Investigating Scam Allegations Around Apollo Currency

Investigating Scam Allegations Around Apollo Currency

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

There are percolating allegations that Apollo Currency is a “pump and dump.” Others claim that one of the project’s co-founders—Stephen McCullah—is a “scam artist,” and that APL is a “massive scam” that is making him “rich.” CryptoSlate explores these allegations and finds evidence of misinformation, claims of sabotage, and a bizarre expedition into the heart of the Congo.

Background on Apollo Currency

Apollo Currency (APL) is an all-in-one cryptocurrency to be “the world’s fastest, most private coin.” The technology of the coin is based off a fork of the Nxt platform.

Apollo boasts a breadth of features that supposedly differentiate it from other cryptocurrency projects. According to a promotional video, If the cryptocurrency is able to fulfill its road map, it would offer smart contracts, IP masking, file sharing, voting, decentralized exchanges, and “much more,” all on a “next-generation blockchain.

A Mountain of Controversy

Reddit and other cryptocurrency communities have been abuzz alleging that Apollo Currency and the Apollo Foundation (a for-profit incorporated in Texas and Missouri) are engaging in fraud and criminal activity.

Some of these allegations include “Apollo Currency team just engaged in massive pump and dump scheme, dumping hundreds of millions of coins on their investors,” “Apollo is a massive scam and you are all making the founder, Steve McCullah, rich,” and “proof that Apollo Foundation is dumping their own coins.”

CryptoSlate interviewed Lior Yaffe, the co-founder of Jelurida (which oversees NXT, Ardor, and Ignis)—and which Apollo Currency cloned most of its code from—had this to say about the project:

“It’s a pure money grab. The features they promised in their roadmap are either trivial or very complex beyond their ability or simply impossible.”

In an even more bizarre twist, some have gone as far as to call Stephen McCullah a “known scam artist” for his involvement in an expedition to the Republic of the Congo. Allegedly, McCullah “disappeared with everyone’s money and never completed the expedition.”

CryptoSlate conducted an investigation into each of these allegations and interviewed project co-founder and public relations director Stephen (Steve) McCullah to examine the veracity of these claims.

Allegations of a Pump and Dump?

One of the most scalding allegations is that Apollo Currency has been actively encouraging speculators to “pump” the price of APL with a later intention to “dump” the Apollo Foundation’s holdings—for illicitly-gained profits.

In the United States, pump and dump crimes are a serious offense with penalties ranging from loss of business licenses to felony charges. The allegations levied are serious, according to one Redditor:

“[The] APL team is fueling this pump as hard as possible. They are actively telling people word-for-word to load their bags now, we’re going to be $1/APL soon (above Ethereum and Ripple in market cap)…”

Meanwhile, comments from McCullah run contrary to these claims:

“We have a lawyer which monitors all of our social media channels for these exact types of statements. We have a very large admin team and every single one of them knows that if they even so much as insinuate a price increase in the future or that we will be on an exchange in a certain amount of time, they will be fired. A team member has never, not once, made a statement like the one that is being claimed.”

Which of these narratives is right?

Purported Pump and Dump Evidence

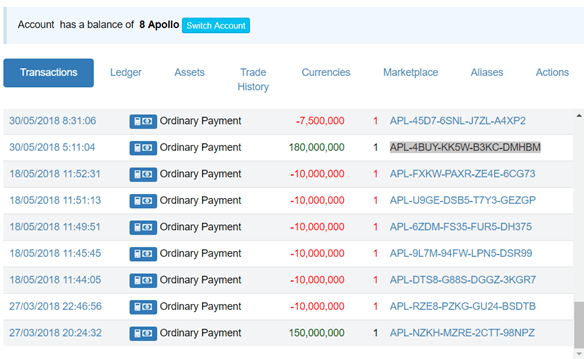

Crypto community members cite that APL movement between two wallet addresses, APL-4BUY-KK5W-B3KC-DMHBM, and APL-NZKH-MZRE-2CTT-98NPZ suggest that the Apollo Foundation—the for-profit enterprise managing the project’s development—is attempting to “disguise this movement of tokens onto exchanges for a massive dump.”

The two transactions pictured on Mar. 27th and May 5th of 2018 were made before accurate price data was available. If calculated using Apollo Currency’s initial distribution event price of $0.02, then these transactions would be worth $300,000 and $360,000, respectively.

