New “Major” Crypto Exchanges Thriving on Fake Volumes, Bad For the Industry

Photo by Rye Jessen on Unsplash

Newly emerging crypto exchanges, equipped with billions of dollars in daily trading volume, are thriving based on fake numbers and malpractices, which may have a significantly negative impact on the long-term growth of the crypto market.

Fake Versus Real Exchanges

Since early 2018, upon the launch of exchanges such as BitForex and FCoin with controversial business models, an increasing number of reports around crypto exchanges and the use of fake volumes were released to the public.

In mid-July 2018, the CryptoExchangeRanks (CER) team, the first complex rating service provider of crypto exchanges in the industry, conducted an extensive investigation into BitForex, one of the three exchanges suspected of having inflated volumes and fake numbers, by comparing the exchange to major cryptocurrency trading platforms KuCoin and Kraken.

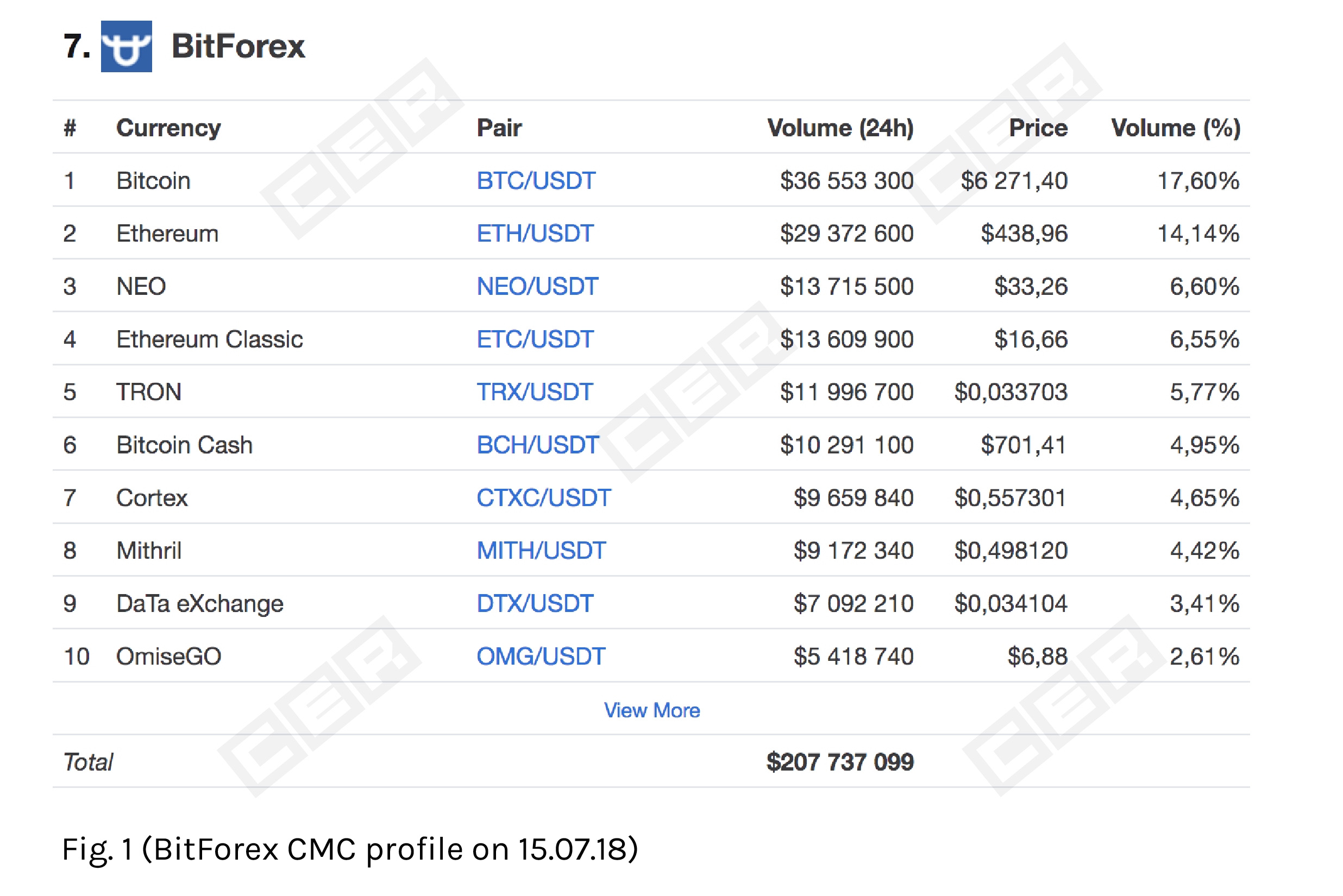

The CER team initiated the investigation subsequent to the release of the daily trading volume report of crypto exchanges by CoinMarketCap, which listed BitForex at number 7, while Kraken and KuCoin took number 15 and 45, two major crypto exchanges that have been around for several years.

According to CoinMarketCap, BitForex had traded $200 million, while Kraken and KuCoin cleared $87 million and $27 million in crypto trades, respectively.

The CER team’s suspicion of the strange difference in the daily trading volume between BitForex and the other two legitimate exchange intensified when a simple traffic comparison was done on Similar Web, which revealed that BitForex had less than 68,000 unique impressions in a month; a number that is more than 10 times lower than the unique impressions of CryptoSlate.

Simply, it is not possible for an exchange or a web platform with 60,000 unique visitors on a monthly basis to process $200 million in a day, as that would mean two thousand users, online at the same time every single day, have to trade $100 million each amongst each other, to make up for the $200 million daily volume, trading more than $100,000 each.

Based on the traffic evaluation of BitForex, it was quite evident that the daily trading volume of the exchange was falsified and inflated. In contrast, KuCoin had 889,000 unique users while Kraken had 666,000 unique users, more than 30 times larger than the unique user base of BitForex.

Other than traffic comparison, the CER team ran several tests such as analyzing the social media platforms of BitForex to other exchanges and ended up with the same conclusion that the daily trading volume of BitForex was not proportional to the user base, reach, and the size of the exchange.

Researchers at CER explained:

“BitForex forges trading volumes to stay on the very top of the rating and draw the attention of crypto investors and new users. However, they have certain issues with processing and converting traffic into users as there is no clear policy regarding interaction with the audience. As a result, the exchange doesn’t have a large number of real supporters and loyal community on social media, Telegram, or email.”

In 2017, Chinese cryptocurrency exchanges OKCoin and Huobi also allegedly ran bots to wash trade and inflate their daily trading volumes to purposefully aggrandize the size of the Chinese cryptocurrency exchange market.

Up until July 2018, 11 months after the imposition of a ban on cryptocurrency trading by the Chinese authorities, several publications have claimed that China accounted for 90 percent of bitcoin, ether, and other major digital asset trades in late 2017, which is inaccurate given that Chinese exchanges relied on a no-fee policy to alter its volumes with ease.

Other Malpractices

Newly emerging cryptocurrency exchanges are depending on all sorts of malpractices and absurd methods to drive users into their platforms. Earlier this month, Chinese cryptocurrency exchange FCoin was heavily criticized by the developers at widely utilized Ethereum wallet platform MyCrypto, for clogging up the Ethereum blockchain network with transactions that have no value to attract the interest of the public.

Due to the high listing fees and large profit margins generated from processing digital asset trades, the cryptocurrency exchange market has seen an influx of entrepreneurs and developers from major industries. However, as of recent, the gold rush of entrepreneurs to create the “next big thing” in the cryptocurrency exchange market has negatively affected the cryptocurrency sector, leading investors to lose trust and confidence in the market.