ICO Contributions In 2018 Already Surpass the $5.6 Billion Raised in 2017

ICO Contributions In 2018 Already Surpass the $5.6 Billion Raised in 2017 ICO Contributions In 2018 Already Surpass the $5.6 Billion Raised in 2017

Photo by lucas Favre on Unsplash

Raising over $6 billion in the first quarter of 2018, the first three months of ICO contributions have outstripped the total raised in 2017.

In the face of crippling market conditions and regulatory blackmail, investors have contributed enough to overtake 2017’s entire $5.6 billion ICO economy. Keep in mind, it is only April.

Beaten into shape by 2017’s spate of ICO scams, large-scale hacks, and volatile market conditions, wary investors have met 2018’s 183 ICOs with unwavering fervor.

In fact, the first three months saw these street-smart capitalists pitch in nearly one hundred times the average contribution of Q1 2017.

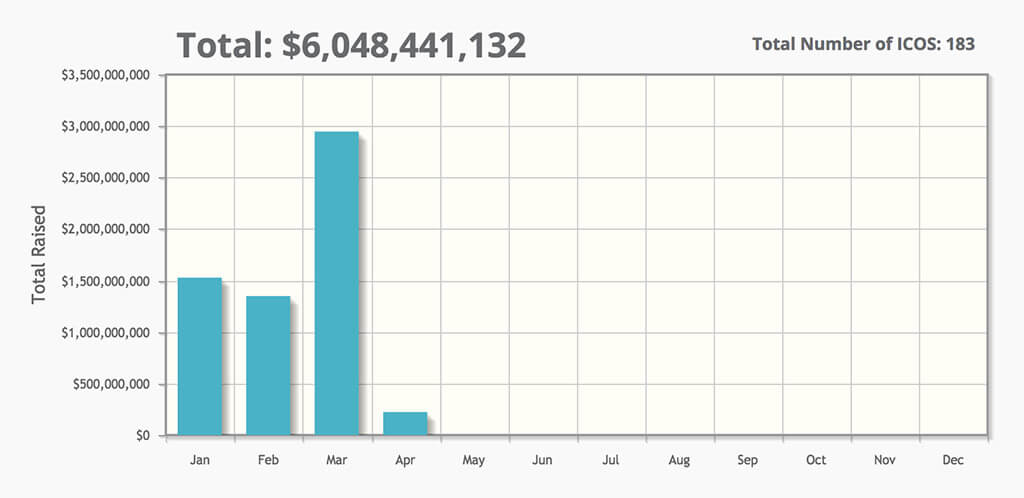

Here is how the year has shaken out so far:

- January – $1,528,463,335

- February – $1,349,743,790

- March – $2,946,645,007

- April – $223,589,000

Raising a whopping $1.7 billion, Telegram’s ICO accounts for nearly a third of the year’s funding — yet even excluding these unthinkable sum contributions would net $4.5 billion, or 85% of 2017’s total.

While Telegram’s titanic raise may have re-written the record book, the communications giant is not alone on the pedestal.

Indicative of the burgeoning confidence of corporations and their shareholders, 2018 has seen a number of substantial raises in quick succession and even the first exit scam prank.

February saw casino cryptocurrency Dragon’s $320 million tokensale, shortly followed by Chinese exchange Huobi’s $300 million “token launch” (the company weaving past the government’s fleeting ICO roadblock).

That said, the bulk of the year’s ICOs have lounged in the $10-25 million mark — the type of metrics expected by increasingly educated investors — who agree on smaller raises as being more lucrative.

On the topic of ICOs, most nations appear to remain at a regulatory crossroads. When peeling away the layers of bureaucracy, however, one might imagine that these superpowers are engaged in an arms-race reminiscent of the Cold War.

Take the US Securities and Exchange Commission’s ominous threat in February to clamp down on ICOs — in shutting up shop Uncle Sam would be turning away what could soon become a multi-trillion dollar economy.

“I want to go back to separating ICOs and cryptocurrencies. ICOs that are securities offerings, we should regulate them like we regulate securities offerings. End of story.” – SEC Chairman, Jay Clayton

While conservative politicians wrap their heads around the radical concept of a peer-to-peer crowdfunding mechanism, the vast potential of an ICO-friendly framework will surely prevail. After all, the one universal priority in this political jumble is money.

For now, one cannot imagine strong enough force to discourage project founders, their faithful investors — or what colossal ICO funding figures we will see throughout the rest of the year.