Did Insiders Trade XRP Before the Coinbase Listing?

Did Insiders Trade XRP Before the Coinbase Listing? Did Insiders Trade XRP Before the Coinbase Listing?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

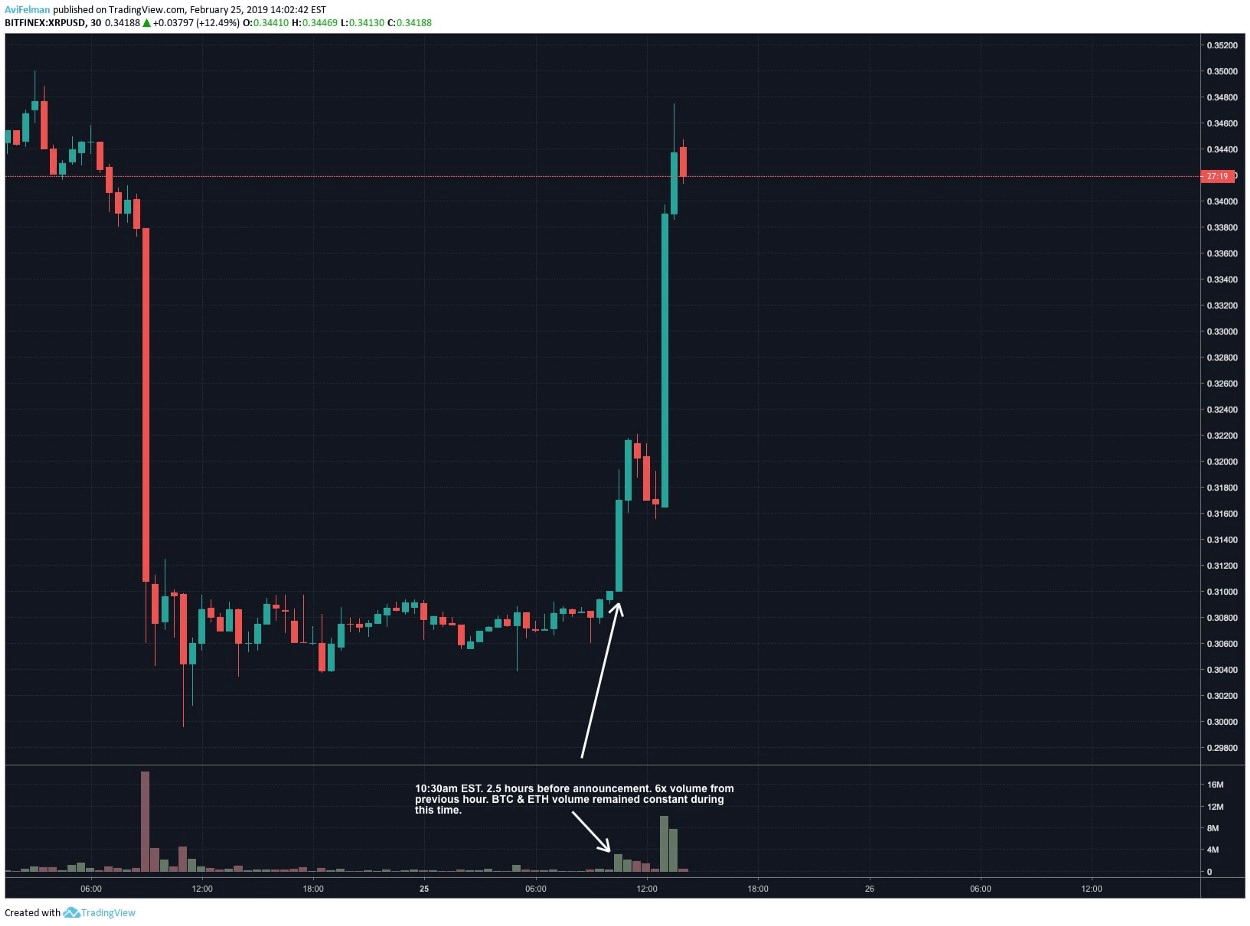

XRP was trading up at approximately 7 percent 15 minutes after the announcement, proving once again that Coinbase listings have a material effect on the price of a cryptocurrency. What was less expected was the small rally in the hours leading up to the announcement, which may indicate insider accumulation.

Coinbase announced on Feb. 25th that they would be adding XRP as a tradeable asset on Coinbase Pro, following years of speculation from XRP supporters and the broader market that it would eventually be listed.

Indications of a Leak

Examining the charts leading up to the tweet, does, in fact, seem to suggest that there was significant accumulation from insiders with information about the upcoming announcement.

In comparison with Bitcoin, Ethereum, and EOS charts from the same period show that XRP had a 6 times increase in hour over hour volume on Bitfinex, compared to a 2x and 1.5x increase, and a 1.5x decrease, respectively.

It is unlikely that XRP would experience such a volume increase out of line with the broader market without news driving the event, hinting at the conclusion there was likely an information leak during the listing discussions.

This kind of price action seems to indicate coordinated buying by larger buyers who had an idea of the upcoming news. And, it’s not without precedent for Coinbase listings. Bitcoin Cash, the third major listing on Coinbase after LTC and ETH, was plagued by similar accusations of insider trading from multiple parties.

Prior to the listing of BCH, there was similar price action with the price and volume of BCH increasing substantially in the hours leading up to the listing. Coinbase vehemently denied accusations of insider trading, and after a six-month internal process, “cleared” all employees of “improper trading.”

Information Asmmetry and Trading

Information asymmetry and advantage is the single most important tool a trader can use to ensure profits, and controversially, according to some finance scholars is the only source of ‘true’ alpha.

Cryptocurrency itself is a market driven by insiders in many ways, as there is a large body of evidence pointing to concentrations of wealth and information among those with access to high profile companies and protocols. And, regulatory bodies have performed few enforcement actions related to insider trading in crypto.

For these reasons, it is likely that the prices in the market are often manipulated by those who have insider information on upcoming events. For most traders, it is critical to acknowledge that they are typically trading at a disadvantage when there is information asymmetry.

Furthermore, those accustomed to the cryptocurrency markets know that exchange listings have been a source of alpha. Many traders pride themselves in being able to catch exchanges as they list assets in order to ride the following price appreciation. Insider leaks, or worse, damage the integrity of the markets and remove the ability of honest traders to generate alpha.

There are clear reasons why the rules and regulations exist in traditional markets, and major exchanges and companies such as Solidus Labs have taken steps to enforce and follow the rules of traditional markets, pre-emptively.