During the interview we asked about the project’s affiliation to the two aforementioned wallet addresses:

“From memory, I believe 98NPZ was the Foundation’s original funding wallet and I believe DMHBM may be the wallet that funded 98NPZ.”

Allegedly, the sale of tokens “below the ICO offering price” makes the transaction “even more suspicious. McCullah also previously made a statement in the group’s Telegram channel denying the allegations, saying:

“I can personally vouch for every team member out there as I know they would never sell. Right now we have so many exchanges and investors looking at us. It would be crazy to sell at this moment and every team member knows this and would not jeapordize [sic] it for a small gain.”

Yet, critics still say “Steve’s statement doesn’t jive with the facts.”

Evidence Refuting Price Manipulation Allegations?

CryptoSlate inquired about these specific pump and dump allegations with Stephen McCullah. When asked about the company’s involved in the potentially criminal activity:

“This could not be further from the truth… we have a circulating supply of over 15 billion with nearly 200,000 wallets created. A few months back nearly every wallet in existence was funded by one of the two foundation wallets. There is absolutely no way that we can track every transaction from every wallet. And stating that because a wallet sold that was funded by one of these two wallets means the foundation is dumping is unbelievably ridiculous, every single APL that’s in circulation originated from these wallets.”

Moreover, McCullah encourages skeptics who would like to verify the Apollo Foundation’s activity to see these transactions themselves:

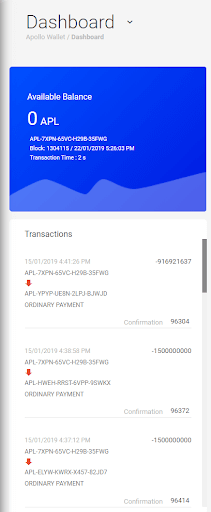

According to McCullah, movement of the Foundation’s funds are in the following wallets:

“This has always been our Foundation wallet: 7XPN-65VC-H29B-35FWG. But recently, after our Apollo Vault feature we decided to store our funds in multiple Vault wallets We had 5.5 billion Apollo in the Foundation’s wallet. This 5.5 billion was divided into these wallets: APL-HWEH-RRST-6VPP-9SWKX, APL-YPYP-UE8N-2LPJ-BJWJD, APL-ELYW-KWRX-X457-82JD7, APL-2S35-2LDG-8WJQ-G8AL8.”

Anybody can verify the movement of these funds on the official blocker explorer or an independent block explorer like Jelurida Snake Oil. McCullah goes on to verify and explain where the team has been spending these tokens:

“In total, the Apollo Foundation received 6 billion. Almost all of the difference between 6 billion and 5.5 billion was distributed during one of our many airdrops. You can see that we sent large transactions to a wallet which distributed these funds to our airdrop recipients.”

McCullah also elaborates on a more in-depth breakdown of the allocation of the project’s funds, which is also consistent with Apollo Currency’s original white paper:

- 30 billion max supply

- 3 percent to Advisors

- 8 percent to the Apollo Team

- 6 percent to Coin Sale Costs

- 10 percent to NXT holders

- 20 percent to the Foundation (for future marketing and development costs)

- 53 percent offered during Coin Sale

Of that 53 percent, over 8 billion was burned—leaving a little over 21 billion as our total supply. The Apollo Foundation owns roughly 26 percent of total supply, worth $13 million at current prices.

Note about the NXT airdrop: the Jelurida Public License requires that developers who clone the Nxt blockchain grant 10 percent of new tokens to existing NXT holders. Whether Apollo Currency conducted its airdrop to NXT holders for that reason is uncertain.

To iterate McCullah’s position, he went on to say:

“The foundation’s wallets have always been publicly available and viewable, never has funds from these wallets gone to an exchange and they never will.”

CryptoSlate cross verified transactions from the Apollo Foundation’s wallets and could not find any transactions that were sent directly to an exchange wallet. McCullah insists that the project has, in fact, been “incredibly transparent”:

“The Foundation has always been incredibly transparent when it comes to where it will use its Apollo and how. We have always said that these will be used to fund development and marketing of Apollo. The reason that the Foundation dumping claims are absolutely preposterous is that the Foundation would never sell via exchanges.”

