Did BitMEX Maintenance and Manipulation Actually Cause a Bitcoin Pump?

Photo by Mahkeo on Unsplash

After trading sideways for a week, Bitcoin volatility came back roaring with a 6 percent move, adding $5 billion to the total market cap in about 20 minutes.

In the world of crypto, 5-6 percent moves in minutes are the norm, although it’s not often that one can point to a specific catalyst for pumps. Yesterday, there was possible evidence of manipulation in the Bitcoin markets, as large traders (or a single trader) pushed up the price of Bitcoin during BitMEX’s downtime. BitMEX is one of Bitcoin’s largest cryptocurrency exchanges.

Scheduled Maintenance to begin in a few minutes at 01:00 UTC.

— BitMEX (@BitMEXdotcom) August 22, 2018

The Evidence

This particular move has raised red flags due to the seemingly planned nature of the pump, as well as the subsequent outcry from the community about the unfair and manipulated nature of the markets.

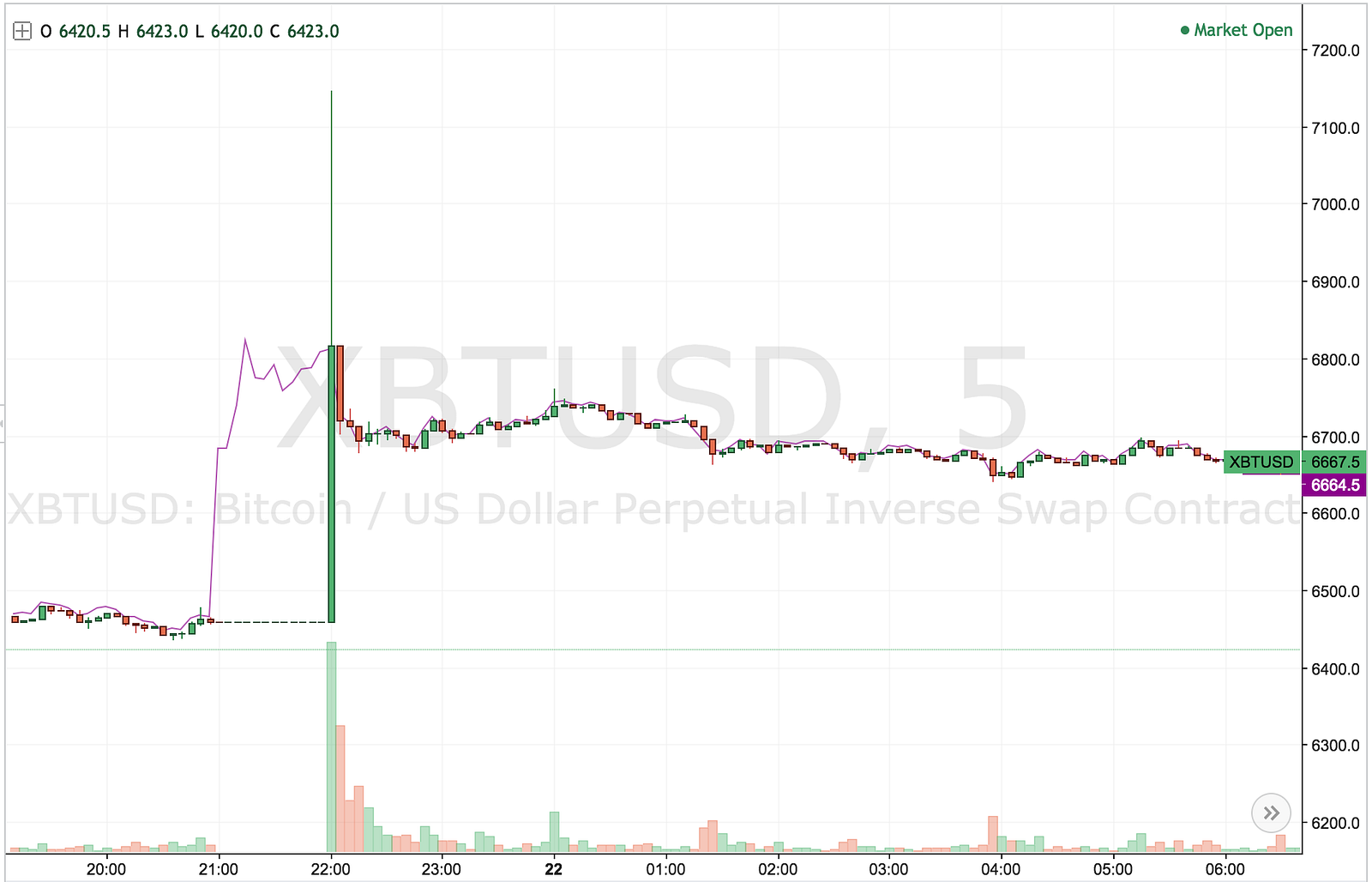

The timing of the pump is definitely suspect, as it started at the exact second BitMEX shut down for maintenance. While it’s unclear where this buy volume came from, it’s clear that it was either a single player or a group of deep-pocketed traders.

The pump originated on Bitfinex, with the highest volume coming from that particular exchange.

It can be determined that the pump started on Bitfinex by looking at the premium paid for BTC on the exchange vs. what users would pay on other exchanges. The chart below explores the premium of buying Bitcoin on Bitfinex vs. buying Bitcoin on Coinbase.

At the time of the pump, the premium for Bitfinex Bitcoin rose by almost $150, meaning the market order pushed up the price on Bitfinex first, and the Bitcoin price on Coinbase followed.

