Dec. 2017. In fact, one prominent crypto trader suggested BTC would do so before July, citing a confluence of technical and fundamental factors.

But, to the surprise of many, Bitcoin did exactly the opposite of what the majority expected: crashing. This was epitomized by the Mar. 12 “Black Thursday” crash, which liquidated hundreds of millions of dollars worth of BitMEX short positions.

The crash has undone so much of the bullish sentiment that derivatives traders see a near-zero chance Bitcoin hits $20,000.

Will Bitcoin hit $20,000 in 2020? Options market prices in low, low chance

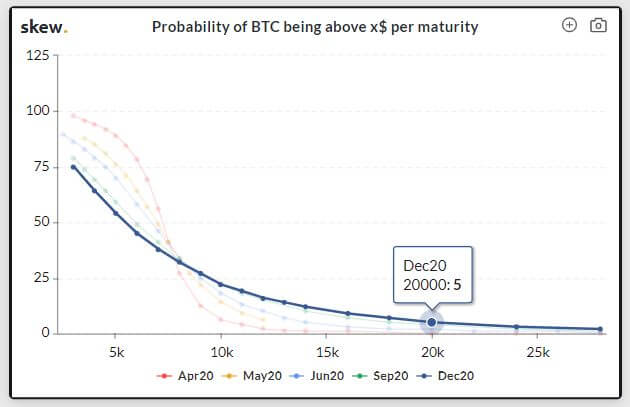

According to data shared by crypto derivatives tracker Skew.com, traders of December 2020 Bitcoin options are currently pricing in a 5% chance the cryptocurrency passes $20,000 by that time.

The skepticism that Bitcoin soon passes $20,000 was echoed in the other contracts listed on Skew.com, with the September maturity, June maturity, and May maturity pricing in effectively a zero percent chance a new all-time high is reached.

Really? Top analysts see it happening

Although options traders see a $20,000 Bitcoin price as a near-impossibility by the end of this year, a number of Wall Street investors turned analysts in the cryptocurrency space beg to differ.

During Apr. 2nd’s episode of CNBC Closing Bell, Michael Novogratz — an ex-partner at Goldman Sachs and CEO of crypto merchant bank Galaxy Digital — asserted that Bitcoin will be at a new all-time high by the end of 2020.

He put so much faith in the prediction that he said:

“This is the year of Bitcoin and if it doesn’t go up now by the end of the year, I might just hang my spurs.”

Per previous reports from CryptoSlate, Dan Morehead of Pantera Capital echoed this, last month writing that Bitcoin is likely to set a “new record” in the next 12 months:

My best guess is that it will take institutional investors 2–3 months to triage their current portfolio issues. Another 3–6 months to research new opportunities like distressed debt, special situations, crypto, etc. Then, as they begin making allocations, those markets will really begin to rise.

Both Morehead and Novogratz cited the same factor: money printing by central banks and governments, which are starkly contrasted by Bitcoin’s scarcity, enforced by miners distributed around the world.

Indeed, with institutions printing money at a rapid clip, to the tunes of trillions of dollars out of thin air, investors expect Bitcoin’s 21 million supply cap and disinflationary characteristic to rapidly be realized by the public, pushing demand and prices dramatically higher.

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=16&h=16&q=75)

![Skew [acquired by Coinbase]](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/11/skew-logo.jpg&w=100&h=100&q=75)