He offers additional reasoning on why. McCullah claims that the Foundation will use over-the-counter (OTC) transactions, which is common practice among cryptocurrency projects, to sell coins in the future. That said, McCullah states that the Apollo Foundation has not made any OTC sales, yet:

“We have been working to accumulate more Apollo, not sell, but when we do sell it will always be OTC to large investors which would not purchase on an exchange anyway and certainly wouldn’t sell on one.”

Is Apollo Currency’s Technology Questionable?

Another circulating allegation is that Apollo Currency overpromises and underdelivers on its technology. According to one Redditor’s accusations:

“[Apollo’s team will] be sure to tell you all about Apollo’s amazing features in their communities. Here’s the only problem—it has absolutely none of those things right now and is all promises from a dev team that has not proven one bit of a competency yet. Their website is even built on Wix.”

Whistleblowers have lambasted the project for its ambitious claims and purportedly underwhelming results, and have gone as far as to call into question the competency of McCullah and the project’s entire team. Another Redditor posted:

“…the Apollo website is a Wix site according to the source code. Perhaps their CEO should master coding his own website before he writes this revolutionary world changing code he’s promising.”

Furthermore, there are claims that the technology is a mere copy of Nxt’s code base, of which Apollo Currency is a fork. Allegedly, the changes made to the forked copy that constitute Apollo Currency are “insignificant” and “change nearly nothing.” Additionally, critics claimed the team did this while “hailing them as the greatest lines of code ever written, using big technical-sounding words to trick their extremely devoted, cult-like followers.”

Comments from Lior Yaffe support the narrative that Apollo Currency is taking advantage of Nxt’s innovations:

“My concern is that he [Stephen McCullah et. al.] is taking a product that my team has developed over 5 years with dozens of man years invested and presenting all our innovations as his own innovations.”

Not only that, Yaffe alleges that some of the features that Apollo Currency implemented may have some deficiencies:

“What information can I provide you to differentiate our products from the Apollo scam? Are you aware of their ‘confidential transactions’ feature that we showed are not confidential at all?”

McCullah Defends Project’s Technology

When McCullah was asked about the allegations around Apollo Currency’s technology, he responded:

“Our devs have added and/or modified over 100,000 lines of code. Just to safely build the infrastructure necessary to incorporate 2 second blocks took well over 2,000 new lines of code. We have not only made significant additions to this code but significant advancements in blockchain.”

The project’s GitHub supports McCullah’s response. With over 1,150 commits those “100,000” lines of code are viewable by anyone with proper developer tools. McCullah goes on to explain how Apollo has actually made “significant advancements in blockchain”:

“One big example of this is our ApolloUpdater, which is a revolutionary technology that allows us to upgrade the entire blockchain protocol using a transaction on the blockchain itself…. Another example is our ChainID technology which allows us to change the blockchain properties without forking as well as allowing backwards compatibility…. Adaptive Forging is groundbreaking because it stops needless blocks from happening increasing its sustainability and decreasing blockchain bloat. Even one of these is a significant amount of work, however there are a large number of these advancements that have added tremendously to the value of the blockchain.”

McCullah is adamant that these changes are not just trivial edits to Nxt. He states that “if these advancements are so simple and easy to do then why haven’t other blockchain projects been able to incorporate them.”

Meanwhile, Yaffe alleges that there is no way to evaluate these claims without wasting an enormous amount of resources:

“…to refute this, I will need to take my best devs to look at his code and expose his fake claims. I guess he speculates that we don’t have the time for this. It’s a war of attrition.”

That said, the difference between “trivial” and “revolutionary” is almost purely subjective. It is difficult, if not impossible, for most speculators to evaluate the merits of these changes. With that bottleneck in mind, it is up to users and speculators to decide whom to trust when evaluating the technical merit of the project.

Purported Community Censorship

Another criticism of Apollo Currency is its purported censorship of negative sentiment. Another Redditor claimed in the coin’s Telegram community:

“Saying ANYTHING… about the tech of APL, mentioning NXT, saying the word ‘fork,’ ‘dump,’ [and] ‘sell,’… will get you immediately banned.”

Furthermore, the same user stated that Apollo Currency’s community is the “single most brainwashed group of people [they] had ever seen in crypto.”

