Modeling altseason, estimating Ethereum, XRP, Bitcoin Cash, Litecoin prices using BTC dominance

Modeling altseason, estimating Ethereum, XRP, Bitcoin Cash, Litecoin prices using BTC dominance Modeling altseason, estimating Ethereum, XRP, Bitcoin Cash, Litecoin prices using BTC dominance

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

If ‘altcoin season’ happened today what would the cryptocurrency prices look like? What about if Bitcoin continues to reign supreme and BTC dominance keeps rising? We model different BTC dominance scenarios and show the price implications on Ethereum, XRP, Bitcoin Cash, and Litecoin—providing a best-guess estimate of what the markets could look like.

Reviewing the 2017-18 altseason

Among cryptocurrency enthusiasts, there is a continuous debate on whether ‘altcoin season,’ a sustained period where altcoin gains outpace Bitcoin, will happen. The last altcoin season happened in 2017, where many altcoins saw 10x+ returns in a matter of weeks.

The last altcoin season started on Dec. 7, 2017, where Bitcoin shortly hit its peak dominance of 69.9 percent. Bitcoin’s percent share of the total market capitalization has not reached that level since. Altcoin season lasted five weeks until Jan. 13, 2018, where BTC dominance briefly hit a low of 35.0 percent.

During this period, major coins such as Ethereum, XRP, and EOS all saw astronomical returns. From Dec. 7 to Jan. 13 these coins yielded the following returns:

Ethereum shot up from $417 to $1312, a 3-fold increase. EOS shot up from $4.4 and wicked to $18.7 with a closing price on the day of $16.0—3-fold returns. And XRP went from $0.21 to $2.0, for eye-popping 9-fold returns.

Smaller capitalization coins saw even bigger gains. Verge, for example, accelerated from $0.0078 to $0.15 for ridiculous 18x returns.

Will market history rhyme?

Now, Bitcoin’s dominance is marching towards the local high of the 2017-18 bull market. And, based on the current trend, seems likely to surpass the previous high. Meanwhile, numerous crypto-traders, analysts, and pundits suggest that the altseason phenomenon may repeat itself.

Starting to feel like it is time for the quality alt coins to begin catching up with BTC. I think the bottom is in

— Barry Silbert (@barrysilbert) July 10, 2019

$BTC Dominance vs $ALT Dominance

Those that don't study history are doomed to repeat it. Markets do not repeat, but, they certainly rhyme

These charts show that $BTC & $ALTs have been status quo following a BTC Bear thus far pic.twitter.com/DjPZUvnJ7y

— Mr. Anderson (@TrueCrypto28) July 10, 2019

Added $MATIC just now to the alt coin lineup today

Current allocation 90% alts, 10% $BTC pic.twitter.com/vAz4n644SK

— Satoshi Flipper (@SatoshiFlipper) July 10, 2019

However, there seems to be an even greater proportion of pundits arguing that market conditions have changed significantly, or that retail investors “learned their lesson” from the last mania, suggesting there won’t be another altseason (or it won’t be nearly as prolific).

Bitcoin is a black hole ?

It will suck in not only Alts‘ liquidity ??? but also the growing ? inflation made by the dovish ?? Fed and on-going massive QE from ?? PBOC

All “money” goes into $BTC

— Dovey 以德服人 Wan ? ? (@DoveyWan) July 10, 2019

Bitcoin’s 4th cycle seems timely for this hockey stick moment. If true, then in this cycle most alts will not amplify BTC’s gains. Value will be sucked out, flowing into BTC and a small set of survivors. Nearly all alts start going the way of Bebo/MySpace.

— Willy Woo (@woonomic) July 10, 2019

The reason you haven’t had an alt season is simple. You all know that alts are junk and aren’t worth shit.

You’re hoping for more clueless morons to pump this shit but they aren’t here. 2017 was a one off, we were all clueless.

Buy Bitcoin, go long, STFU!

— Peter McCormack (@PeterMcCormack) July 10, 2019

Regardless of the outcome, it is good to be prepared for either scenario. To assist our readers we modeled cryptocurrency prices based on different levels of Bitcoin dominance.

Modeling prices using BTC dominance

The model makes one large assumption: that the proportional market share (dominance) of each altcoin remains the same relative to each other. Although proportional market capitalization will shift as market conditions change, it is a good enough heuristic for making best-guess predictions.

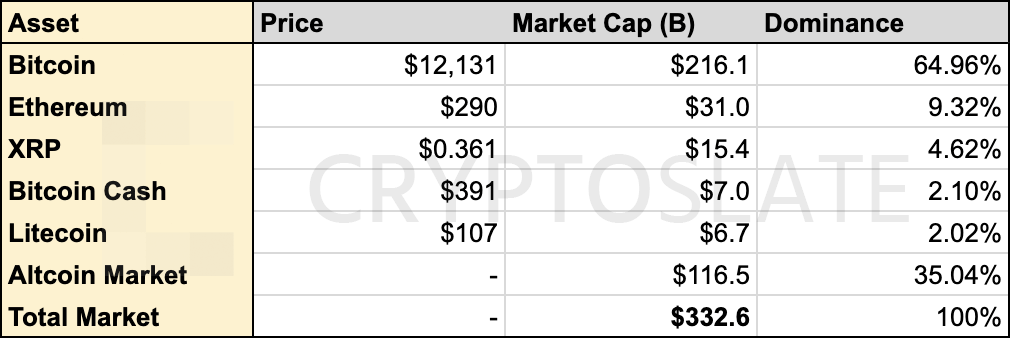

Based on recent CoinMarketCap data, dominance for the respective coins are as follows:

