Ethereum DeFi platform Centrifuge wants everyone to access liquidity via tokenized real-world assets

Ethereum DeFi platform Centrifuge wants everyone to access liquidity via tokenized real-world assets Ethereum DeFi platform Centrifuge wants everyone to access liquidity via tokenized real-world assets

Photo by Mae Mu on Unsplash

If ICOs were the theme of 2017, stablecoins of 2018, DeFi certainly looks like it’s dominating 2020.

DApps building on Ethereum have attracted institutional investment and massive attention this year, focused on a wide array of use cases and unveiling newer avenues for blockchain to shine.

Now, Centrifuge, a company founded in 2018, is looking to make its mark on the space with the launch of new products. The firm’s thesis looks to empower individuals and businesses to unlock capital and finance real-world assets via an extensive, yet decentralized, finance pool.

Tokenizing real-world assets

Referring to DeFi, Centrifuge recognizes it’s in the middle of a young ecosystem that is “ready to prove itself in the finance world.” The firm’s building a framework that allows lending against real-world assets, which in turn, allows businesses around the world to tap into new capital.

Today, the firm is launching two major releases: an asset-backed lending Dapp called Tinlake, and the general availability of the Centrifuge Chain mainnet.

Today, Centrifuge ? unlocks trillions of real-world value in DeFi with our Decentralized Asset Financing Protocol.

We will bring the #DeFi and #Fintech world closer together and open access to capital around the world ???

https://t.co/itAhVDrQqe— Centrifuge (@centrifuge) May 26, 2020

Tinlake, the dApp, features two pools: a shipping invoice pool in partnership with ConsolFreight, and a music streaming pool that uses data from Paperchain. The former has funded 49 freight invoices so far totaling 278k DAI so far, and information on the latter’s pool for Spotify invoices can be assessed here.

Centrifuge notes the “investor side” is set to be even more decentralized, as the two pools have applied on MakerDAO to be collateralized against MCD.

In a release shared with CryptoSlate, the firm noted crypto-assets remain highly correlated, which causes instability with most DeFi systems. Case in point, MakerDAO suffered a $4 million crisis in March after ETH-collateralized positions on the platform were dropped to zero when ether fell 45 percent over two trading sessions.

But using real-world assets as collateral avoids and even solves the above issue, in Centrifuge’s view.

Tinlake and NFTs

Tinlake lets investors and borrowers finance their own asset pools. Its smart contracts are open source and integrate easily into the DeFi ecosystem. The native “Centrifuge Chain” is used to originate individual nonfungible assets used as collateral for loans.

Centrifuge Chain, on the other hand, is the firm’s permissionless Proof-of-Stake blockchain built on Substrate. It’s touted as the “starting point for originating real-world assets,” and a one-stop platform to deploy assets as “non-fungible tokens” on-chain.

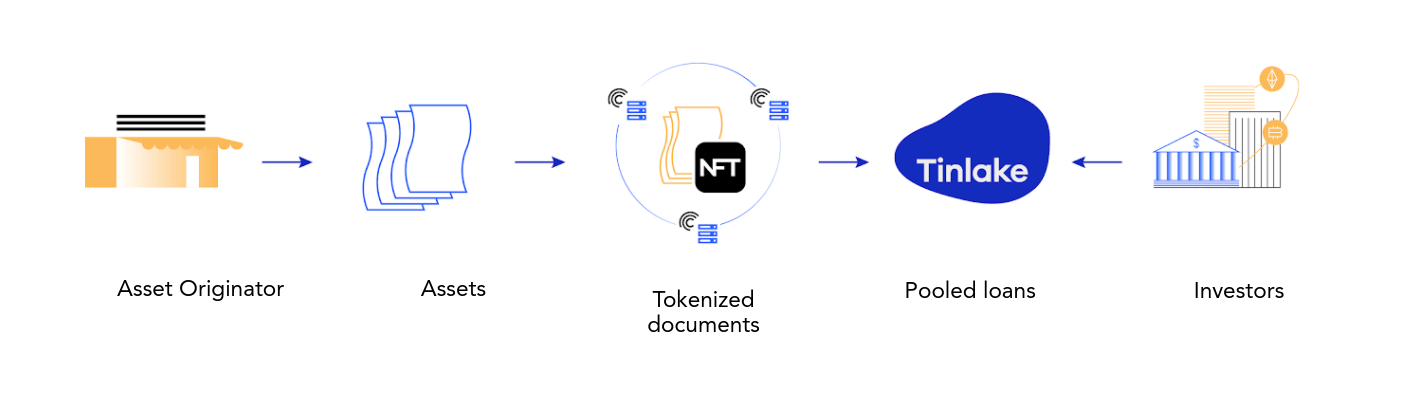

Here’s how Tinlake works; Asset originators launch their Tinlake pools, making them available to anyone to invest. Investors can browse through a list of pools to finance based on asset type and risk. All of this happens without any third party; and transactions are settled trustlessly on-chain.

The below graphic illustrates:

NFTs are easily bridged to Ethereum from day one. Centrifuge Chain is powered by the Radial token, which empowers its holder with governance and provides the incentive for validators to operate the chain. Centrifuge is launching with 10 validators securing the chain.

Using Centrifuge Chain and Tinlake, any business can now originate their real-world asset on-chain and access liquidity through Centrifuge.

Tinlake issues ERC20-based DROP and TIN tokens against a loan portfolio. These tokens are stable, backed by the individual loans, but also interest-bearing: this creates a whole new way to stake in DeFi and in crypto.

Both Centrifuge Chain and Tinlake.js are open source platforms. Developers can build on top of Centrifuge Chain, and develop their own decentralized asset financing protocol with Tinlake.js.

DeFi has much to grow

DeFi systems like Centrifuge and Tinlake are forcing a move away from centralized financial systems, inflated fiat currencies, non-verifiable asset financing, and the ill-effects of trade wars. Such systems help eliminate bureaucracy and mitigate risk with better data and trustless technology.

Founder Lucas Vogelsang believes the DeFi ecosystem has much to offer beyond trading-based platforms, which seems to be the current flavor. He explains:

Only when we get from building DeFi solely for crypto traders to addressing the needs of the average Joe, will DeFi become truly decentralized and open for all. Bringing real-world assets into DeFi provides the first step to DeFi to fulfilling this promise.

“Our chain is built as a foundation for the decentralized finance grid, providing the gateway for any real-world asset to enter the blockchain multiverse,” concludes the release.