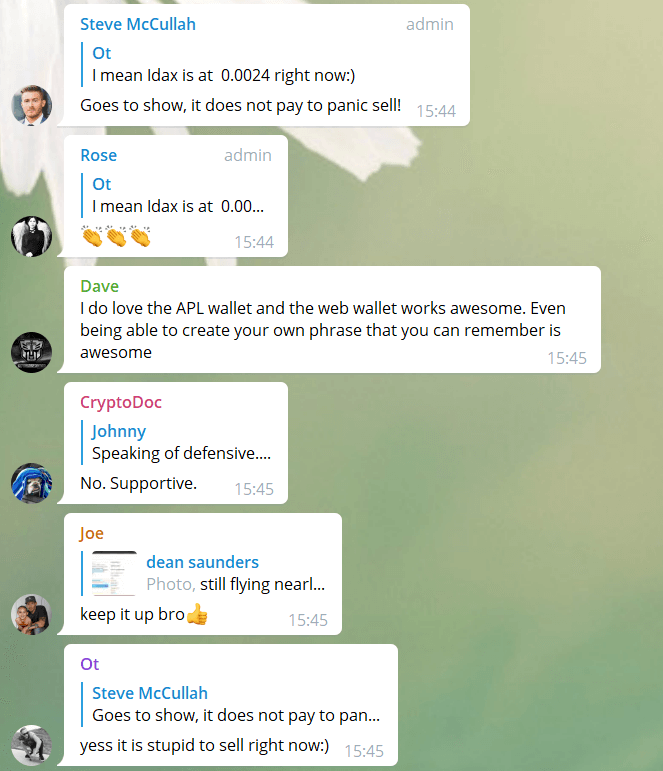

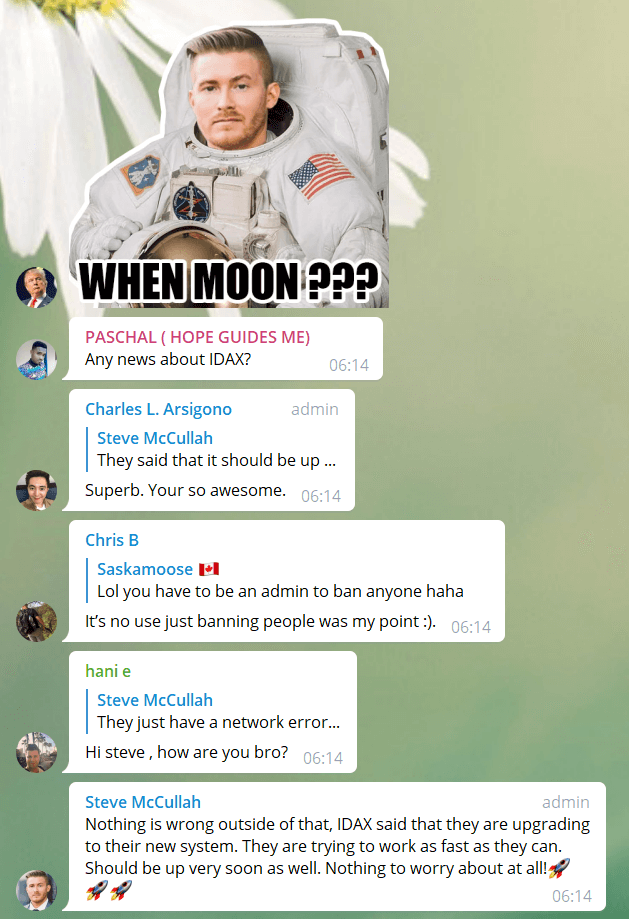

Like most Telegram channels, Apollo’s could also be subjectively called an ‘echo-chamber’:

Although some of McCullah’s statements to the community are certainly optimistic, it’s hard to determine whether they constitute criminal pump and dump behavior, as the critics may claim:

Given this evidence, it’s difficult to say whether Apollo’s Telegram group is any more “brainwashed” than most in crypto. Although the moderation might be questionable, it’s not technically illegal to monitor a community at a business’s discretion.

Scam Artist Allegations (from the Congo)?

There have been other allegations that McCullah is a “scam artist,” stealing funds from a Kickstarter campaign promising an expedition to the Democratic Republic of Congo.

McCullah went on the record to confirm he went on the expedition, partially funded via Kickstarter, to explore the Congo:

“Nearly 7 years ago, while I was in college I joined an expedition to explore the Congo basin, at the time one of the least explored and most dangerous locations on Earth.”

