Crypto in Turkey: Everything you need to know

Crypto in Turkey: Everything you need to know Crypto in Turkey: Everything you need to know

Recent falling in the value of Turkish lira made to the global crypto news as a “motivator towards crypto for Turkish residents." However, Turkey got the crypto bug way earlier. An exhilarating growth was seen since then, and this is just the beginning.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The crypto market started to grow in Turkey in 2017 and consolidated its roots during 2020 through many factors, including the COVID-19 pandemic. Since then, residents of Turkey have increased their investments in the crypto space exponentially. However, just as things started to settle for linear growth, the history-making Thodex scam forced the Turkish authorities to set ground rules for the crypto space.

While the final version of regulations is yet to be released, the overall interest in crypto, along with transaction volumes, is to continue their increase.

Crypto Blooming in Turkey

The first Bitcoin price peak in December 2017 kindled a higher rate of crypto adoption for Turks than the rest of the world. A study conducted by Ipsos in 2018 revealed that 57% of the USA and 66% of European participants have “heard of cryptocurrencies” while Turkey stands out with a strong 70%.

The same survey investigates the ownership of cryptocurrencies as well, and Turkey places itself at the top of the list with 18%, while the European average comes out as 9%, and the USA as 8%.

Demonstrating the perseverance of Turkish investors, the numbers from the same study also indicate that 45% of Turkish participants “expect to own cryptocurrencies in the future” while only 25% of European and 21% of USA consumers do.

One year later, in 2019, a report by Datalight listed the top 20 countries with the highest crypto trading traffic, where Turkey was placed 9th with 2.4 million unique monthly visits to exchange platforms. These numbers show that interest in crypto was already high when the COVID-19 pandemic hit in 2020.

Bitcoin’s increase during the early days of the pandemic consolidated the place of crypto assets for Turkish consumers once and for all. The 2020 Global Crypto Adaptation Index documented this adoption by placing Turkey 6th within the European region and 29th worldwide.

Towards the end of 2021, the CEO of Turkish crypto exchange giant BTCTurk revealed the massiveness of adoption by stating:

“Based on our numbers I can comfortably say that approximately 4 million users are trading on a daily basis, and the daily volume increased tenfold in comparison to last year.”

The second biggest Turkish crypto exchange platform Paribu released their annual study in mid-2021, where they also concluded that the number of crypto traders increased 11 times within a year. Crypto adoption started to appear on the news as well, announcing strong public belief in cryptocurrencies.

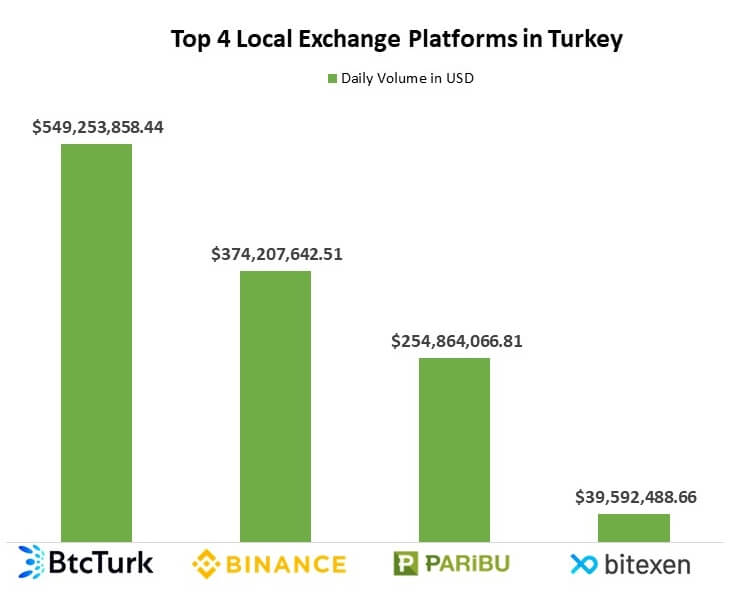

The sum of four major Turkish crypto exchanges’ 24-hour volume for the 1st of March is $1,217,918,056.42, while the Istanbul Stock Exchange’s 24-hour volume for the 28th of February is $2,677,515.469.