The Motivation

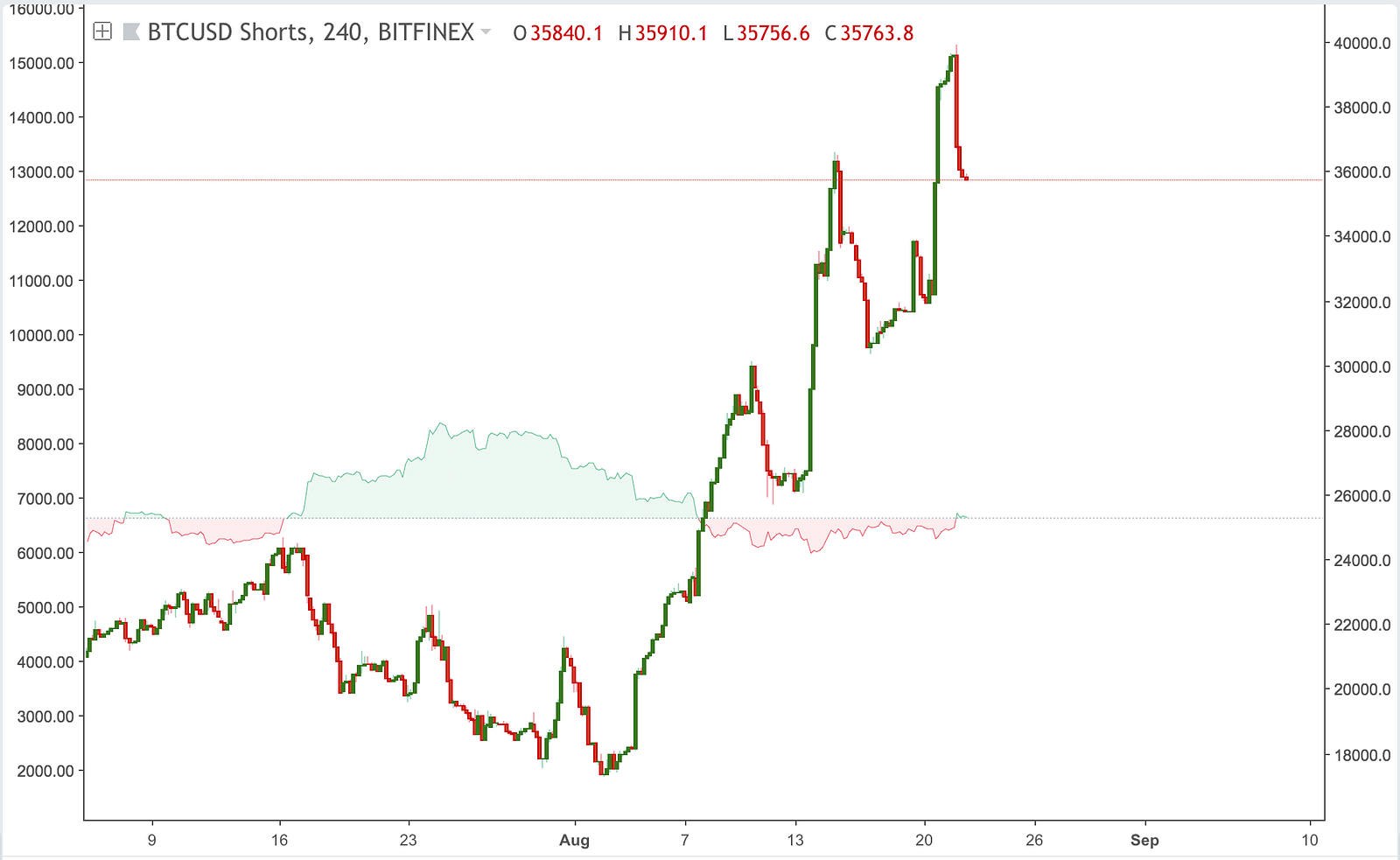

People have been piling on shorts in the past couple of days in anticipation of a market overreaction to the ETF denial, which was released Aug. 22. Most shorts opened are now underwater, and many people that were shorting the market on BitMEX also set market stop-losses to protect themselves in case of a pump. The situation was primed for a “short squeeze.”

What is a Short Squeeze?

When the market moves up rapidly against the expectation of those shorting, something called a “short squeeze” occurs. Due to a rapid rise in price, people shorting the market are automatically forced to close out all of their positions, and the market buys Bitcoin to cover their short positions. This creates a feedback loop and further pushes up the price of Bitcoin.

Often, whales will attempt to trigger a short squeeze, as one can profit immensely from it. For example, if you push the price of Bitcoin from $6,500 to $6,700, shorts with an entry point of $6,600 will be forced to close their positions, which means the market buying Bitcoin (or liquidation). This will push the price even higher and allow whales to exit at a profit.

It’s clear from the chart that the majority of shorts opened were already underwater, and that a few hundred dollars of price action would drive massive amounts of liquidations and push the price upward.

Over the past few months, liquidity has significantly declined, allowing people with large amounts of capital the opportunity to take advantage of moments like this, where traders are unable to tend to their positions.

