Bitcoin whale accumulation trend on Bitfinex shows $14k or lower isn’t likely

Bitcoin whale accumulation trend on Bitfinex shows $14k or lower isn’t likely Bitcoin whale accumulation trend on Bitfinex shows $14k or lower isn’t likely

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Whales on Bitfinex have been accumulating after the recent Bitcoin dip. The market trend shows extremely low price targets, like $14,000, are less likely in the near term.

Accumulation ongoing as Bitcoin begins to recover

Bitcoin briefly dropped to around $17,600 in a sharp intraday drop. It pulled all of the major altcoins lower, causing the market to swiftly correct within around 18 hours.

But, following the initial correction, Bitcoin is beginning to recover and it is seeing decent buyer demand from whales on Bitfinex.

A pseudonymous technical analyst pinpointed large buy orders at near-term support levels to suggest a deeper drop is unlikely for now. The analyst wrote:

“Bitfinex has been accumulating in this range I don’t think we’re getting 14k or whatever crazy targets the bears have but if we go that low it’s time to go balls deep long like we’re at 10k again”

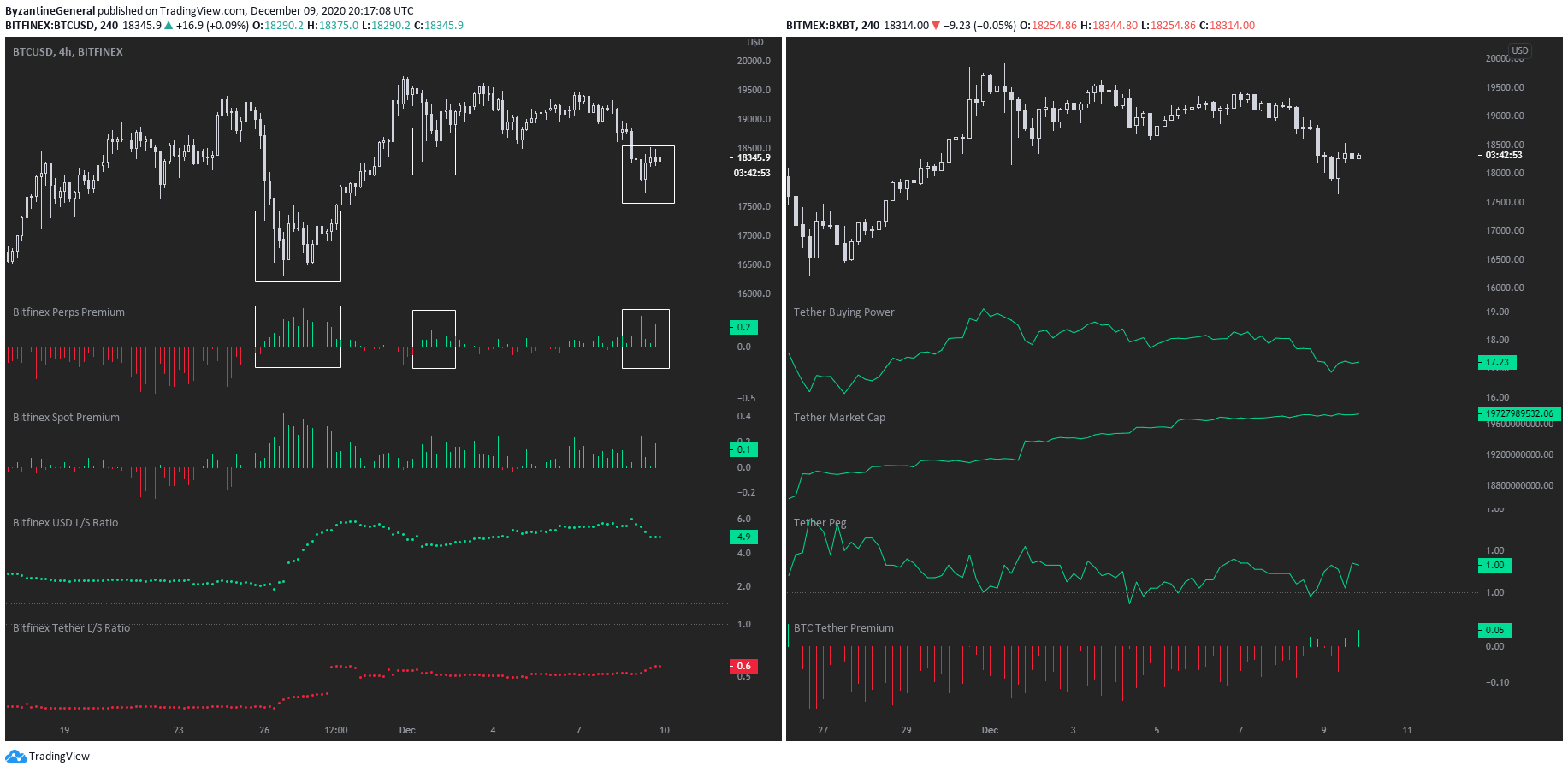

Other traders and analysts have found a similar trend. A trader known as “Byzantine General” found that the recovery of Bitcoin coincides with a spike in buyer activity on Bitfinex.

Historically, Bitfinex has been long considered as the whale exchange. It has seen many high-net-worth Bitcoin buyers in the past bidding BTC after major corrections.

Not all traders are convinced

However, in the near term, some traders still remain cautious around Bitcoin.

A pseudonymous trader known as “Salsa Tekila” said that he would consider a bullish trajectory for Bitcoin if BTC continues to rise on Thursday. Until then, the trader noted that the bearish bias remains. The trader said:

“If we get a strong Thursday, I’ll ditch the bearish $BTC bias, and favor dips buying over rips selling. For now, this bounce is a sell opportunity. I treat it as such until proven wrong. Reason being: weak market reaction to many recent bullish news. Something shifted, possibly.”

One reassuring sign for Bitcoin in the foreseeable future is the strong recovery of the so-called “OG” altcoins. XRP rose 18% from the day’s lowest point, which signals an appetite from investors for risk-on assets within the cryptocurrency market.

In the short term, the key to the momentum of the Bitcoin price is remaining above the $18,300 support area. Since BTC surpassed the $18,000 level in November, the $18,300 area has consistently acted as an important support level.

Reclaiming $18,300 as a support area once again and making its way towards $18,800 to $19,000 would likely bring back confidence in the market. So far, BTC is hovering above $18,400, showing signs of breaking past the $18,500 to $18,800 resistance range.

One concern for Bitcoin is the recovery of the U.S. dollar index. The DXY began to rebound from a monthly support level, which could pose a threat to BTC’s recovery.