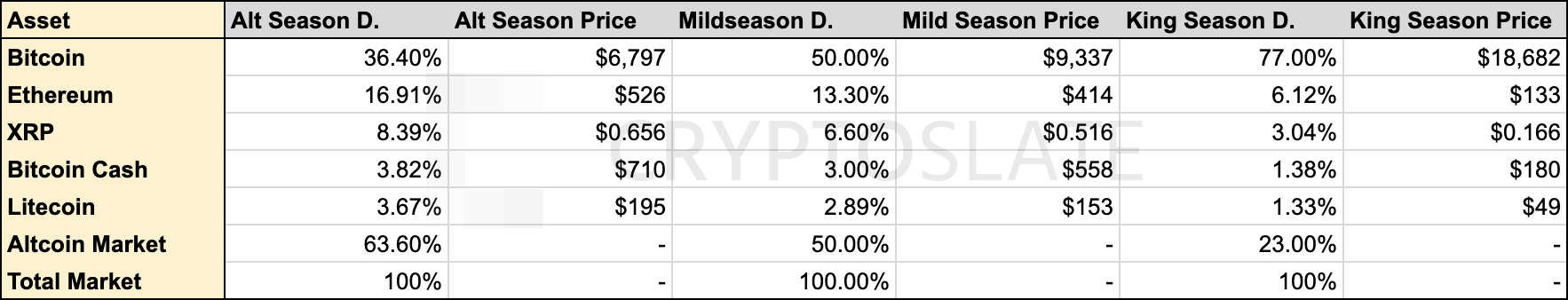

The “Alt Season Dominance” value is the lowest value for Bitcoin dominance during the 2017-2018 bear market and should be used as a maximum for projecting altcoin prices. Meanwhile, “King Season Dominance” somewhat arbitrarily uses the 77 percent dominance predicted by Atlanta Digital Currency Fund co-founder Alistair Milne.

I believe everyone should consider the possibility that Bitcoin's dominance returns to the ~77% level (when you remove stablecoins from the marketcap)https://t.co/qd6jBNNKfT

— Alistair Milne (@alistairmilne) July 10, 2019

Finally, “Mild Season Dominance” uses 50 percent Bitcoin dominance as an arbitrary middle-ground. Prices are then extrapolated from changes in this data, giving reasonable estimates of what prices would look given the current market capitalization.

As shown by the model, a return to altseason would yield prices for Ethereum at $526, XRP at $0.656, Bitcoin Cash at $710, and Litecoin at $195 while Bitcoin would drop to $6,797. On the other side of the extreme, if BTC achieves unprecedented dominance its price could rise to $18,682. Again, this does not account for market capitalization growth. Projects are cannibalizing value from each other in the above table.

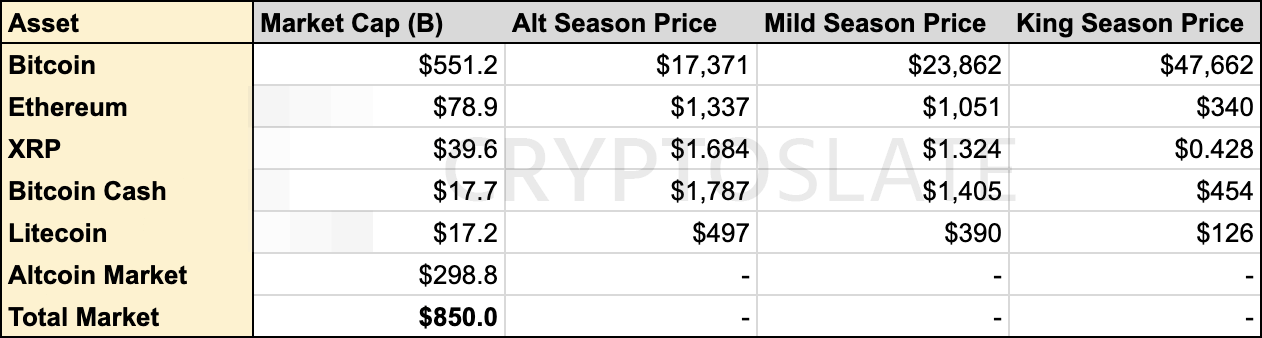

However, the model can also project prices should overall market capitalization increase or decrease. For example, if market capitalization were to breach its previous peak of $835 billion and reach $850 billion, for example, using the same set of assumptions, prices would (obviously) be much rosier:

In a return to the 2017-18 market high scenario, Bitcoin could range anywhere from $17,371 to $47,662. Ranges for the other coins are also provided.

Note: the model also does not take into account changes to coin supply if using it as a projection for future market conditions.

Although these figures are unlikely to be precise, they provide a good “gut check” for what to expect in different market scenarios. The model is not advice on what or when to buy but can help determine risk tolerance and potential upside more broadly.

Mentioned in this article

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Verge

Verge  Barry Silbert

Barry Silbert  Dovey Wan

Dovey Wan  Willy Woo

Willy Woo  Peter McCormack

Peter McCormack  Alistair Milne

Alistair Milne