Catalysts of the Crypto Surge

While the pandemic definitely played a role in accelerating crypto adoption, it wasn’t the only influence.

Skyrocketing Inflation

Inflation has always had a considerable impact on crypto adoption, and the numbers from the Turkish Statistical Institute show that it has been high since 2018. As Turkish investors lost the profits of their fiat-based investments to increasing inflation, they turned to crypto.

Within two years from January 1st of 2020, Bitcoin increased 6,403% in value while inflation in Turkey increased from 12,15% to 48,69%. Exposing the severity of the situation, a private Turkish institution calculated the inflation as 114,87% by using a method promoted by the MIT economists instead of the Eurostat principles the Turkish Statistical Institute uses. This was announced as the actual inflation, which aroused public distress, resulting in more flow towards crypto assets.

Golden Turkish Culture

Gold has a well-established place in Turkish culture. It is the number one inflation hedge for investors, just like anywhere in the world. But for the rest of the society, especially women, gold is perceived as financial security and therefore is physically collected “under the pillows” by the elderly, worn to declare status by certain socio-economic groups, and given away as a gift to financially support newlyweds and parents with newborns.

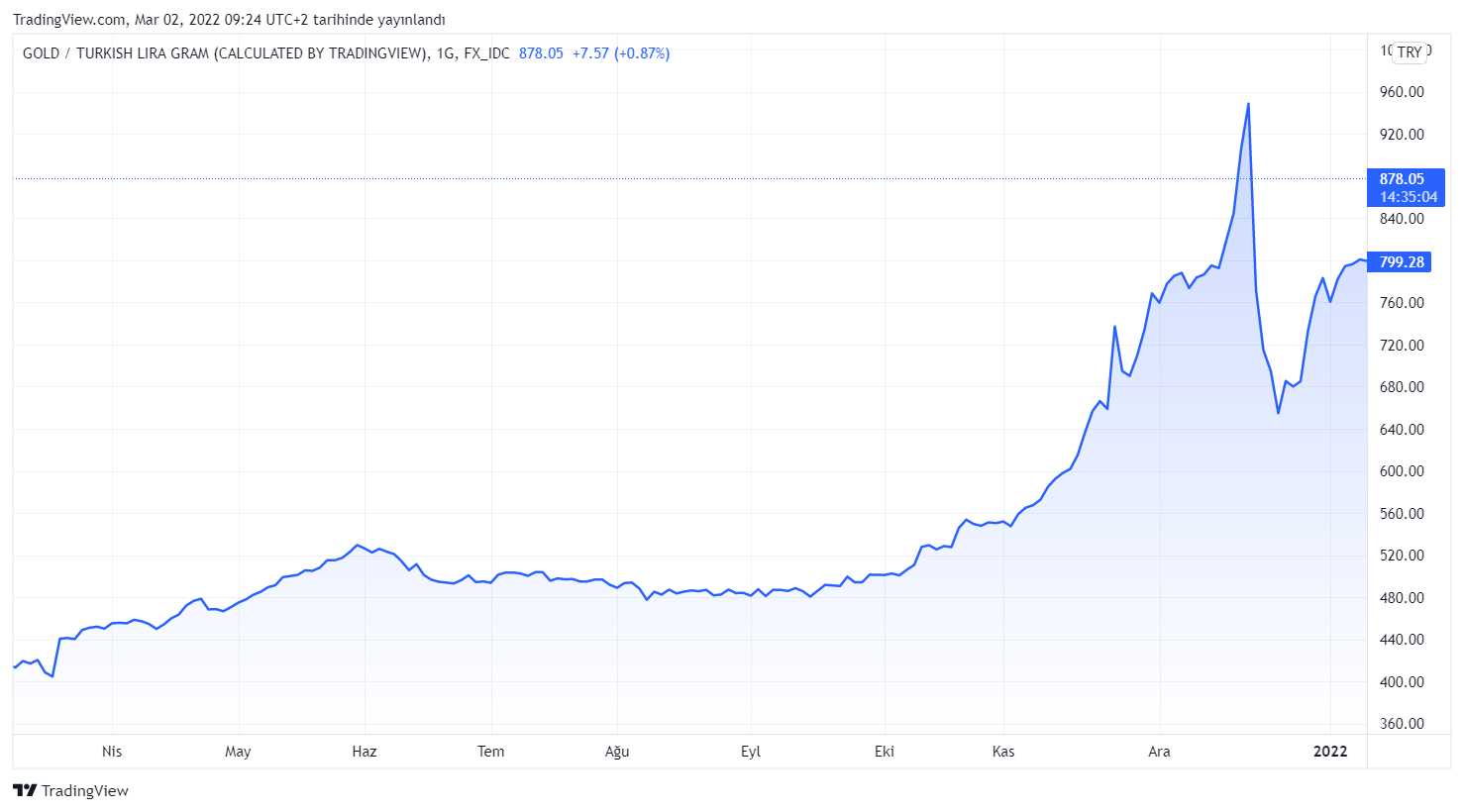

Between the beginning of 2020 and 2022, the price of one gram of gold increased from 293,95 Turkish lira to 786,30 Turkish lira. Together with the inflation, this 167.5% increase in the price of gold was enough to transform it into a luxury item that couldn’t be afforded easily to collect, wear or gift away.

As a result, the existing physical gold became too precious to continue its social circulation, which is why president Erdoğan targeted it to save the lira’s value against US dollars.

However, this increase also wasn’t high enough to re-position gold as an investment option against inflation. In comparison to Bitcoin, gold’s price increase remained miserably low.

As a result, investors who wanted an effective inflation hedge and the rest of the society who couldn’t afford gold or didn’t think it was as valuable anymore started to turn towards the most popular investment option – crypto.

