IMF warns of more crypto pain ahead, including stablecoin failures

IMF warns of more crypto pain ahead, including stablecoin failures IMF warns of more crypto pain ahead, including stablecoin failures

IMF Director Tobias Adrian warned crypto investors that macroeconomic factors are expected to put pressure on digital assets, particularly stablecoins.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The International Monetary Fund’s (IMF) Director of Monetary and Capital Markets, Tobias Adrian, warned that more crypto projects might fail, particularly stablecoins.

The comments made for unwelcome news as investors, still raw from the Terra implosion and subsequent liquidity drain, continue to hold hope that the worst is over.

Speaking to Yahoo Finance, Adrian said that if a recession arises, he expects cryptocurrencies and other risk-on assets to come under further sell pressure, giving way to more pain ahead.

Crypto stablecoins under the spotlight

Expanding further, the IMF Director said the knock-on effect of an economic downturn could see the failure of “coin offerings,” as he singled out algorithmic stablecoins as particularly vulnerable.

“There could be further failures of some of the coin offerings — in particular, some of the algorithmic stablecoins that have been hit most hard, and there are others that could fail.”

Algorithmic stablecoins achieve price stability by an automated process that mints more tokens when the price increases above the peg, and burns tokens when the price falls below the peg.

Current significant algorithmic stablecoins in operation are USDD on Tron, USDN on the Near Protocol, and Ethereum’s Frax, which is part algorithmic part collateralized.

However, collateralized stablecoin offerings are also at risk, according to Adrian. In particular, Tether, which Adrian said is vulnerable “because they’re not backed one to one.”

“[Some fiat-backed stablecoins] are backed by somewhat risky assets…it is certainly a vulnerability that some of the stablecoins are not fully backed by cash-like assets.”

Tether was ordered by the New York Attorney General to submit mandatory quarterly reports on its reserve holdings in February 2021. Subsequent reports showed reserves were composed of significant illiquid assets, such as “commercial papers,” raising doubts over the company’s ability to meet its obligations.

Since then, Tether has reduced its commercial paper holdings by $5 billion to $3.5 billion.

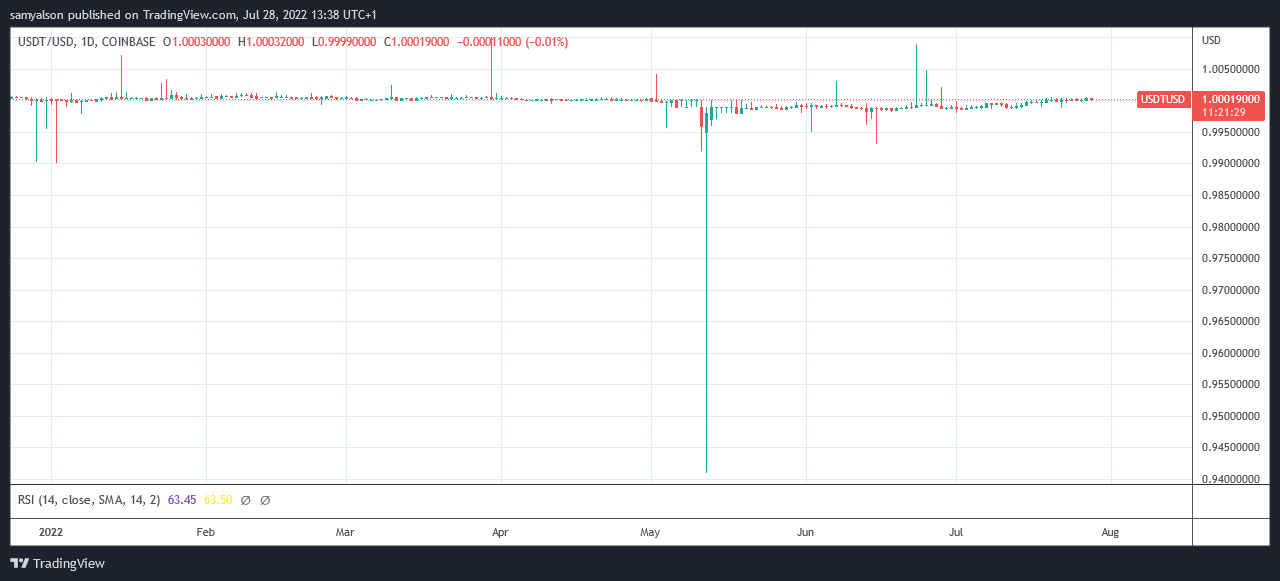

Tether dropped significantly below its $1 price peg during the Terra collapse, going as low as $0.94. At the time, Bitfinex CTO Paolo Ardoino played down the significance of the drop, saying the peg was not broken as holders could always redeem directly from the company for face value.

What recession?

Previously, a recession was defined as two consecutive quarters of negative GDP growth. However, policymakers have redefined the term as a ” holistic look at the data – including the labor market, consumer and business spending, industrial production, and incomes.”

The move was widely mocked as an incredulous play by the current U.S. administration. Political Commentator Glenn Beck called this a weak ploy to win a losing argument while also bringing in a host of other political hot potatoes.

Under Biden alone, the Left has tried to redefine woman, fetus, domestic terrorist, insurrection, voter suppression, illegal alien, anti-police, and now recession. What a strategy! When you lose an argument, just change the DICTIONARY!

— Glenn Beck (@glennbeck) July 27, 2022

On July 28, the Bureau of Economic Analysis said U.S. GDP for the second quarter had shrunk by 0.9%, marking the second successive quarter of economic contraction.

Despite denials of a recession from the current administration, crypto investors would be prudent to heed Adrian’s words.