However, according to McCullah, complications including “getting much of our equipment stolen, being detained by law enforcement and military, having to pay enormous bribes at every turn, and getting temporarily rejected on our scientific permit we ended up having to come back.” With this explanation in mind, it’s not hard to imagine why he was unable to fulfill all of the Kickstarter promises. However, McCullah asserts that he rectified the situation:

“We refunded everyone that asked for a refund and continued to regroup for the next expedition.”

And, eventually, McCullah claims to have fulfilled his Kickstarter promises:

“We risked our lives to fulfill our initial promise and meet the expectations of those backers. I have the photos and proof to validate this… During this trip we were detained more than 7 times by police and military and on more times than one interrogated. We risked our lives to fulfill our initial promise and meet the expectations of those backers.”

The photos sent to CryptoSlate appear to validate these claims:

Claims Around McCullah’s Qualifications

Others have claimed that he misconstrued his qualifications on LinkedIn, saying McCullah claimed to have bachelor’s degrees when, in fact, he did not. In one YouTube video, there is a clip of the co-founder with “bachelor’s degree” listed under the two previous universities where he claimed to have studied. McCullah later removed these bachelor’s degree labels from his profile.

In the interview with CryptoSlate, Steve McCullah describes it as “nothing but a simple misunderstanding.”

As far as CryptoSlate’s investigation could find, McCullah never changed the dates of attendance listed on his LinkedIn.

“When it was pointed out that it may look like I am trying to pretend to have a biology degree I immediately removed it as I was now able to show only the year without listing the degree… This person points out that it is a horrible thing that this was changed, to me this is just seeing a simple mistake and doing so transparently.”

From these accusations and statements alone, it’s impossible to know McCullah’s intentions when he listed these qualifications. However, lying about degrees that McCullah listed as only having attended for one and two years is either incredibly foolish or a simple mistake.

“To me it’s obvious that you would not have received a bachelor degree in a single year. I would have never expected anyone to have believed that was possible and I didn’t want them to.”

Speculation about Competitor Sabotage

The origins of these rumors, McCullah claims, is a jealous competitor. “There’s no question on our side” that it is Jelurida (and by extension Lior Yaffe) spreading “misinformation.” Jelurida is the entity that oversees development of both Nxt which McCullah says is a competitor for Apollo Currency.

Some of the same points that were made on these critical Reddit threads were first made by Jelurida co-founder Lior Yaffe. McCullah believes that Jelurida is worried about the competition from his project:

“Apollo is Ardor with faster speeds, sustainability, privacy, and soon smart contracts… So Ardor becomes obsolete… for them it’s survival. We’ve already rebutted 90% of this but they are not worried about the facts.”

McCullah’s accusations aside, CryptoSlate could not find tangible evidence that Yaffe’s critiques were voiced with the intention to spread “misinformation.” When Yaffe was asked to comment on his opinions on Apollo Currency he had this to say:

I don’t have a crystal ball to tell me if this guy will runaway with the funds tomorrow, next year or if he actually going to develop a masterpiece blockchain product. From past experience the chance for the latter is very very small but miracles do happen.

Conclusions from Investigation

Overall, evidence gathered from CryptoSlate’s investigation might contradict some of the narrative surrounding Apollo Currency.

Apollo Currency is largely a United States-based project, with McCullah and many other team members under the jurisdiction of these stricter laws, when compared to places such as Malta, Singapore, and the Bahamas. McCullah even says that he has multiple companies that he owns in the United States, including a “medical manufacturing company.”

“I have a lot to lose,” he said in the interview, suggesting that committing any criminal activity or fraud would not make sense for him or his team.

McCullah’s statements during his interview seem to coincide with third-party facts around matters dispelling Apollo Currency’s alleged criminal misconduct. That said, some of his statements are impossible to verify for accuracy, and McCullah is obviously biased considering his position in the project.

There are still many in the community that are adamant that the project is a “scam,” yet there is not nearly enough evidence to conclusively say that Apollo Currency is engaging in criminal activity. Although the company’s marketing could be interpreted as overambitious, grand marketing claims are not unusual in a space rife with exaggeration and salesmanship.

It is not a crime to engage in practices that the crypto community merely dislikes. It is also not a crime to make business decisions that the broader community disagrees with.

Nevertheless, in general, cryptocurrency projects tend to be ripe with fraud, as the ICO boom of 2017 taught many investors; for those who aren’t prepared to lose money, the safest option is not to invest at all.