Dow futures drops 700 points at day’s lowest point, leaving Bitcoin vulnerable to a correction

Dow futures drops 700 points at day’s lowest point, leaving Bitcoin vulnerable to a correction Dow futures drops 700 points at day’s lowest point, leaving Bitcoin vulnerable to a correction

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Dow Futures indicate that the Dow Jones Industrial Average (DJIA) is set to fall at open, following a strong recovery on March 10. The sell-off in the U.S. equities market puts Bitcoin at risk of a further pullback.

Bitcoin on track for three consecutive weeks of steep sell-off

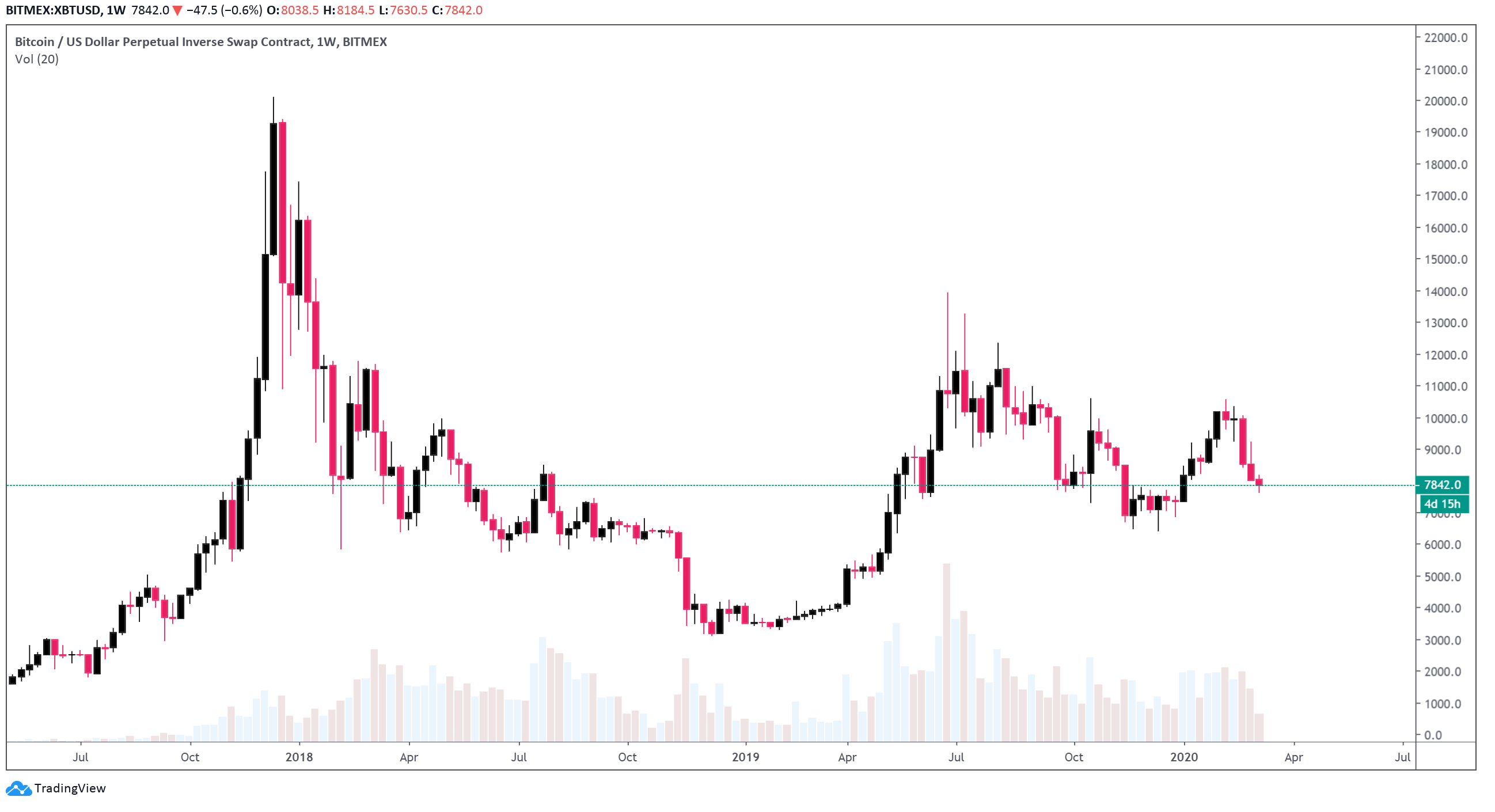

Since the last week of February, the Bitcoin price has declined from $10,000 to $7,832, by nearly 25 percent against the USD.

Before the coronavirus epidemic in China, South Korea, Japan, Italy, and Iran started to invoke unprecedented levels of fear in the global financial market, highly-regarded cryptocurrency traders like DonAlt pointed out that the technical structure of Bitcoin makes a pullback likely in the short-term.

Heightened concerns towards the stability of financial markets exacerbated the downtrend of Bitcoin, intensifying selling pressure on the entire cryptocurrency market.

During times of extreme uncertainty, investors tend to sell high-risk assets to cover for their existing positions. Considering the relatively low market capitalization of $143 billion, it is difficult to consider Bitcoin as a safe haven, risk-on, and risk-off asset.

Bitcoin does not fit any of the three categories; rather, it is merely an emerging asset with a low market cap that has not been tested in a recession-type environment throughout the ten years of its existence.

The 700-point drop of Dow Futures, despite the unified stance of major central banks across Europe to not hold back in releasing every stimulus package that is currently available, is set to translate to added selling pressure on Bitcoin and the cryptocurrency market.

Throughout the past five days, Bitcoin has shown a high level of correlation with the Dow Jones. It fell when the U.S. stock market pulled back and recovered when stocks showed signs of a firm rebound.

The drop of the Dow Jones at market open in spite of U.S. President Donald Trump’s suggestions for strong stimuli such as a 0 percent tax rate until the end of 2020 suggests significant weakness in the global financial market.

Lack of appetite from investors

It also shows a general lack of appetite from investors to re-enter the stock market at a phase when experts remain uncertain whether the coronavirus outbreak in the U.S. could worsen due to a lack of testing capacity.

While South Korea and China have already run hundreds of thousands of coronavirus tests with vamped up capacity and large-scale implementation of easy-to-use testing kits, the U.S. is yet to see a nationwide increase in testing with sufficient resources.

President Trump’s controversial tweet comparing coronavirus to the common flu led to skepticism towards the awareness of the severity of the outbreak by the U.S. government.

Bitcoin Market Data

At the time of press 10:38 am UTC on Mar. 11, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.25% over the past 24 hours. Bitcoin has a market capitalization of $142.55 billion with a 24-hour trading volume of $40.85 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:38 am UTC on Mar. 11, 2020, the total crypto market is valued at at $221.75 billion with a 24-hour volume of $135.38 billion. Bitcoin dominance is currently at 64.26%. Learn more about the crypto market ›