Numbers also indicate a similar result — while two out of every ten people who traded cryptocurrencies were women in 2020, this number doubled in one year and increased to four out of every ten people. Users from both Y and X generations also increased in numbers.

Speculations of Emergency Rule

Upon the failed coup attempt on July 15th, 2016, the government of Turkey announced an Emergency Rule for two years that would allow them to bypass certain regulations in an effort to make the healing process easier. However, two years later, the Emergency Rule was extended for another three years instead of being terminated due to the socio-political circumstances at the time.

The deadline for the extended Emergency Rule was set as July 2021, when the government extended it for another three years to be terminated in 2024. Given the inflation rate, this extension raised speculations claiming the government’s intention to utilize its abnormal power granted by the emergency rule to seize the capital accumulated in the banks. These claims also nudged a portion of the society to invest in stable coins on international exchange platforms.

Major Exchange Platforms

BTCTurk is currently the largest local exchange platform in Turkey. It was founded in 2013, becoming Turkey’s first and the world’s 4th crypto exchange platform. They currently offer 119 coins.

Binance TR follows BTCTurk with a $374,207,642.51 daily volume. However, Binance entered the Turkish market in 2020 and currently offers 88 coins. Even though it didn’t originate in Turkey, Binance TR behaves as a local exchange market and is therefore included in the above chart.

Paribu was founded in 2017 and currently holds the largest daily trading volume amongst Turkish crypto exchange platforms with 89 coins.

Bitexen was founded in 2018 and currently offers 50 coins. Even though it’s considerably low volume, Bitexen still manages to secure third place.

According to the Chainalysis 2021 Geography of Cryptocurrency Report, throughout 2021, these five coins were the most invested in Turkey: Bitcoin, Ethereum, XRP, ChainLink, and USDT.

Regulations

All the attention and volume growing around crypto captured the government’s attention as well. As a result, there have been small but important steps towards crypto regulations since 2019, but a complete decree is yet to be announced.