The Effects

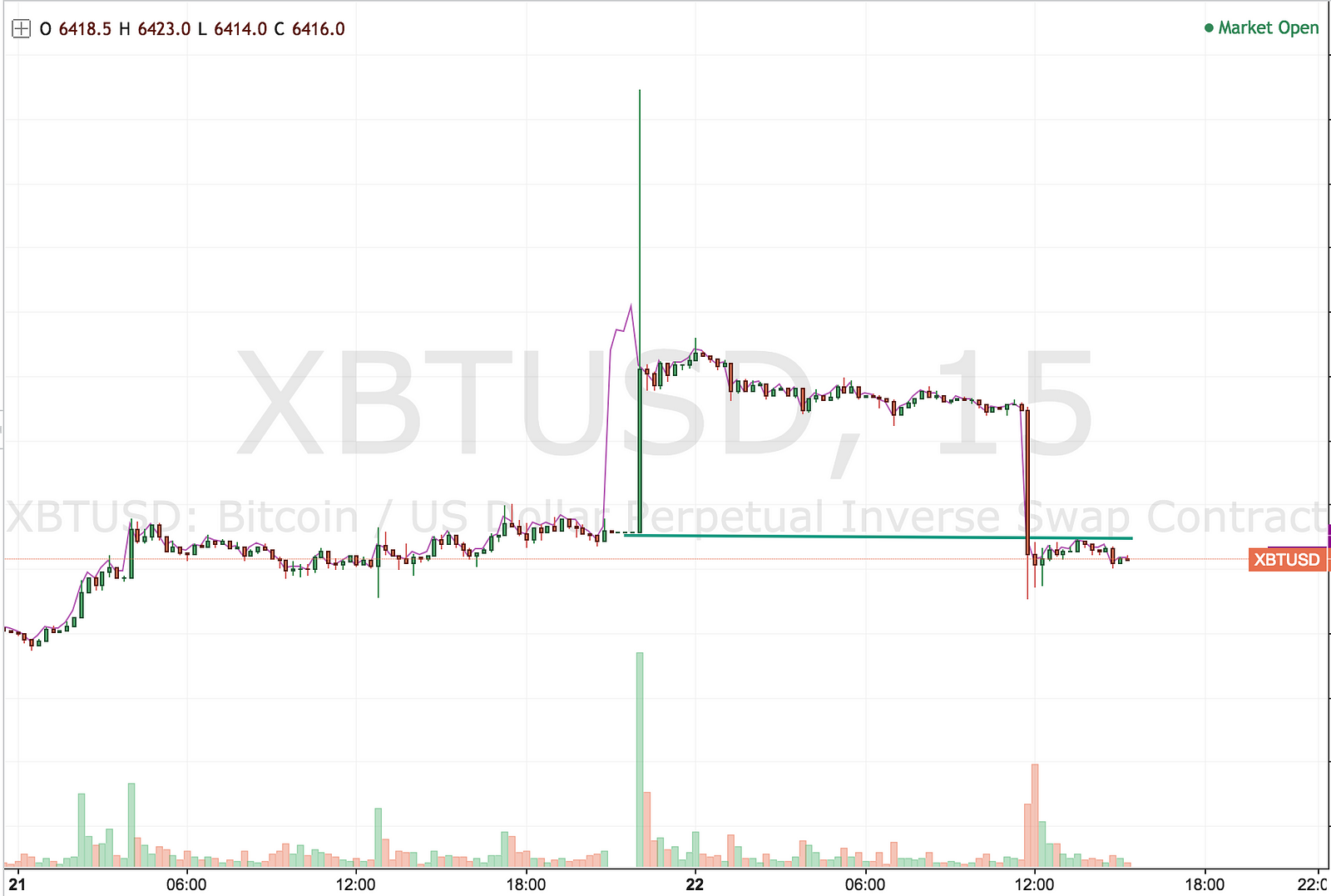

When BitMEX came back online, many people who had short positions were immediately liquidated at sky-high prices due to huge price movement during the pump. In the minutes after re-opening, BitMEX saw Bitcoin prices briefly hit $7,100, just seconds after trading at $6,450.

This caused additional mayhem in the markets, with Tron seeing a 108 percent increase in seconds and Ripple seeing a whopping 400-plus percent price bump due to liquidations.

Is this Manipulation?

The suspicion comes from the following pieces:

- No news catalyst.

- Huge volume originating on one exchange, which was only followed by other exchanges after a delay. This indicates one big buyer or a group of buyers colluding.

- Immediate retracement down less than 24 hours later to almost the exact same price as before, indicating price movement was artificial.

If there was any collusion, this is definitely manipulation. Even if there wasn’t, it is illegal to artificially inflate the price of an asset to cause liquidations or entice other traders to enter the market.

Most likely, no legal action will come from this as it is too difficult to prove who exactly caused this pump and what the intentions of the trader/traders were.

Some people, however, claim that because the maintenance was public information, it was just a trader taking advantage of the moment.

In reality, it doesn’t matter if it’s public information, it’s manipulation to push up the price of an asset in this manner if they wouldn’t have bought it otherwise—which without this opportunity they likely wouldn’t have.

Even if no manipulation was involved, it highlights a huge issue in the markets; the importance of BitMEX, a fully unregulated market with 40 percent market share. One exchange shutting down shouldn’t provide an opportunity for people to game the system.

Tuesday’s market movement throws a wrench in the plans of any ETF approval, as the SEC has made it clear their biggest concern with an ETF is market manipulation.

The real winner in all of this? BitMEX, who most recently purchased the most expensive real estate in Hong Kong.