Here’s who bought $67 billion worth of Bitcoin, crypto in America in 2020

Here’s who bought $67 billion worth of Bitcoin, crypto in America in 2020 Here’s who bought $67 billion worth of Bitcoin, crypto in America in 2020

Photo by Trent Yarnell on Unsplash

Bitcoin, and the crypto market, have finally blossomed after a long two-year-wait. The pioneer cryptocurrency broke its $11,000 resistance earlier this week, spurring double-digit gains across a broader set of altcoins.

Firms like Coin Metrics, a crypto markets data and investment provider, say that if these growth rates are maintained, Bitcoin’s current daily volume would need “fewer than 4 years of growth to exceed the daily volume of all US equities and fewer than 5 years to exceed the daily volume of all US bonds.”

But who’s buying billions of dollars worth of cryptocurrencies anyway? A recent survey has the answer.

$67 billion in crypto purchased this year

A new study from Cornerstone Advisors concluded 15 percent of American adults now own Bitcoin or other altcoins, with half of the first-time cryptocurrency investors coming only in the first six months of 2020.

New investors, on average, obtained over $67 billion worth of Bitcoin and cryptocurrencies in 2020, an average of $4,000 per person. However, the figure is still lesser than last year’s $111 billion, or $7,000 per person.

The U.S. also leads in crypto adoption. The survey said that among the top-ten countries, America had a 15 percent penetration of digital asset investment and awareness as of 2019 (the figures may have changed since).

The demographics buying crypto

The top demographic is high income, well-educated men. Nearly eight in 10 of 2020 crypto buyers were men with an average annual income of $130,000. Four in 10 have a Master’s degree or higher (70% have a Bachelor’s degree or higher), noted the survey.

Next are millennials — between the ages 25-40 — and “Gen Xers. The two groups compromised over 57 percent, with Gen Xers with 30 percent of that. The survey noted:

“Overall, 27% of Millennials and 21% of Gen Xers now hold some form of cryptocurrency, in contrast to 7% of Gen Zers, and 3% of Baby Boomers.”

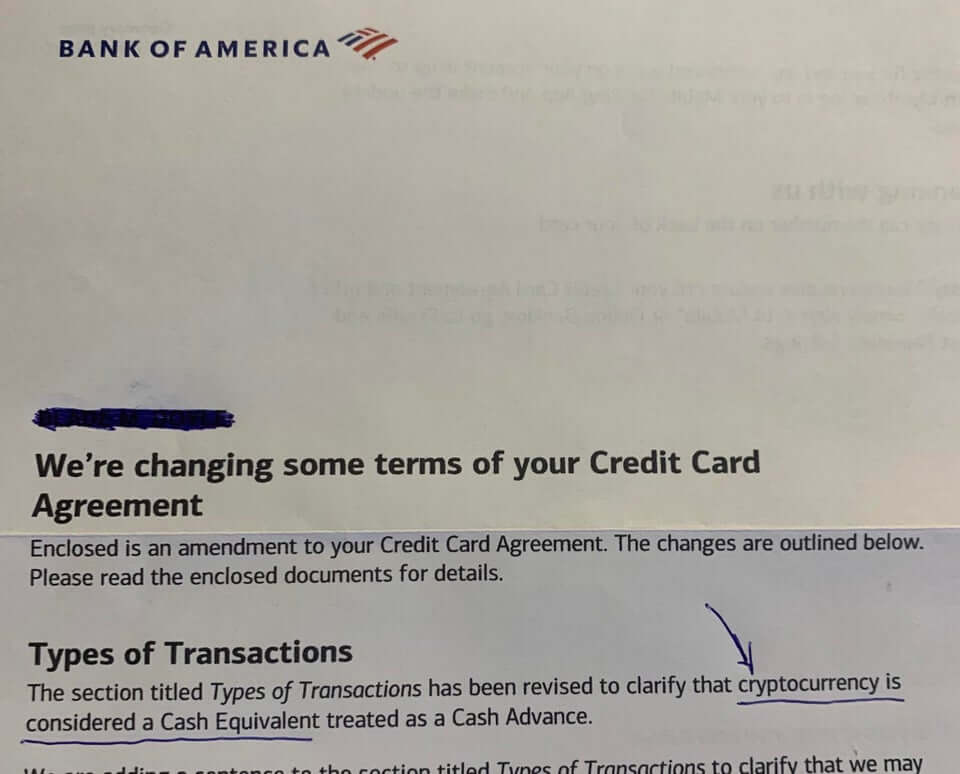

Then comes a rather surprising demographic; Bank of America customers. 21 percent of individuals holding a BoA account held some cryptocurrencies.

This may be attributed to the bank’s relative crypto-friendly stance — it allowed customers to use credit and debit cards to purchase crypto earlier this year.

Other demographics and a “better” financial condition

Of other demographics, women made up 22 percent of all surveyed cryptocurrency investors and minorities like African-American and Hispanic with 23 percent of current crypto investors.

Meanwhile — and while it’s hard to prove that holding cryptocurrencies is the cause of this — Forbes said over 44 percent of Americans invested in crypto noted “their financial health is “much better” since the beginning of the COVID crisis.” That’s in contrast to just 5% of all other US consumers, the report added.

However, one area of concern lingers. Just 30 percent of upcoming crypto investors, in the survey, considered themselves “very financially literate,” in comparison to 54 percent of those who already hold cryptocurrencies.

This could cause scams to prey on those individuals, which in turn, could spark a repeat of the 2017 ICO money grab.