FCIB Acknowledges Crypto

The first regulatory step was taken on September 11th, 2019, when the Financial Crimes Investigation Board (FCIB) of Turkey updated the Suspicious Transaction Reporting Guide to include the statements below:

- “Transferring cryptocurrencies to national and international crypto exchange platforms with the purpose of purchasing cryptocurrency or transferring cryptocurrencies to other individual and/or commercial accounts in a way that seems ill-fitted to the user profile.”

- “Receiving a cryptocurrency transfer from an unknown source that seems ill-fitted to the user profile.”

This recognition of cryptocurrencies as “suspicious” was the only regulatory step until 2021.

Thodex Scam Alerts the Government

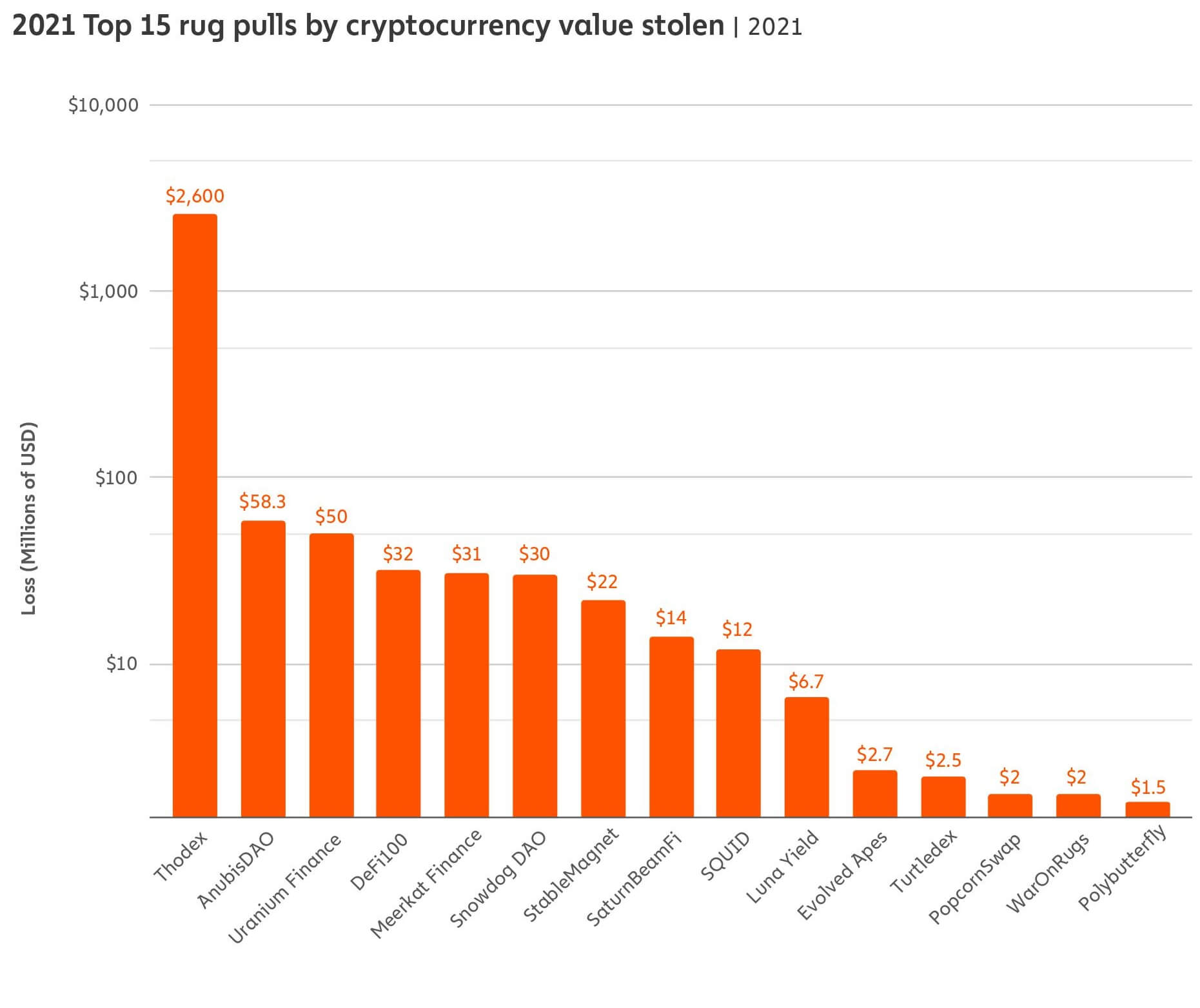

Thodex launched as a Turkish crypto exchange platform in 2017 and reached up to 700,000 users by 2021. In April 2021, users expressed their distress when they couldn’t withdraw their assets. Their worries were soothed by the representatives from Thodex announcing that the transactions would be paused for five days due to an undergoing sale process. By the end of the fifth day, Thodex CEO Fatih Özer fled the country and took more than 2 million $ worth of assets with him.

The scam is so big that according to Chainalysis 2022 Crypto Crime Report, it was by far the biggest rug pull scam in the crypto space during 2021. The severity of this attack motivated regulatory figures to work on comprehensive crypto regulation.

2021: The Year of Regulations

Except for the acknowledgement of cryptocurrencies as suspicious, all the existing decrees on cryptocurrencies were released in the second half of 2021.

Firstly, on April 2021, FCIB released the Crypto Payments Regulation. The whole body of the text consisted of 4 paragraphs and included no operational guidance whatsoever. However, it did include a clear ban on using cryptocurrencies as a form of payment.

Secondly, one month after Crypto Payments Regulation, a rather larger text was released by the FIDU. Guide for Crypto Asset Service Providers included a comprehensive definition of crypto assets and crypto asset service providers. It also gives crypto-asset service providers the responsibility to run thorough KYC for both commercial and individual users, storing all data for eight years and alerting the FIDU within ten days in case of suspicious activity. The document concludes by informing the crypto asset service providers of possible penalties that could increase up to 4 million Turkish liras.

