Ethereum NFT market cap shrank 60% in 2022

Ethereum NFT market cap shrank 60% in 2022 Ethereum NFT market cap shrank 60% in 2022

Ethereum-based NFT collections' market cap dropped from $9.3 billion to $3.7 billion in 2022. However, numbers from January indicate growth.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The total market cap of the NFT collections deployed on Ethereum (ETH) recorded a 59.6% drop in 2022, according to a DappRadar report.

The aggregate market cap of the ETH-based NFT projects started the year 2022 at $9.3 billion and ended at $3.7 billion, according to the report. However, numbers from January indicate that the NFT market started to flourish, which includes ETH-based NFTs.

Yuga Labs

ETH has 81 NFT collections deployed on its chain. The numbers indicate that Yuga Labs NFTs account for 67% of the total NFT market cap on the ETH chain.

Yuga Labs include popular NFT collections like CryptoPunks, Bored Ape Yacht Club (BAYC), Bored Ape Kennel Clum (BAKC), Mutant Ape Yacht Club (MAYC), Meebits, and Otherdeeds for Otherside.

Together, CryptoPunks and BAYC account for 46.7% of the total ETH NFT market cap. BAYC, with a floor price of $98,438, recorded a $49 million trading volume in January.

NFTs in January

In January, the NFT trading volume recorded a 38% growth from about $700 million in December 2022, according to another report by DappRadar. The current trading volume, $946 million, marks an all-time high since June 2022. NFT sales count also increased from 6.7 million in December to 9.2 million in January, reflecting a 42% growth.

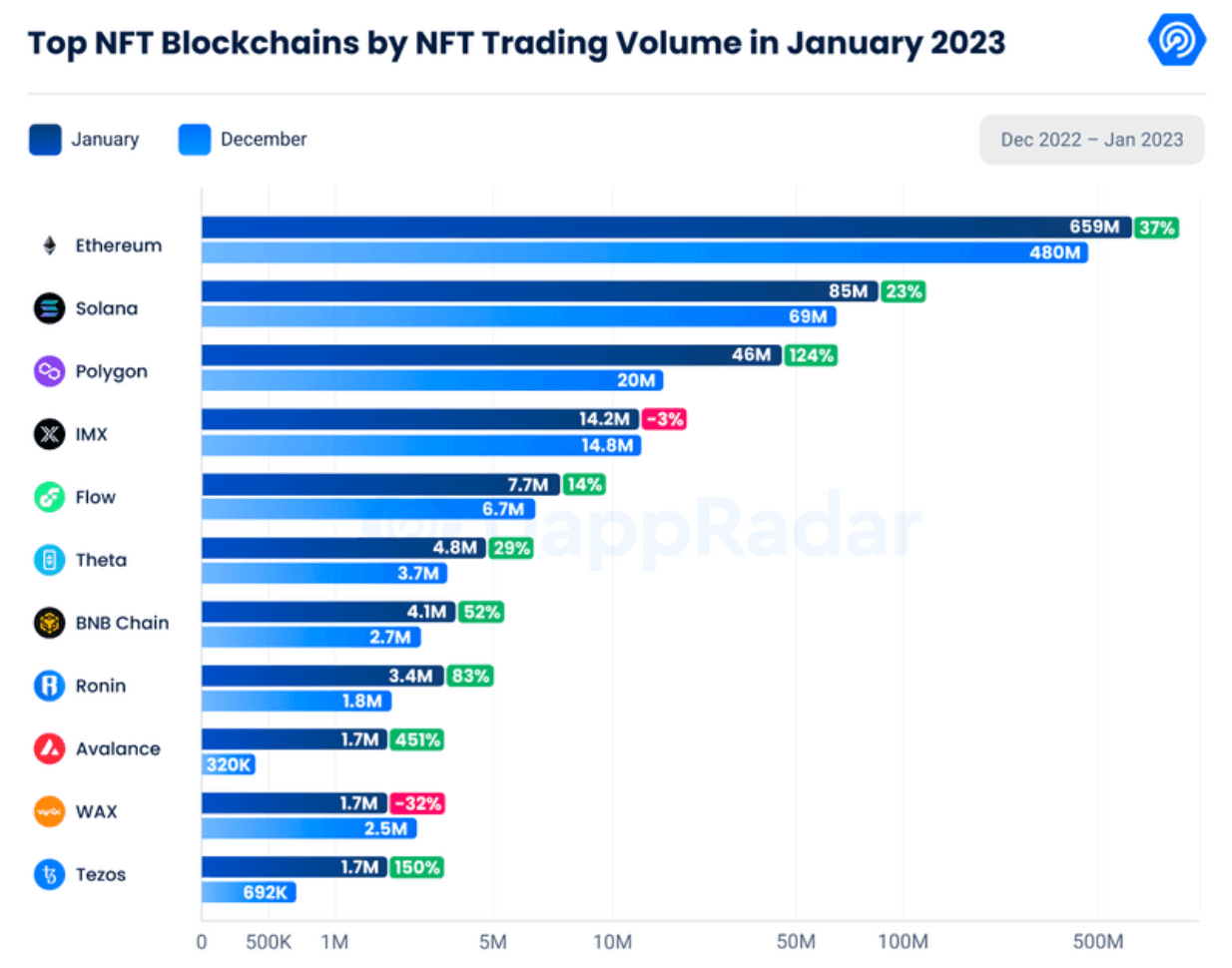

ETH also ranks first in the highest NFT trading volume. The chain’s trading volume recorded a 37% increase from $480 million in December 2022 to $659 million in January.

Solana (SOL) and Polygon (MATIC) followed ETH as the second and third with $85 million, and $46 million, respectively. While SOL recorded a 23% increase from December’s $69 million, MATIC stood out by recording the third-highest growth rate of the month with 124%.

Avalanche (AVAX) and Tezos (XTZ) recorded the first and second-largest monthly growth rates, with 451% and 150%, respectively. Immutable X (IMX) and WAX (WAXP) blockchains, on the other hand, recorded -3% and -32% decreases in January, respectively.