As FIDU took the reins, the Turkish Central Bank announced that it established the Digital Turkish Lira Association in September 2021. Representatives from the association stated that there was no consensus on launching a digital lira to clear any misunderstandings. They described the association as a research and development project where the blockchain technology would be tested to understand it better.

Fourthly, the Turkish Central Bank updated the core regulation on Payment Services and Electronic Money to include a definition for Bitcoin in December 2021. This definition did not define Bitcoin and Bitcoin-like crypto-assets as “electronic money,” which caused cryptocurrencies to bypass existing regulations on electronic money.

Are Real Regulations on their Way?

After strict prohibitions and new responsibilities were defined by FIDU, the December 2021 update on the Payment Services and Electronic Payments regulation puzzled the crypto enthusiasts because it did not exactly “regulate” cryptocurrencies. However, the fact that it separated cryptocurrencies from electronic money signalled the coming of whole new cryptocurrency regulation.

A month after the update, some news confirmed these signals. High-level representatives from BTC Turk, Binance TR, and Paribu were invited to the parliament to meet with the ruling party to express their suggestions on the new cryptocurrency regulations. While the details were restrained from the public, it was stated that all three guests of the parliament insisted on regulations to be regulatory rather than prohibitive.

In addition, participants also suggested that if taxations were to be implemented, they’d be implemented only for the international exchanges operating in Turkey.

Conclusion

As the establishment of the largest Turkish crypto exchange platform also indicates, cryptocurrencies have been actively traded in Turkey since 2013. However, 2020 was the year when crypto established its root and spread amongst the residents like a pandemic. Within a year, transaction volumes and user numbers grew tenfold. Unfortunately, this hype around crypto also attracted malicious actions, such as Thodex, which behaved as a wake-up call for the legal authorities.

As a result, 2020 was the year of growing, and 2021 was the year of regulations for crypto in Turkey. For the year 2022, two things are for sure: judging by the state of lira and gold, crypto investments will grow regardless of the crypto winter, and a full-scale regulation is expected to release to control this growth.